General Motors was caught in the entire planet’s crosshairs earlier this month when it announced its intention to ditch Android Auto and CarPlay.

Starting in 2024, the company will no longer offer the two smartphone mirroring options in new EVs. These models will be equipped with Android Automotive as General Motors is transitioning to a subscription-based strategy.

New customers, however, won’t have to pay anything in the first eight years after buying a new EV. But connecting their phones to vehicles to run Android Auto or CarPlay would no longer be possible, it says.

The announcement took potential customers by surprise. According to Apple statistics, close to 80 percent of new-car buyers wouldn’t even consider ordering a vehicle without CarPlay support. General Motors might be in for a huge surprise if these numbers are accurate.

Given the criticism that emerged following GM’s announcement, the rest of the carmakers rushed to confirm their commitment to keeping Android Auto and CarPlay in their cars. Ford, Volvo, Honda, BMW, and others will continue to offer the two systems.

Nevertheless, the entire industry might follow in GM’s footsteps. Not because they want to but because they need to.

Radio Free Mobile's founder and analyst Richard Windsor says auto manufacturers have no other option than to become the main provider of digital services in their cars. As such, they must invest in new systems, both at the software and hardware levels, to convince their customers to stop using smartphones.

In other words, they must build something better than Android Auto and CarPlay, eventually giving drivers a good reason to leave these two behind.

In the last few years, carmakers have more or less abandoned the fight for controlling the infotainment component of the driving experience. Most gave in to Google and Apple, leading to record adoption of Android Auto and CarPlay. More than 150 million vehicles were using Android Auto in early 2022, according to Google’s data.

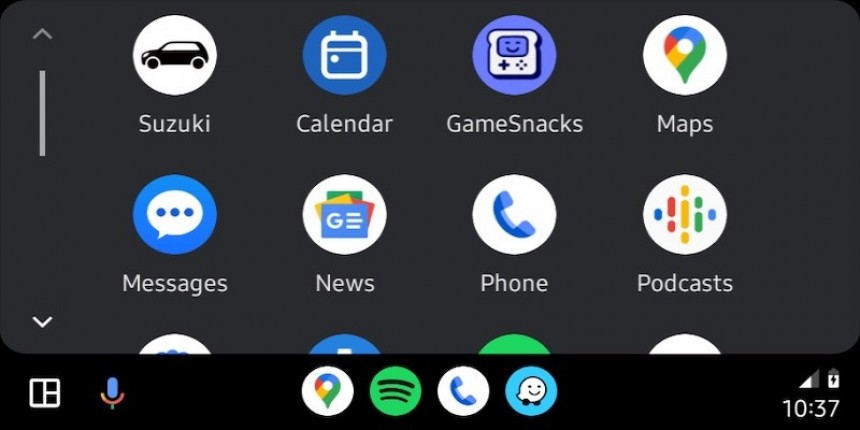

Adoption has been on the rise ever since, as everybody has a phone in their pocket. Connecting the smartphone to the head unit allows drivers to project Google Maps or Waze on the larger screen in the cabin. They can listen to music using the stereo system in the vehicle. Voice commands enable them to control everything hands-free.

Windsor signals the importance of investing in digital services. On the one hand, such a strategy could build a new revenue stream. It’s not something customers like, or at least not now, but most carmakers are expected to insist on subscriptions in the long term.

General Motors, Volkswagen, BMW, and others will continue to invest in subscription models as they try to turn them into an important cash cow.

There’s no doubt customers will try to resist the change. Especially when looking at the paths carmakers could eventually embrace.

The analyst says auto manufacturers could use several approaches to make money using subscription systems. One of them is digital advertising. Sure enough, this sounds horrible, but we might not be too far from the point where carmakers could end up showing you an ad every once in a while.

But eventually, carmakers must find the right balance between their own benefits and the features offered to customers. The analyst says automakers could try to entice customers with more integrated services, such as smart parking support. Drivers would be able to reserve a parking spot in advance and then get directions via the navigation system embedded into the vehicle.

However, both Android Auto and CarPlay have evolved substantially in this regard. Parking apps are already available on the two platforms, and drivers can make payments right from their screens. Windsor believes an integrated system would offer control over all displays in the cabin, but this is something that Apple is exploring as well.

The new-generation CarPlay will support all screens, including the instrument cluster. Carmakers will have the option to customize the look and feel, specifically to retain the brand identity, but otherwise, it’ll still be CarPlay running everywhere.

In the long term, carmakers might try to get rid of CarPlay and Android Auto specifically as they want to turn the infotainment and digital services into a money-making machine. Indeed, by giving in the infotainment to Google and Apple, they significantly slow down their strategies on this front.

But without a doubt, ditching CarPlay and Android Auto isn’t going to be easy. First of all, carmakers must build something better. And given their know-how on this front, this could take more time than they can afford. Second of all, convincing customers to pay for something they can otherwise get for free is going to be hard. Everybody has a phone in their pocket, and given that drivers had already paid for it, using all its capabilities makes perfect sense. Android Auto and CarPlay are essential features of the two mobile platforms.

