Several BEV advocates thought that all it would take for customers to buy more electric cars was a broader offer of products. Or more financial incentives, more chargers, and more "education" for those who are not that interested in vehicles powered by a massive battery. This year provided a lot of that. Even so, 2023 was when interest in BEVs dropped for the first time in Ipsos' Navigator study. The global market research company tried to explain that as an ownership costs misunderstanding, but is it?

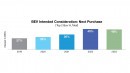

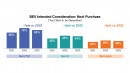

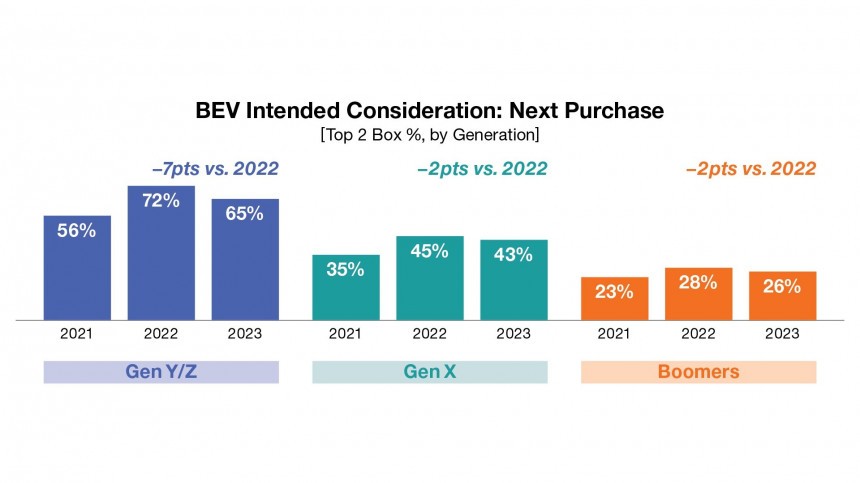

Ipsos apparently started this study in 2019. That year, 27% of the respondents wanted to buy a BEV as their next car. The number raised to 30% in 2020, 36% in 2021, 49% in 2022, and dropped to 48% in 2023. Although that could be considered as a demand stabilization, a more thorough analysis by age shows the intentions have gone down slightly for baby boomers and Generation X but fallen more sharply for Generation Z and Generation Y customers: seven points from 2022 (72%) to 2023 (65%).

The research company considered that a problem and tried to find an explanation for the phenomenon. A list of concerns about owning a BEV submitted to the respondents theoretically helped. However, Ipsos dedicated a generous portion of that explanation to one of the least relevant reasons not to buy a BEV: the belief that these cars present a "higher overall cost of ownership." Pay careful attention to how this concern is worded: it will be important to understand its full reach.

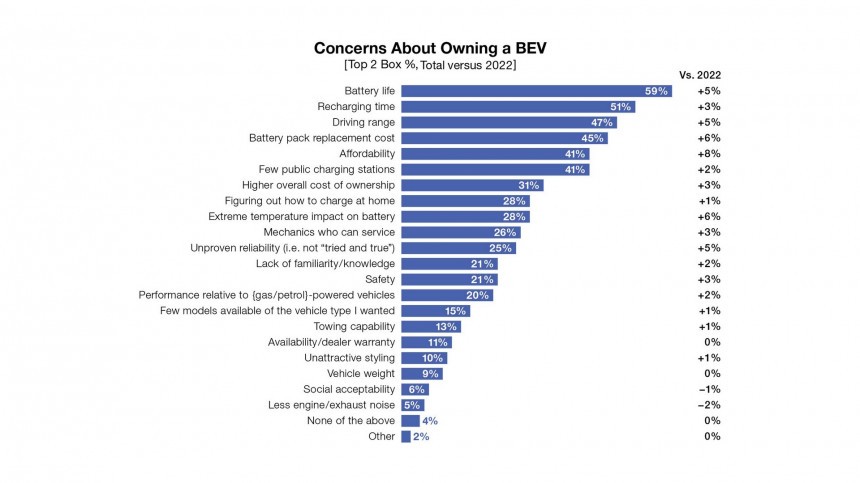

There is no focus on the main deterrent to BEV adoption: battery life. According to Ipsos, 59% of the respondents said they were worried about that, an increase of five percentual points compared to those who were afraid of the same thing in 2022. The second most relevant concern was recharging time, also with a higher percentage (51% instead of 48%). The research company only recognized that "driving range and battery life cannot yet measure up to what traditional ICE vehicles provide." Yet, Ipsos reinforced that the "worrying backslide in interest" (...) "couldn't come at a worse time for the automotive industry, where new BEV launches are happening at an accelerating pace."

