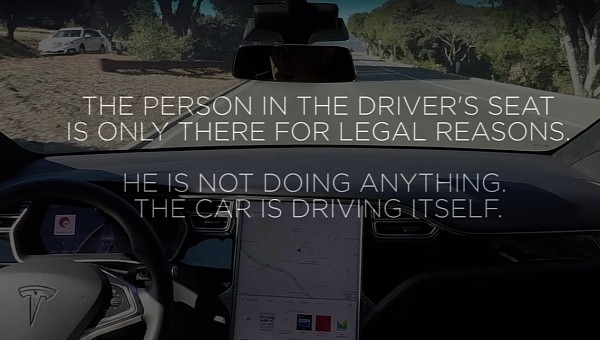

It seems the U.S. government is not going after Tesla only in the criminal sphere. After Reuters disclosed that the Department of Justice (DOJ) is investigating the company for stating they are more autonomous than they really are – something defined as autonowashing – the Wall Street Journal (WSJ) discovered that the U.S. Securities and Exchange Commission (SEC) is also checking how these promises may have hurt investors.

Elon Musk recently said that Tesla is worth zero without Full Self-Driving (FSD). For a company with such an extensive fast-charging network as Supercharging, that is a dangerous statement. If you think it through, it would mean that Tesla’s astronomical market cap is based solely on a promise if Musk were right. With that in mind, SEC’s investigation may have even taken too long to happen.

Tesla’s most severe critics have accused the SEC of allowing Tesla and Musk to break the law and doing nothing about it. That refers to the late filing of mandatory reports, not stating everything it should when these reports are filed. The security regulators would have been so lenient that these critics often repeated a very derogatory meaning for its acronym. The Tesla CEO himself coined it: SEC would mean suck Elon’s… you know how this ends.

It seems the SEC finally had enough. According to the WSJ, it has already investigated Musk for disclosing his stake in Twitter later than he should have (we have never heard about this inquiry or its results). Musk and his brother Kimbal would have also been investigated for selling Tesla shares when the Tesla CEO made a poll asking whether he should sell or not 10% of his stocks to pay taxes.

While the DOJ is checking the criminal implications of overpromising Autopilot and Full Self-Driving, the SEC will verify civil consequences related to the securities market. The WSJ did not mention which could be the outcomes of this investigation or whether the securities regulators already had enough evidence to sue Tesla and Musk. At this point, we only know the SEC has joined the DOJ, the California Department of Motor Vehicles (DMV), and the National Highway Traffic Safety Administration (NHTSA) in their scrutinies of Autopilot and FSD. It makes us wonder if Tesla is valuable because of them or if these pieces of software are actually a massive liability.

Tesla’s most severe critics have accused the SEC of allowing Tesla and Musk to break the law and doing nothing about it. That refers to the late filing of mandatory reports, not stating everything it should when these reports are filed. The security regulators would have been so lenient that these critics often repeated a very derogatory meaning for its acronym. The Tesla CEO himself coined it: SEC would mean suck Elon’s… you know how this ends.

It seems the SEC finally had enough. According to the WSJ, it has already investigated Musk for disclosing his stake in Twitter later than he should have (we have never heard about this inquiry or its results). Musk and his brother Kimbal would have also been investigated for selling Tesla shares when the Tesla CEO made a poll asking whether he should sell or not 10% of his stocks to pay taxes.

While the DOJ is checking the criminal implications of overpromising Autopilot and Full Self-Driving, the SEC will verify civil consequences related to the securities market. The WSJ did not mention which could be the outcomes of this investigation or whether the securities regulators already had enough evidence to sue Tesla and Musk. At this point, we only know the SEC has joined the DOJ, the California Department of Motor Vehicles (DMV), and the National Highway Traffic Safety Administration (NHTSA) in their scrutinies of Autopilot and FSD. It makes us wonder if Tesla is valuable because of them or if these pieces of software are actually a massive liability.