Elon Musk once pledged to take raw material sourcing “all the way to the mine.” A report from Financial Times shows that Tesla tried to achieve this by buying a stake in mining giant Glencore. The deal supposedly fell apart, but this doesn’t mean it’s the end.

The battery raw material crunch is the next thing that will starve the auto industry, and car companies already try to think ahead by partnering with mining companies. Tesla is probably further along than anybody else in this endeavor, and, according to recent reports, the EV maker even considered entering the mining business. Financial Times revealed that Tesla and Glencore started preliminary discussions last year, and the talks continued this spring.

According to FT, Tesla considered buying a minority stake of 10% to 20% in Glencore, but the deal fell apart over alleged Tesla concerns about Glencore’s environmental issues. The Swiss company is the world’s largest trading house and producer of cobalt, nickel, copper, and many other minerals, including coal.

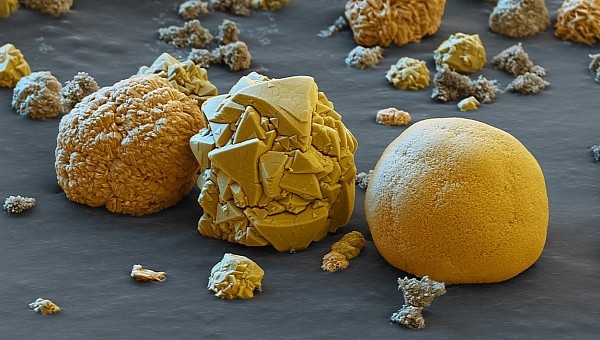

Some of its mining practices have come into focus over the years, and cobalt mining in Congo was particularly controversial. Reports about hiring underage miners have cast a shadow on the general cobalt mining business. Cobalt mining in Congo has also raised concerns due to miners’ continued exposure to dust and particles, which resulted in lung and skin diseases.

Financial Times reveals that preliminary discussions started in 2021 and continued in March this year when Glencore CEO Gary Nagle visited the Tesla factory in Fremont. Although the talks ended with no agreement, Elon Musk indicated in April that Tesla would enter mining and refining directly if needed. Speculations abound about Tesla still considering investing in Glencore’s business but in a different way.

Glencore is a major producer of battery raw minerals and one of the world’s largest battery recyclers. Although it does not mine lithium, it trades the metal, offering many incentives for a battery manufacturing company like Tesla. Nevertheless, Elon Musk would not want to touch on the coal mining business, so this deal cannot go through unless Glencore’s battery minerals business is spun-off.

Considering that Glencore has a market cap of around $73 billion, Tesla’s investment would be between $7-$15 billion. It’s still debatable whether Glencore would want to sell its most future-proof business, considering the adoption rate of electric vehicles will skyrocket in the next ten years.

According to FT, Tesla considered buying a minority stake of 10% to 20% in Glencore, but the deal fell apart over alleged Tesla concerns about Glencore’s environmental issues. The Swiss company is the world’s largest trading house and producer of cobalt, nickel, copper, and many other minerals, including coal.

Some of its mining practices have come into focus over the years, and cobalt mining in Congo was particularly controversial. Reports about hiring underage miners have cast a shadow on the general cobalt mining business. Cobalt mining in Congo has also raised concerns due to miners’ continued exposure to dust and particles, which resulted in lung and skin diseases.

Financial Times reveals that preliminary discussions started in 2021 and continued in March this year when Glencore CEO Gary Nagle visited the Tesla factory in Fremont. Although the talks ended with no agreement, Elon Musk indicated in April that Tesla would enter mining and refining directly if needed. Speculations abound about Tesla still considering investing in Glencore’s business but in a different way.

Glencore is a major producer of battery raw minerals and one of the world’s largest battery recyclers. Although it does not mine lithium, it trades the metal, offering many incentives for a battery manufacturing company like Tesla. Nevertheless, Elon Musk would not want to touch on the coal mining business, so this deal cannot go through unless Glencore’s battery minerals business is spun-off.

Considering that Glencore has a market cap of around $73 billion, Tesla’s investment would be between $7-$15 billion. It’s still debatable whether Glencore would want to sell its most future-proof business, considering the adoption rate of electric vehicles will skyrocket in the next ten years.