With the explanation respondents provided with their list of concerns, it is puzzling that the research company thinks things could be any different. In other words, Ipsos defends that this moment would call for an increase in BEV ownership. It states that the "sustainability benefits BEVs bring to an environmentally conscious world" and other positive factors it comes up with suggest this moment "should theoretically be a perfect opportunity for the industry to capitalize and see a spike in BEV adoption." How, if the main concerns about BEV adoption are yet to be addressed?

The only point into which Ipsos goes a little deeper is when it talks about the cost of ownership, giving it a relevance it does not have. Among all concerns about purchasing a BEV, a "higher overall cost of ownership" is in the seventh place. That means there are six more pressing issues for potential customers. That did not prevent the research company from stating that "the myth persists that BEV ownership costs are higher than internal combustion vehicles" and trying to debunk that by using AAA's annual cost of ownership report. Based on that document, Ipsos stated that "the average cost of maintaining a BEV is $9,048 per year, compared to the $10,728 industry average." Indeed, but a better look at the AAA report shows a different picture.

First of all, AAA calculated three cost scenarios per year: 10,000 miles, 15,000 miles, and 20,000 miles. Ipsos mentioned the one that relates to the average mileage for American drivers: 15,000 miles per year. In those conditions, BEVs present only the second lowest ownership costs: small sedans demand less money. Driving 10,000 miles per year, small sedans and compact SUVs beat BEVs. Those running their cars 20,000 miles annually also make a better deal buying small sedans than cars powered by batteries.

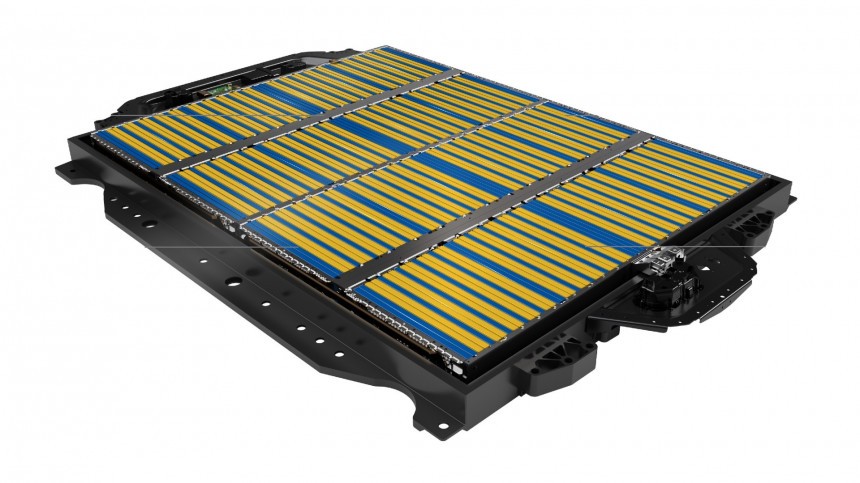

Second, the AAA report calculates only five years of ownership, during which BEVs still have their battery packs covered by the mandatory eight-year warranty. What if these components fail after that period? If the AAA added the expenses for replacing battery packs to the ownership costs, the figures would be much higher. These components are costly (between $15,000 and $20,000), and BEV makers say they are not repairable. The only choice for people willing to keep their cars is to replace the battery packs.

Finally, Ipsos asked its respondents about the "higher overall cost of ownership." The word "overall" implies something comprehensive, which includes the vehicle's price tag. If that were the case, BEVs would have a problem: they are more expensive than ICE vehicles, leading to a higher cost of ownership right off the bat. These cars only dodge that bullet with government incentives, which is equivalent to saying the government is partially paying for those BEVs or renouncing part of the taxes it would demand from their purchase and use. AAA's annual cost of ownership report only considers the purchase price indirectly: through depreciation. According to the association, BEVs are the vehicles that lose more value among all the categories evaluated. Intriguingly, depreciation is not among the concerns with electric cart ownership that the research company presented.

