Most users believe Google is the king of the navigation world, as Google Maps is the number one mobile navigation solution. The battle for the leading mapping platform doesn't come down to mobile domination exclusively, and overall, Google has a hard time securing the number one spot.

Recent research conducted by TechInsights puts HERE in pole position in the mapping race, as it obtained a better score in most categories, including map freshness, vision growth, and sustainability. Google ranked better in the non-automotive category.

The analysis also includes a closer look at the strengths and weaknesses of every location platform, and in HERE's case, its main problem is the limited consumer brand.

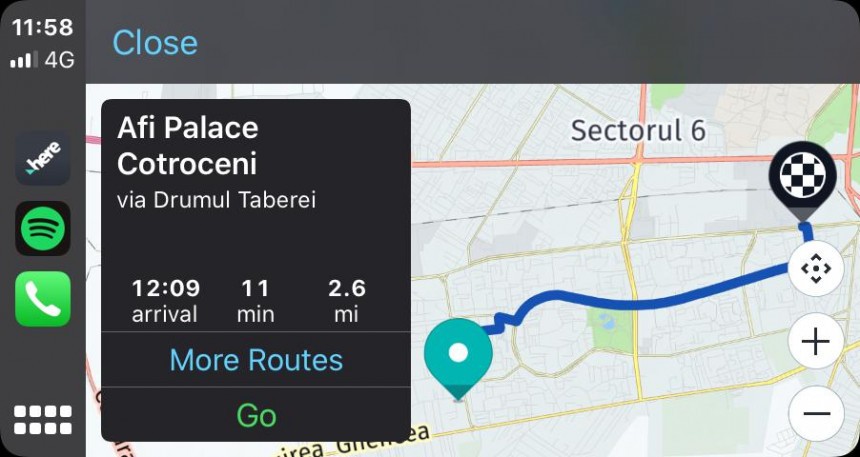

HERE has been betting big on collaborations with carmakers worldwide, focusing less on consumers. It recently launched mobile navigation apps, but its audience is still very limited, especially as the mapping services offered to car manufacturers and the connected services continue to bring home the bacon.

Compared to Google and Google Maps, HERE is seriously lagging behind rivals in terms of consumers, though the race for profits seems to focus mainly on automotive collaborations.

HERE also struggles in its relationship with developers, especially when looking at how Google expanded in this direction. Google Maps is the dominating mapping platform in the developer community, while HERE is almost a non-existent name. It isn't surprising, though: HERE turned partnerships with carmakers into its number one priority, so developers don't receive much attention.

TechInsights also reminds us that HERE is involved in an upper management shuffle, as it is still searching for a new CEO to replace Edzard Overbeek.

HERE's main strength is its momentum in the automotive business. The company is a leader in ISA (Intelligent Speed Assist), and its solutions are recording skyrocketing adoption following the new regulations coming into effect in Europe. The ADAS and HD Map adoption is also increasing, with HERE becoming the leading map provider in North America and Western Europe. The study reveals HERE had approximately 70 percent market in 2022 in these two large markets.

HERE's product offering isn't limited to these regions, though. The company has a strong presence in China, Japan, and South Korea – Google loses precious points for not offering its services to Chinese customers, while HERE works with local companies to expand in this country.

TechInsights notes that HERE has a strong growth vision and product lines beyond automotive, though I believe the company can do more on this front. Despite offering impressive navigation capabilities, its consumer focus is very limited, so improving the mobile navigation solutions and providing Android and iPhone users with new-generation features should become a priority.

Additionally, HERE has become independent and open, eventually paving the way for partnerships with carmakers, especially as its ISA, ADAS, and HD Map products keep gaining traction in the automotive world.

This massive expansion is not a surprise, TechInsights says. HERE has a very strong message on privacy, and given the obsession for data, the company rapidly wins customers' hearts worldwide. On the other hand, Google loses precious points on this front, as the company is known for its data appetite. Some users avoid installing Google Maps mainly because of its data collection practices, so the search giant loses market share in favor of rivals like HERE.

