For now, Americans still like gas- and diesel-powered pickup trucks. So far, the top three best-selling vehicles in 2023 are Ford's F-Series, the Chevrolet Silverado, and the Ram pickup. But in fourth place resides nonother than the Tesla Model Y – an all-electric crossover SUV that also happens to be considered the world's best-selling car. It's a sign that we must take taxing EVs seriously. But not by disregarding fairness.

Last year, over 755,000 of the 13,903,429 new vehicles sold in the US were all-electric. Only 2.86 million were cars. The absolute champions were Toyota, Ford, and Chevrolet.

But the demand for vehicles with a battery on the floor of their chassis continued to grow exponentially in 2023. Experian data shows that Americans registered over 257,000 EVs in the first three months. Cox Automotive revealed that EV sales rose to almost 300,000 in the second quarter.

We expect the third quarter of 2023 to bring the number of new EVs on the road until October 1 to a new yearly record. Such a feat would overshadow the 2022 new EV sales by a considerable margin and three months earlier.

Given that Tesla, Ford, and Lucid applied serious discounts and that Rivian and Fisker have ramped up production and deliveries, the total number of all-electric vehicles sold in 2023 could surpass the 1 million mark.

Adding General Motors' and Stellantis' efforts regarding the electrification of their brands' fleets and European manufacturers like BMW, Mercedes-Benz, Porsche, and VW with their all-electric offers in the mix further cements our hypothesis that Americans will buy over 1 million new EVs this year.

But Asian automakers like Hyundai, Kia, Honda, and even Toyota are also contributing to the effort of leaving the internal combustion engine in history books. And with all the federal and state incentives available for buying EVs and expanding the fast-charging infrastructure, it's clear that we're moving away from burning fossil fuel for personal mobility.

I would argue that the Organization of the Petroleum Exporting Countries (OPEC) also contributes to more and more people exploring owning an EV. After all, it can be charged at home. That's much cheaper than filling up a gas tank. Saudi Arabia championed the move to reduce daily oil output, even though the US opposed it.

Consequently, gas prices rose nearly everywhere in the last couple of weeks and remain on an upward trend.

But with an ever-increasing number of all-electric vehicles on the road, states face an important dilemma – how not to lose the funds needed to maintain road infrastructure. Since EV owners are not filling up anymore, they're not paying the gas tax. This levy varies from state to state, with Pennsylvania charging the highest tax rate – $0.61 per gallon of gas and $0.78 per gallon of undyed diesel.

So, should states make those not burning fossil fuels pay more for registration and higher property taxes because they're not buying gas?

In comparison, those driving a Ford F-150 Raptor will still pay $50.75 to register their pickup truck annually. The idea behind this fee structure is that people driving gas- or diesel-powered vehicles contribute to the state's infrastructure budget by filling up, whereas EV owners don't.

(F-150 Lightning Raptor Concept Render)

When it comes to cars being subject to property taxes, things are a tad bit more complicated in the Lone Star state. However, if you own your vehicle, most counties do not require you to pay a yearly property tax. The $50.75 or $200 registration will be your only worry unless you reside in counties like Denton and lease or use the vehicle for business purposes.

Technically, 23 states and Washington, DC, do not have a yearly car property tax. Texas is one of them, but a two-decade-old legislation allowed some municipalities to include cars in property taxes. Some took advantage of that short-term window, and some didn't.

Two very different people buy an all-electric vehicle. One gets the dual-motor 2024 GMC Hummer EV SUV. The other buys a Tesla Model Y Long Range. Starting in September, both will pay $400 to register their vehicle for the first time. In January 2024, they'll be due another $200 for renewing the registration.

Let's look at some numbers and determine if that uniform approach is right.

The GMC watt-waster puts out 830 hp and 1,200 lb-ft of torque. It has a curb weight of 9,640 lb. The battery pack alone tips the scales at 2,818 lb, which is just 59 lb less than a 2023 Honda Civic. The Volt vulture has a starting cost of $84,650.

On the other hand, the world-best selling car has an output of 384 hp and 376 lb-ft of torque. Its starting price is $50,490 when writing. The curb weight of the Model Y LR is almost half of the Hummer's – 4,464 lb. Similarly, the battery pack is estimated to be nearly three times more lightweight than the GMC's energy storage unit, weighing just 981 lb.

When these two owners are ready to pay their registration, they both spend the same. Considering the above figure, that is not a fair situation.

Moreover, Texas' approach rewards automakers to continue making heavy, massive, and inefficient EVs. These zero-tailpipe emission behemoths might never reach their climate-friendly goal since they come out of the factory with a large carbon footprint due to mining for minerals used in batteries and lengthy supply chains.

On top of that, an owner of an incredibly potent EV will most likely want to use their vehicle's capabilities. That'll only lead to more wear and energy consumption, proving what we've said above – making every EV owner pay the same yearly fee isn't correct.

