Those are two different studies that demonstrate a worrying reality: the risk of taking out a car loan and going underwater on it is increasingly high, and more and more Americans not only end up paying over $1,000 on their car loan but the payments themselves represent more than 15% of their monthly income. Mind you, we are referencing the conclusions of two studies in this paragraph, so it does not mean that people who are paying over $1,000 a month on their car loan are making 15 times as much.

Now, I am not a financial advisor, and this is not financial advice, just a warning. If you ask me, you do not have to be a finance expert to know that having a monthly $1,000 car payment is not a fabulous idea. Unless you make several times that amount each month (ideally, more than ten times the amount) and you have a stable job, you should think twice before going near a contract with a pen if that “deal” will lead to payments like these.

Even with over $10,000 a month in income, it may not be smart to get a car that involves paying $1,000+, as things may shift in the market before you finish paying for said vehicle, and you risk losing income while having a massive car payment. The only situation where it may be acceptable to have a payment this big would be if you already have a financial safety net.

As a reference, the amount in question should be enough to cover your monthly expenses for six months, so it depends on each person and their needs. You get the idea, right? It is easy to understand, but it involves individual math, and that's on you. Use an app to track your spending and make a budget.

If you factor in a $1,000 car payment, your monthly expenses will be quite high, and you should have $6,000 just for six months of car payments set aside.

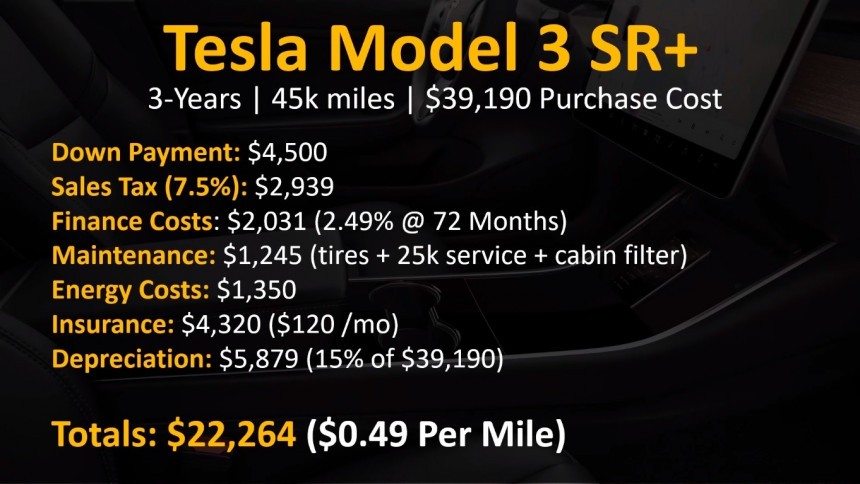

What most people do not account for is the cost of insurance—and it is advisable to get a quote online before you buy the vehicle and then make a worst-case scenario simulation where you see if you could pay twice as much for insurance to see if you can still afford it. Yes, that special vehicle that you desire should not involve a $1,000+ monthly payment.

Can you get tires and insurance and then still make the payment for the vehicle this month? Well, you might be on the right path if you still have money to spend after running the math on the rest of your expenses, and you still have money left in your account.

Mind you, all the estimates that we are referencing here must be done by you using your income, your expenses, and your estimated car and insurance payments. Remember to consider variable expenses such as fuel, as well as the occasional maintenance interval.

The financial safety net described above has multiple steps, and the described one is the first of many, and people who are financial advisors describe that step as an emergency fund. While I am not a financial advisor or a finance expert, and this is not financial advice, I dare suggest you start an “emergency fund” for your upcoming vehicle purchase, as well.

Currently, statistics made by Edmunds estimate that the average amount owed on upside-down loans was $5,341 in Q4 2022, while the same period of last year had that value at $4,141, and 2020 was in between, at $5,059. What does the data from this paragraph mean? Well, it means that fewer people were “less underwater” on their car loans in Q4 2021 than they were in 2022 and 2020. Those people will have a tough time selling their cars for close to what they paid for them.

The difference can be explained by lower APRs offered back in 2021, as well as in higher resale values of used vehicles, some of which were off the charts. As we wrote at the time, the used car price bubble was set to burst, and some will get burnt.

Sadly, it looks like that time has come, and people who owe about $5,000 for their vehicles are the most hurt, as those vehicles are not worth that much anymore, and they financed them for more, and now they are stuck with the payment for an overpriced used vehicle.

Do your best to not be put in a situation where you acquire a vehicle that ends up being worth significantly less than what you will pay for it, and if you do get a vehicle that sets you back that far, at least get a reliable one. Make your money's worth out of it by driving it to work, making more money, and paying it sooner rather than later to reduce your financial strain.