Additionally, the analysis emphasizes that HERE is not a small firm. It has over 6,000 employees worldwide, and its annual revenue reached 946 million Euros last year. It has large enterprise customers, such as Amazon and Microsoft.

Eventually, HERE ended up dominating a market simply because it's investing in a more efficient side of the location platform battle. Google is slowly but surely expanding in the automotive industry, though the search giant uses a different approach. While its strategy involves working together with carmakers (something that HERE already excels at), Google has a much harder time convincing auto manufacturers that it's worth their trust. Google's Android Automotive requires carmakers to give in control of the infotainment to the search giant, and some companies, such as BMW, aren't big fans of this concept.

BMW has decided to adopt Android Automotive without GAS, meaning that Google's services won't be available in its cars. The German carmaker will stick with a third-party store and offer alternatives to Google services to maintain control of the infotainment system.

TechInsights explains that some carmakers see Google as a potential rival, though the search giant hasn't yet expressed its intention of building a full car. Apple embraced this strategy, as the iPhone maker is expected to unveil its first vehicle built from scratch in 2025 or 2026.

Meanwhile, HERE keeps growing, while companies like Google, TomTom, and Mapbox follow in their footsteps with investments in new-generation technology to bring home the bacon in the short and the long term.

The analysis also includes a closer look at the strengths and weaknesses of every location platform, and in HERE's case, its main problem is the limited consumer brand.

HERE has been betting big on collaborations with carmakers worldwide, focusing less on consumers. It recently launched mobile navigation apps, but its audience is still very limited, especially as the mapping services offered to car manufacturers and the connected services continue to bring home the bacon.

Compared to Google and Google Maps, HERE is seriously lagging behind rivals in terms of consumers, though the race for profits seems to focus mainly on automotive collaborations.

HERE also struggles in its relationship with developers, especially when looking at how Google expanded in this direction. Google Maps is the dominating mapping platform in the developer community, while HERE is almost a non-existent name. It isn't surprising, though: HERE turned partnerships with carmakers into its number one priority, so developers don't receive much attention.

HERE's main strength is its momentum in the automotive business. The company is a leader in ISA (Intelligent Speed Assist), and its solutions are recording skyrocketing adoption following the new regulations coming into effect in Europe. The ADAS and HD Map adoption is also increasing, with HERE becoming the leading map provider in North America and Western Europe. The study reveals HERE had approximately 70 percent market in 2022 in these two large markets.

HERE's product offering isn't limited to these regions, though. The company has a strong presence in China, Japan, and South Korea – Google loses precious points for not offering its services to Chinese customers, while HERE works with local companies to expand in this country.

TechInsights notes that HERE has a strong growth vision and product lines beyond automotive, though I believe the company can do more on this front. Despite offering impressive navigation capabilities, its consumer focus is very limited, so improving the mobile navigation solutions and providing Android and iPhone users with new-generation features should become a priority.

Additionally, HERE has become independent and open, eventually paving the way for partnerships with carmakers, especially as its ISA, ADAS, and HD Map products keep gaining traction in the automotive world.

This massive expansion is not a surprise, TechInsights says. HERE has a very strong message on privacy, and given the obsession for data, the company rapidly wins customers' hearts worldwide. On the other hand, Google loses precious points on this front, as the company is known for its data appetite. Some users avoid installing Google Maps mainly because of its data collection practices, so the search giant loses market share in favor of rivals like HERE.

Additionally, the analysis emphasizes that HERE is not a small firm. It has over 6,000 employees worldwide, and its annual revenue reached 946 million Euros last year. It has large enterprise customers, such as Amazon and Microsoft.

BMW has decided to adopt Android Automotive without GAS, meaning that Google's services won't be available in its cars. The German carmaker will stick with a third-party store and offer alternatives to Google services to maintain control of the infotainment system.

TechInsights explains that some carmakers see Google as a potential rival, though the search giant hasn't yet expressed its intention of building a full car. Apple embraced this strategy, as the iPhone maker is expected to unveil its first vehicle built from scratch in 2025 or 2026.

Meanwhile, HERE keeps growing, while companies like Google, TomTom, and Mapbox follow in their footsteps with investments in new-generation technology to bring home the bacon in the short and the long term.