Carbon Tracker provides analysis and company profiles for nearly 85% of big players in the Oil & Gas, Power & Utilities, and Automotive sectors. The latter is the subject of the Slipped Gear report, and the general conclusion is that most car manufacturers’ emissions goals are unaligned to meet the climate targets of the Paris Agreement.

The Paris Agreement seemed a historical international treaty on climate change. That is until governments and industries proved that they favored business-as-usual carbon-intensive activities.

At least that’s what the Carbon Tracker report concludes for the automotive sector. This is to say that carmakers must really gear up the pledges they made seven years ago.

Carbon Tracker dived into data about 2050 net zero GHG emissions objectives, strategy implementation, and financial climate-risk disclosures. Sounds complicated, huh? Let’s keep things simple.

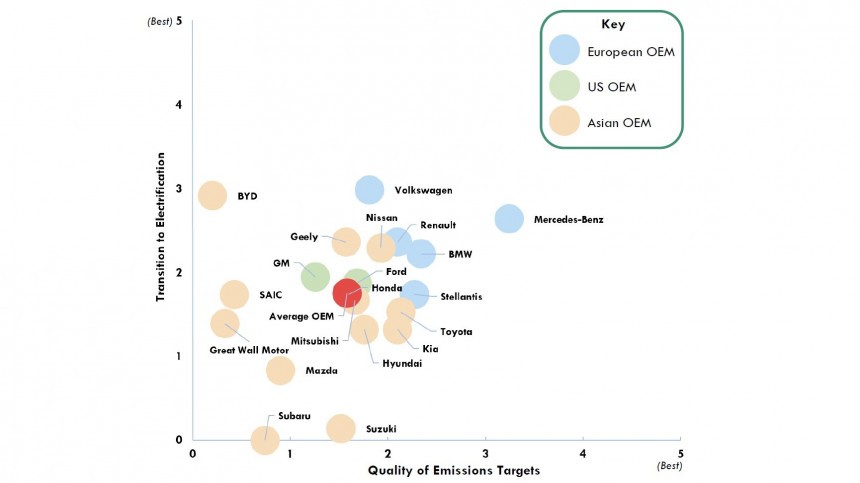

While Volkswagen and BYD are the best in terms of leadership in electrification, Mercedes-Benz is the one standing out in both categories. VW still has to deliver on promises, while BYD’s lack of a clear strategy is a downgrade.

In fact, all the Chinese carmakers considered are plagued by a lack of transparency. But half of the Japanese companies are really disappointing in terms of planning.

The average for car manufacturers is considered pretty low, which is to say that even the best in this report – which is European carmakers – still need to do a lot of improvements to achieve their goals.

These are the ones coming out of a car’s tailpipe when it’s in use. They make up 75% of all vehicle emissions, while the rest of the emissions are due to the manufacturing and disposal of the car.

Simply put, car manufacturers have to ditch as fast as they can the internal combustion engines in favor of battery-electric propulsion or hydrogen, or other non-polluting solutions. This is part of the Paris Agreement pledges.

But Carbon Tracker is telling us that “quantifying their GHG emissions reduction strategy is lacking.” And that most car manufacturers also “put brakes on transparent financial alignment with Paris Agreement”.

This is a credibility issue, and a lack of relevant information and planning could lead to overstated assets, understated liabilities, and overstated profits. It’s like simply lying to investors and stakeholders about their investments and heading right to bankruptcy.

This is merely a warning based on data gathered up to this point by Carbon Tracker. Make no mistake, they all have much more to do, and it seems European companies are on the right track. But they need to speed things up.

For instance, FCA (Fiat-Chrysler Automobiles, now part of Stellantis) paid Tesla €2 billion in 2019 and 2020. That way, FCA avoided significant penalty fines for the non-compliant fleet. Also, Mercedes-Benz relied on its smart all-electric sub-brand to comply with the emissions regulations.

But for Carbon Tracker, these are only tricks to hide the true emissions and are affecting the long-term commitments of brands. Buying emissions credits instead of investing that money in R&D and electrification is simply wasted capital.

This practice should be phased-out in order to force each company to accelerate its e-mobility transition. For instance, the FCA and PSA merger created Stellantis, and now Peugeot-Citroen advanced know-how in electromobility is conveniently transferred to other group brands.

Therefore, Carbon Tracker urges regulators to enact stricter emissions targets for the short term. The controversial Euro 7 norms are a good example, where carmakers raise concerns about hard-to-meet criteria.

But analysts and regulators already agree that many fears are unfounded and the industry is simply “hooked on the profits from ICE vehicles.” Carmakers must gear up converting their assets towards BEVs.