Starting in 2022, a group of volunteers representing ordinary citizens and companies from all the states enrolled in a three-year program tracking with a telematics device how often and for how long they get behind the wheel. They are asked to pay a quarterly fee based on the mileage recorded.

Known as the vehicle miles-traveled (VMT) tax, this is a relatively new concept in the US, but it has already been implemented in some parts of the world. The federal government wants to figure out by 2025 if such an approach would be good enough to gradually replace the revenue collected by states from the gas tax with a per-mile levy from… Everyone who's driving! It will return the quarterly fees paid by the volunteers to them, so participation in this experiment won't cost them a penny.

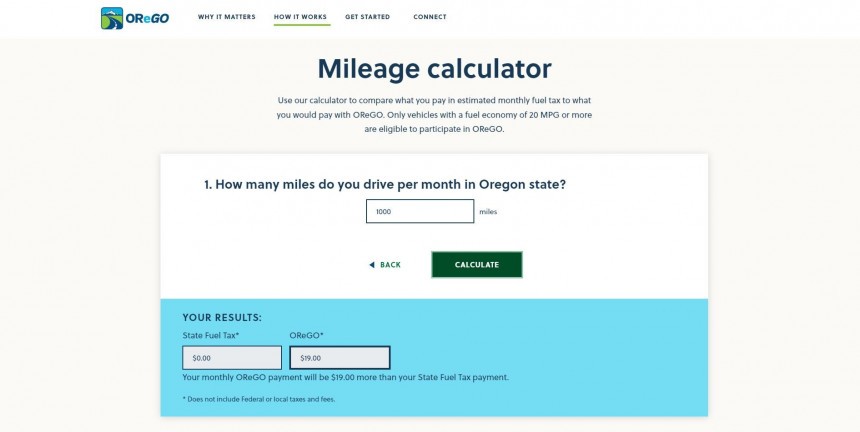

Oregon took it a step further and made it into an optional state program called OReGO. An EV owner would pay $19 per 1,000 miles were they to join.

On the other hand, drivers of gas-powered cars automatically contribute to the state's infrastructure budget with $0.38 per every gallon they put in the tank. But if they have a vehicle with a consumption of at least 20 mph, they can join too! A 2022 Toyota Camry has a fuel economy of 32 mpg. Were the owner to enter the OReGO program and drive the same 1,000 miles per month, they'd pay the same $19 - $7.12 more than the state's fuel tax.

Thus, the program isn't fair because an EV owner would contribute more to the state's infrastructure budget than someone driving an internal combustion engine-powered vehicle who's not part of the OReGO.

Taxing EVs based on their weight and power output is a better and fairer option.

Lawmakers in every state should consider adopting a progressive yearly tax for EVs used for non-commercial purposes, such as:

At the same time, the federal government should push states to adopt more aggressive yearly fees for cars and trucks that are exclusively powered by an internal combustion engine that does not use renewable fuel or any form of electrification.

A tax structure like the one above would allow states to collect enough revenue to maintain the roads in good condition in a scenario where most of the vehicles present on the streets are EVs. It would also prompt automakers to consider making more efficient cars, invest in better battery chemistry, and focus on a simplified chassis that doesn't stray from federal motor vehicle safety standards.

But, most importantly, such a tax system would eliminate inequalities and ensure that those most prone to damage the roads are also paying enough to fix them.

But the demand for vehicles with a battery on the floor of their chassis continued to grow exponentially in 2023. Experian data shows that Americans registered over 257,000 EVs in the first three months. Cox Automotive revealed that EV sales rose to almost 300,000 in the second quarter.

We expect the third quarter of 2023 to bring the number of new EVs on the road until October 1 to a new yearly record. Such a feat would overshadow the 2022 new EV sales by a considerable margin and three months earlier.

Given that Tesla, Ford, and Lucid applied serious discounts and that Rivian and Fisker have ramped up production and deliveries, the total number of all-electric vehicles sold in 2023 could surpass the 1 million mark.

Changes – for the better?

Approximately 7% of these new EV sales should comprise the Bolt EV and EUV since GM said that production of the two vehicles in 2023 would rise to 70,000.But Asian automakers like Hyundai, Kia, Honda, and even Toyota are also contributing to the effort of leaving the internal combustion engine in history books. And with all the federal and state incentives available for buying EVs and expanding the fast-charging infrastructure, it's clear that we're moving away from burning fossil fuel for personal mobility.

I would argue that the Organization of the Petroleum Exporting Countries (OPEC) also contributes to more and more people exploring owning an EV. After all, it can be charged at home. That's much cheaper than filling up a gas tank. Saudi Arabia championed the move to reduce daily oil output, even though the US opposed it.

But with an ever-increasing number of all-electric vehicles on the road, states face an important dilemma – how not to lose the funds needed to maintain road infrastructure. Since EV owners are not filling up anymore, they're not paying the gas tax. This levy varies from state to state, with Pennsylvania charging the highest tax rate – $0.61 per gallon of gas and $0.78 per gallon of undyed diesel.

