The non-governmental organization (NGO) Transport & Environment published a report in which they say Hyundai, Kia, BMW, and other automakers are misleading investors about their environmental impact. The NGO calls most major carmakers “oil companies in disguise” and recommends avoiding holding their stocks. Here’s why.

The EU and the U.S. decided they will enforce the Corporate Value Chain Standard (Scope 3) from 2023, claiming it protects investors from incomplete data submitted by companies that are committed to reducing their international or global carbon footprint. Essentially, it refers to the entities that adhered to the environmental, social, and governance (ESG) investing standards. These are meant to help investors put their money into companies that are conscious of their impact on the environment and take active measures to change what’s not right or fit in the long term.

Scope 3 will also allow investors and climate-conscious buyers to see which cars contribute more to the world’s pollution thanks to the disclosure of life-cycle emissions. Basically, this standard will force every ESG-rated automaker to reveal how much a car pollutes the environment during its lifetime.

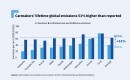

The Transport & Environment (T&E) comprehensive report reveals that Hyundai and Kia have 116% higher estimated emissions than what’s being currently disclosed. Once Scope 3 is implemented, this data will become publicly and widely available, and the stock price could take a hit. That’s why the NGO is warning investors against buying or holding automakers’ stocks.

T&E estimates BMW is at 81%, Toyota at 69%, Mercedes-Benz at 62%, the Renault-Mitsubishi-Nissan Alliance at 61%, and Volkswagen at 58% over their currently disclosed emissions.

Tesla is not included because it is not part of the ESG-adhering companies anymore. It was removed from the index back in May for not showing proper business conduct and having a low carbon strategy, even though it manufactures only zero-tailpipe emission vehicles.

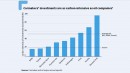

The NGO argues in its analysis that investing in a carmaker right now is worse than sending money right to the oil industry, which has a carbon-intensive activity. For example, investing €1 million ($976,250) in the Renault-Mitsubishi-Nissan Alliance would quintuple the carbon emissions created by an oil company like Exxon that receives similar funding. Honda, Ford, Volkswagen, and Stellantis are the runners-up in this scenario.

“Carmakers are trying to pull the wool over investors eyes by underreporting the lifetime emissions of their cars. This makes a mockery of carmakers’ green claims,” says T&E’s director of sustainable finance.

Finally, the T&E study available down below says most carmakers underestimate their cars’ lifetime emissions and Scope 3 will reveal that next year or in 2024, which is why investors should act now.

Scope 3 will also allow investors and climate-conscious buyers to see which cars contribute more to the world’s pollution thanks to the disclosure of life-cycle emissions. Basically, this standard will force every ESG-rated automaker to reveal how much a car pollutes the environment during its lifetime.

The Transport & Environment (T&E) comprehensive report reveals that Hyundai and Kia have 116% higher estimated emissions than what’s being currently disclosed. Once Scope 3 is implemented, this data will become publicly and widely available, and the stock price could take a hit. That’s why the NGO is warning investors against buying or holding automakers’ stocks.

T&E estimates BMW is at 81%, Toyota at 69%, Mercedes-Benz at 62%, the Renault-Mitsubishi-Nissan Alliance at 61%, and Volkswagen at 58% over their currently disclosed emissions.

Tesla is not included because it is not part of the ESG-adhering companies anymore. It was removed from the index back in May for not showing proper business conduct and having a low carbon strategy, even though it manufactures only zero-tailpipe emission vehicles.

The NGO argues in its analysis that investing in a carmaker right now is worse than sending money right to the oil industry, which has a carbon-intensive activity. For example, investing €1 million ($976,250) in the Renault-Mitsubishi-Nissan Alliance would quintuple the carbon emissions created by an oil company like Exxon that receives similar funding. Honda, Ford, Volkswagen, and Stellantis are the runners-up in this scenario.

“Carmakers are trying to pull the wool over investors eyes by underreporting the lifetime emissions of their cars. This makes a mockery of carmakers’ green claims,” says T&E’s director of sustainable finance.

Finally, the T&E study available down below says most carmakers underestimate their cars’ lifetime emissions and Scope 3 will reveal that next year or in 2024, which is why investors should act now.