Of course, we cannot ignore the context. There is a big possibility for an economic recession in 2023, the war in Eastern Europe is far from ending, and inflation and the energy crisis are here to stay for some time.

Despite this harsh reality, carmakers simply cannot afford to slow down the e-mobility transition. Carbon Tracker report adds the missing link of climate risk to the capital markets.

This means that carmakers will eventually face a clear choice. Either convert ICE cars factories to EV factories (the sooner, the better). Or sell – or even shut down – ICE cars assets, likely leading to huge losses or asset stranding.

At least that’s what the Carbon Tracker report concludes for the automotive sector. This is to say that carmakers must really gear up the pledges they made seven years ago.

Carbon Tracker dived into data about 2050 net zero GHG emissions objectives, strategy implementation, and financial climate-risk disclosures. Sounds complicated, huh? Let’s keep things simple.

Who is better in the race to net zero goals?

The Slipped Gear report took into consideration 20 car manufacturers, covering 85% of the global vehicles production and sales:- seven Japanese: Honda, Mazda, Mitsubishi, Nissan, Subaru, Suzuki, Toyota

- five European: BMW, Mercedes-Benz, Renault, Stellantis, Volkswagen

- five Chinese: BYD, Geely, Great Wall Motors, SAIC

- two Korean: Hyundai, KIA

- two U.S.: Ford, GM

In fact, all the Chinese carmakers considered are plagued by a lack of transparency. But half of the Japanese companies are really disappointing in terms of planning.

The average for car manufacturers is considered pretty low, which is to say that even the best in this report – which is European carmakers – still need to do a lot of improvements to achieve their goals.

ICE emissions are really the elephant in the room

Regarding the net zero goal, the most important objective is for car manufacturers to reduce down to zero the so-called Scope 3 emissions.These are the ones coming out of a car’s tailpipe when it’s in use. They make up 75% of all vehicle emissions, while the rest of the emissions are due to the manufacturing and disposal of the car.

Simply put, car manufacturers have to ditch as fast as they can the internal combustion engines in favor of battery-electric propulsion or hydrogen, or other non-polluting solutions. This is part of the Paris Agreement pledges.

But Carbon Tracker is telling us that “quantifying their GHG emissions reduction strategy is lacking.” And that most car manufacturers also “put brakes on transparent financial alignment with Paris Agreement”.

This is a credibility issue, and a lack of relevant information and planning could lead to overstated assets, understated liabilities, and overstated profits. It’s like simply lying to investors and stakeholders about their investments and heading right to bankruptcy.

This is merely a warning based on data gathered up to this point by Carbon Tracker. Make no mistake, they all have much more to do, and it seems European companies are on the right track. But they need to speed things up.

Is emissions pooling a trick?

An unsettling issue this report sheds light on is the fleet emissions pool. Simply put, a non-compliant carmaker can combine its fleet emissions with a compliant carmaker. And the regulator will take into account the new average fleet emissions.For instance, FCA (Fiat-Chrysler Automobiles, now part of Stellantis) paid Tesla €2 billion in 2019 and 2020. That way, FCA avoided significant penalty fines for the non-compliant fleet. Also, Mercedes-Benz relied on its smart all-electric sub-brand to comply with the emissions regulations.

But for Carbon Tracker, these are only tricks to hide the true emissions and are affecting the long-term commitments of brands. Buying emissions credits instead of investing that money in R&D and electrification is simply wasted capital.

This practice should be phased-out in order to force each company to accelerate its e-mobility transition. For instance, the FCA and PSA merger created Stellantis, and now Peugeot-Citroen advanced know-how in electromobility is conveniently transferred to other group brands.

ICE’s profits is still a big love affair

For the foreseeable future, most carmakers will rely on profits from internal combustion engine cars. While these profits are funding the e-mobility transition, there is also the very clear risk of slowing it down.Therefore, Carbon Tracker urges regulators to enact stricter emissions targets for the short term. The controversial Euro 7 norms are a good example, where carmakers raise concerns about hard-to-meet criteria.

But analysts and regulators already agree that many fears are unfounded and the industry is simply “hooked on the profits from ICE vehicles.” Carmakers must gear up converting their assets towards BEVs.

Of course, we cannot ignore the context. There is a big possibility for an economic recession in 2023, the war in Eastern Europe is far from ending, and inflation and the energy crisis are here to stay for some time.

Despite this harsh reality, carmakers simply cannot afford to slow down the e-mobility transition. Carbon Tracker report adds the missing link of climate risk to the capital markets.

This means that carmakers will eventually face a clear choice. Either convert ICE cars factories to EV factories (the sooner, the better). Or sell – or even shut down – ICE cars assets, likely leading to huge losses or asset stranding.