So, should states make those not burning fossil fuels pay more for registration and higher property taxes because they're not buying gas?

Putting early adopters on the spot

Texas recently implemented such a measure. Existing EV owners must pay $400 when registering a climate-friendly car or truck weighing 10,000 lb or less for the first time. That means someone owning a Tesla who registered their vehicle in 2023 must pay an extra $349.25 starting in September. Next year, they will be due just $200 per year to prove they're from Texas and own that EV.In comparison, those driving a Ford F-150 Raptor will still pay $50.75 to register their pickup truck annually. The idea behind this fee structure is that people driving gas- or diesel-powered vehicles contribute to the state's infrastructure budget by filling up, whereas EV owners don't.

When it comes to cars being subject to property taxes, things are a tad bit more complicated in the Lone Star state. However, if you own your vehicle, most counties do not require you to pay a yearly property tax. The $50.75 or $200 registration will be your only worry unless you reside in counties like Denton and lease or use the vehicle for business purposes.

Technically, 23 states and Washington, DC, do not have a yearly car property tax. Texas is one of them, but a two-decade-old legislation allowed some municipalities to include cars in property taxes. Some took advantage of that short-term window, and some didn't.

Choices without consequences

But let's continue taking Texas as an example.Two very different people buy an all-electric vehicle. One gets the dual-motor 2024 GMC Hummer EV SUV. The other buys a Tesla Model Y Long Range. Starting in September, both will pay $400 to register their vehicle for the first time. In January 2024, they'll be due another $200 for renewing the registration.

Let's look at some numbers and determine if that uniform approach is right.

On the other hand, the world-best selling car has an output of 384 hp and 376 lb-ft of torque. Its starting price is $50,490 when writing. The curb weight of the Model Y LR is almost half of the Hummer's – 4,464 lb. Similarly, the battery pack is estimated to be nearly three times more lightweight than the GMC's energy storage unit, weighing just 981 lb.

When these two owners are ready to pay their registration, they both spend the same. Considering the above figure, that is not a fair situation.

Moreover, Texas' approach rewards automakers to continue making heavy, massive, and inefficient EVs. These zero-tailpipe emission behemoths might never reach their climate-friendly goal since they come out of the factory with a large carbon footprint due to mining for minerals used in batteries and lengthy supply chains.

A better approach to taxing EVs

So, what would be the better version? We envisioned two. One's already in the works, even if some of us forgot. It's the pilot program launched with the Bipartisan Infrastructure Law.Starting in 2022, a group of volunteers representing ordinary citizens and companies from all the states enrolled in a three-year program tracking with a telematics device how often and for how long they get behind the wheel. They are asked to pay a quarterly fee based on the mileage recorded.

Known as the vehicle miles-traveled (VMT) tax, this is a relatively new concept in the US, but it has already been implemented in some parts of the world. The federal government wants to figure out by 2025 if such an approach would be good enough to gradually replace the revenue collected by states from the gas tax with a per-mile levy from… Everyone who's driving! It will return the quarterly fees paid by the volunteers to them, so participation in this experiment won't cost them a penny.

Oregon took it a step further and made it into an optional state program called OReGO. An EV owner would pay $19 per 1,000 miles were they to join.

Thus, the program isn't fair because an EV owner would contribute more to the state's infrastructure budget than someone driving an internal combustion engine-powered vehicle who's not part of the OReGO.

Taxing EVs based on their weight and power output is a better and fairer option.

Making sure everyone's chipping in

EVs may not burn fossil fuels to empower our mobility or use the physical brakes as often as a gas car, but they chew through tires faster than a conventional automobile. Rubber ring wear releases air particulate emissions that harm humans and the environment. In fact, just last year, we learned that tires generate so many microplastics that are now considered the second-largest pollutant of our oceans.- $50 for cars and trucks weighing under 3,500 lb and with an output of 200 hp or less;

- $100 for cars and trucks weighing between 3,501 lb and 5,000 lb and with an output between 201 hp and 350 hp;

- $150 for cars and trucks weighing between 5,001 lb and 5,999 lb and with an output between 351 hp and 400 hp;

- $200 for cars and trucks weighing between 6,000 lb and 6,600 lb and with an output between 401 hp and 500 hp;

- $0.5 per lb supplement over 6,600 lb and over 501 hp.

At the same time, the federal government should push states to adopt more aggressive yearly fees for cars and trucks that are exclusively powered by an internal combustion engine that does not use renewable fuel or any form of electrification.

A tax structure like the one above would allow states to collect enough revenue to maintain the roads in good condition in a scenario where most of the vehicles present on the streets are EVs. It would also prompt automakers to consider making more efficient cars, invest in better battery chemistry, and focus on a simplified chassis that doesn't stray from federal motor vehicle safety standards.

But, most importantly, such a tax system would eliminate inequalities and ensure that those most prone to damage the roads are also paying enough to fix them.