With Ipsos data, it is clear what automakers have to do: deal with battery pack lifespan concerns and increase range. The latter would automatically address worries about charging times: a vehicle that does not have to stop during a road trip will not demand fast charging. Our Next Energy (ONE) already suggested its solution for that, but we are yet to hear how it plans to solve battery pack lifespan concerns. The fourth more pressing worry related to BEV ownership is the cost of battery pack replacement, which is intimately connected to fears about the component's lifespan. The only company that seems to be willing to discuss that is AEHRA. The Italian startup said it intends to make battery packs repairable. Sadly, there is no official explanation of what it will do to sort that out.

This shows customers are perfectly aware of the dangers involved with BEV ownership. Despite that, Ipsos suggested three measures to improve adoption: offering more range, investing in fast chargers, and educating customers.

Apart from improving the range, the two other measures are controversial. As my readers already know, fast charging stresses the battery pack and reduces its lifespan, the main concern related to BEV ownership. "Educating customers" is a euphemism for trying to convince them that BEVs will save the world and their wallets when they know that this is not true. The research company even mentions "the cost of ownership savings" would help attract them when its own source shows they would save more driving small ICE sedans. The bottom line is that educated customers know they will have to worry about battery pack replacements and ranges that may be cut in half at high speeds or cold weather. Is it any wonder why BEV adoption has dropped?

The research company considered that a problem and tried to find an explanation for the phenomenon. A list of concerns about owning a BEV submitted to the respondents theoretically helped. However, Ipsos dedicated a generous portion of that explanation to one of the least relevant reasons not to buy a BEV: the belief that these cars present a "higher overall cost of ownership." Pay careful attention to how this concern is worded: it will be important to understand its full reach.

With the explanation respondents provided with their list of concerns, it is puzzling that the research company thinks things could be any different. In other words, Ipsos defends that this moment would call for an increase in BEV ownership. It states that the "sustainability benefits BEVs bring to an environmentally conscious world" and other positive factors it comes up with suggest this moment "should theoretically be a perfect opportunity for the industry to capitalize and see a spike in BEV adoption." How, if the main concerns about BEV adoption are yet to be addressed?

First of all, AAA calculated three cost scenarios per year: 10,000 miles, 15,000 miles, and 20,000 miles. Ipsos mentioned the one that relates to the average mileage for American drivers: 15,000 miles per year. In those conditions, BEVs present only the second lowest ownership costs: small sedans demand less money. Driving 10,000 miles per year, small sedans and compact SUVs beat BEVs. Those running their cars 20,000 miles annually also make a better deal buying small sedans than cars powered by batteries.

Finally, Ipsos asked its respondents about the "higher overall cost of ownership." The word "overall" implies something comprehensive, which includes the vehicle's price tag. If that were the case, BEVs would have a problem: they are more expensive than ICE vehicles, leading to a higher cost of ownership right off the bat. These cars only dodge that bullet with government incentives, which is equivalent to saying the government is partially paying for those BEVs or renouncing part of the taxes it would demand from their purchase and use. AAA's annual cost of ownership report only considers the purchase price indirectly: through depreciation. According to the association, BEVs are the vehicles that lose more value among all the categories evaluated. Intriguingly, depreciation is not among the concerns with electric cart ownership that the research company presented.

This shows customers are perfectly aware of the dangers involved with BEV ownership. Despite that, Ipsos suggested three measures to improve adoption: offering more range, investing in fast chargers, and educating customers.

Apart from improving the range, the two other measures are controversial. As my readers already know, fast charging stresses the battery pack and reduces its lifespan, the main concern related to BEV ownership. "Educating customers" is a euphemism for trying to convince them that BEVs will save the world and their wallets when they know that this is not true. The research company even mentions "the cost of ownership savings" would help attract them when its own source shows they would save more driving small ICE sedans. The bottom line is that educated customers know they will have to worry about battery pack replacements and ranges that may be cut in half at high speeds or cold weather. Is it any wonder why BEV adoption has dropped?