The dealership in question is presenting the videos under the tagline “Big Boy Edition,” which should mean that the people in question are somehow better than the rest of us for making those four-figure monthly payments without any complaints about the absurdity of the situation.

Now, I am not writing that those values themselves are the culprit alone, but I am thinking about the “fatal” combination between a high car payment, paying a sizable chunk of your monthly income for a depreciating asset, being underwater on a car loan, making it appear to be cool to be this much in debt, and not knowing where you purchase should be regarding your current position in your career.

I will admit that the above paragraph was a bit too long, but please follow my point on this one. I am a firm believer in the fact that you should make responsible choices when buying goods as expensive as a vehicle.

The acquisition of such an object should be considered for several days or weeks, not just hours or minutes. A vehicle should never be an impulse purchase.

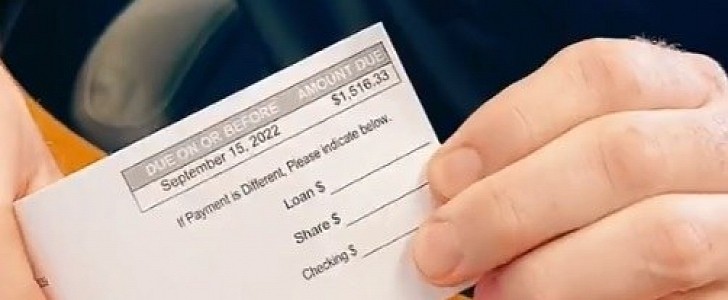

In fact, if the purchase gets you signed for a monthly payment, you have the first sign that you should think things through just a bit more. If that payment is more than what some people pay rent, it may be considered a red flag when thinking about purchasing said item. Sure, you may afford it today or next month, but are you sure you will be able to afford it six months from now?

Another important aspect to consider before purchasing something expensive is job security. I am referring to your job security, which ranges from predictable income to the potential risk of losing your job.

If you work in sales, you do not need me to tell you that your income may vary. Depending on seasonal trends, currency fluctuations, international events, interest rates, bank policies, and so on, the number of people who want to buy a car may vary dramatically.

With a fluctuating income, the last thing that anyone would advise would be to acquire a depreciating asset with money that you borrowed from the bank. You may not know how much money you are going to make two or three months from today, but the bank will still want its payment for that flashy new vehicle of yours.

Yes, buying a new and flashy vehicle is another recipe for financial failure. The idea that should have been promoted is not buying a new car when vehicle prices are through the roof these days and if you have an office job that only needs you to get there on time in the morning and leave when the schedule has concluded for the day.

You do not need a big truck, a large SUV, or another vehicle that costs more than $50k just to get to and from work. Especially if you do not make money with your vehicle, you are not the owner of the business, and you need to pay thousands of dollars each month for the privilege of getting to drive that vehicle.

In this case, car dealership employees can purchase a new vehicle at a more advantageous price or with preferential deals on financing, which their customers cannot get.

Some people on the Internet have come forward and explained that many dealership salespersons have ended up selling a vehicle to themselves just to meet the monthly or quarterly quota, only to “unload” that vehicle to another customer weeks later.

Similar conditions apply to bank tellers who apply for loans at the bank they work for or for other salespersons who can get the product they are selling at a discount if they buy from their employer. You get the picture here, but there is a twist- if they fail to sell that vehicle in time or lose their jobs, the bank still needs to get paid.

What many people who are not working at a dealership end up doing is being underwater on car loans because they keep financing vehicles that they cannot afford and then trade them in for newer models, only to get another loan for a more expensive vehicle. In the end, those people end up continuously paying more and more for their (newer) vehicles, all while pretending to be successful.

As a general idea, being underwater on a car loan means owing more money on a vehicle than its market value. If the down payment is not big enough, you will be underwater on most car loans, but the worst situation is trading in a vehicle that you have not finished paying for to get a newer model. While the salesperson will be happy to serve you, you are getting the short end of the stick from the bank, the dealer, and the car market.

Many years ago, credit cards were presented as the solution to everyday problems. Many got them and used them poorly, and this resulted in debt for millions of people. The 2008 financial crash is an event that happened 14 years ago, and I feel that people have forgotten what that was like for many.

Well, being underwater on a loan with a four-figure monthly payment and a volatile job with variable income is a dangerous place to be in if the financial world manages to crash as it did back then. Instead, we should make purchases without putting our financial stability at risk, or at least stop glorifying those who do such foolish things.

As usual, young people will miss the entire thing, and we will have another generation in debt for depreciating assets. But hey, who rolled 'up in that '23 truck with dealer plates?

Does this dealership realize this makes them all look really bad???? pic.twitter.com/RGhOoMznXt

— Jessica Ray (@jessicaray0) August 27, 2022