Eventually, the efforts to build something better could come down to building a unified platform that would include all the benefits of CarPlay and Android Auto but also allow app developers to maintain their apps with reduced effort. If every carmaker comes up with its own platform, app developers could end up ignoring them altogether. As such, building a new revenue stream is much harder than it appears to be.

Carmakers themselves are the ones that made everybody love Android Auto and CarPlay. They insisted on these features in their models, and more often than not, they used them as huge selling points. Now that everybody is addicted to using them, auto manufacturers must find a way to convince customers to try something new.

At the end of the day, in their struggle to build new revenue streams, carmakers must first deal with their limited know-how in their software market. Then, they must be committed to updates and working with developers. Ensuring proper developer support is critical, and drivers will end up frustrated without apps. Third, finding the right balance between an aggressive money-making strategy and customers’ benefits will be crucial. Carmakers know they must make money with infotainment, but they don’t know how to do it. And killing off Android Auto and CarPlay overnight certainly isn’t possible.

Winning back the infotainment isn’t going to be easy, that’s for sure.

New customers, however, won’t have to pay anything in the first eight years after buying a new EV. But connecting their phones to vehicles to run Android Auto or CarPlay would no longer be possible, it says.

The announcement took potential customers by surprise. According to Apple statistics, close to 80 percent of new-car buyers wouldn’t even consider ordering a vehicle without CarPlay support. General Motors might be in for a huge surprise if these numbers are accurate.

Given the criticism that emerged following GM’s announcement, the rest of the carmakers rushed to confirm their commitment to keeping Android Auto and CarPlay in their cars. Ford, Volvo, Honda, BMW, and others will continue to offer the two systems.

Nevertheless, the entire industry might follow in GM’s footsteps. Not because they want to but because they need to.

In other words, they must build something better than Android Auto and CarPlay, eventually giving drivers a good reason to leave these two behind.

In the last few years, carmakers have more or less abandoned the fight for controlling the infotainment component of the driving experience. Most gave in to Google and Apple, leading to record adoption of Android Auto and CarPlay. More than 150 million vehicles were using Android Auto in early 2022, according to Google’s data.

Adoption has been on the rise ever since, as everybody has a phone in their pocket. Connecting the smartphone to the head unit allows drivers to project Google Maps or Waze on the larger screen in the cabin. They can listen to music using the stereo system in the vehicle. Voice commands enable them to control everything hands-free.

Windsor signals the importance of investing in digital services. On the one hand, such a strategy could build a new revenue stream. It’s not something customers like, or at least not now, but most carmakers are expected to insist on subscriptions in the long term.

There’s no doubt customers will try to resist the change. Especially when looking at the paths carmakers could eventually embrace.

The analyst says auto manufacturers could use several approaches to make money using subscription systems. One of them is digital advertising. Sure enough, this sounds horrible, but we might not be too far from the point where carmakers could end up showing you an ad every once in a while.

But eventually, carmakers must find the right balance between their own benefits and the features offered to customers. The analyst says automakers could try to entice customers with more integrated services, such as smart parking support. Drivers would be able to reserve a parking spot in advance and then get directions via the navigation system embedded into the vehicle.

However, both Android Auto and CarPlay have evolved substantially in this regard. Parking apps are already available on the two platforms, and drivers can make payments right from their screens. Windsor believes an integrated system would offer control over all displays in the cabin, but this is something that Apple is exploring as well.

The new-generation CarPlay will support all screens, including the instrument cluster. Carmakers will have the option to customize the look and feel, specifically to retain the brand identity, but otherwise, it’ll still be CarPlay running everywhere.

In the long term, carmakers might try to get rid of CarPlay and Android Auto specifically as they want to turn the infotainment and digital services into a money-making machine. Indeed, by giving in the infotainment to Google and Apple, they significantly slow down their strategies on this front.

Eventually, the efforts to build something better could come down to building a unified platform that would include all the benefits of CarPlay and Android Auto but also allow app developers to maintain their apps with reduced effort. If every carmaker comes up with its own platform, app developers could end up ignoring them altogether. As such, building a new revenue stream is much harder than it appears to be.

Carmakers themselves are the ones that made everybody love Android Auto and CarPlay. They insisted on these features in their models, and more often than not, they used them as huge selling points. Now that everybody is addicted to using them, auto manufacturers must find a way to convince customers to try something new.

At the end of the day, in their struggle to build new revenue streams, carmakers must first deal with their limited know-how in their software market. Then, they must be committed to updates and working with developers. Ensuring proper developer support is critical, and drivers will end up frustrated without apps. Third, finding the right balance between an aggressive money-making strategy and customers’ benefits will be crucial. Carmakers know they must make money with infotainment, but they don’t know how to do it. And killing off Android Auto and CarPlay overnight certainly isn’t possible.

Winning back the infotainment isn’t going to be easy, that’s for sure.