No legacy carmaker can sell electric vehicles profitably, although everyone expected this to be easy. The culprit seems to be the outdated sales model that puts dealerships in charge of EV adoption. Instead of doing so, there is plenty of evidence showing how dealers actively sabotaged EV programs, making carmakers lose money and struggle to sell their electric cars.

Legacy carmakers were expected to steal Tesla's launch and dominate the EV market once they put their mind to it. However, analysts have underestimated the industry's reluctance to compete in a field they couldn't quite understand. Traditionally one of the most conservative domains, the automotive industry was happy to keep doing what they've been doing for over a century. And when they finally noticed the wind changing and money flying, it was already too late to compete.

EV adoption has accelerated in the post-pandemic years, and it has now reached a tipping point when replacing gas-powered vehicles with EVs has become not only possible but inevitable. Governments offered incentives, and once the Inflation Reduction Act entered into effect, everyone wanted to flood the market with electric vehicles. Volkswagen, GM, Ford, and, to a lesser extent, Stellantis pledged billions in Li-ion battery plants and EV production facilities.

Still, after a couple of years vowing to surpass Tesla, legacy carmakers had to admit this was not possible. Even though Tesla's margins have shrunk in 2023, the EV market leader is still turning a considerable profit, while other carmakers continue to lose billions. This is, of course, unsustainable, and something has to change. Still, the way things developed, I'm not sure what carmakers want to change are what they SHOULD change.

GM has been cleverer by pacing its EV production just enough to still exist but not enough to make a hole in the company's profits. The only EV models produced in significant numbers were the Bolt EV/Bolt EUV, which I suspect were made with a substantial battery discount from LGES. There's no other explanation for the low price and increased production compared to the Ultium EVs.

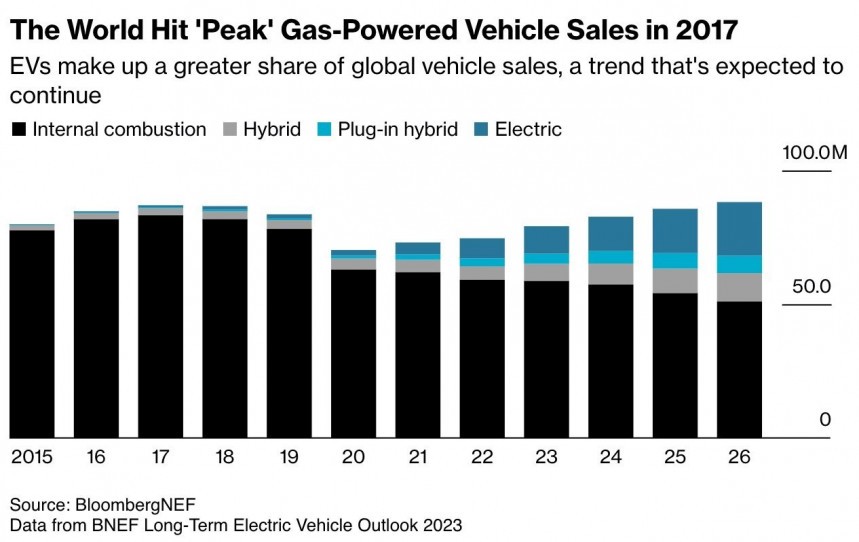

While stalling for time, legacy carmakers have started talking about a slowdown of EV sales and how customers don't really want them. This couldn't be further from the truth, considering that the entire growth in the automotive industry is owed to EV sales. Combustion car sales peaked in 2019 and have been going downhill ever since, as recent BloomberNEF intelligence shows. Still, no carmaker has been so active in pushing back against electrification as their dealers.

Franchised dealers have been even more reluctant than carmakers to promote the sales of electric vehicles. In their defense, EVs require minimal maintenance, and that's not enough for dealers to make a living. With no oil changes and fewer parts to break and replace, electric cars are bad business. To make matters worse, carmakers pressured them to make hefty investments in tooling and charging stations.

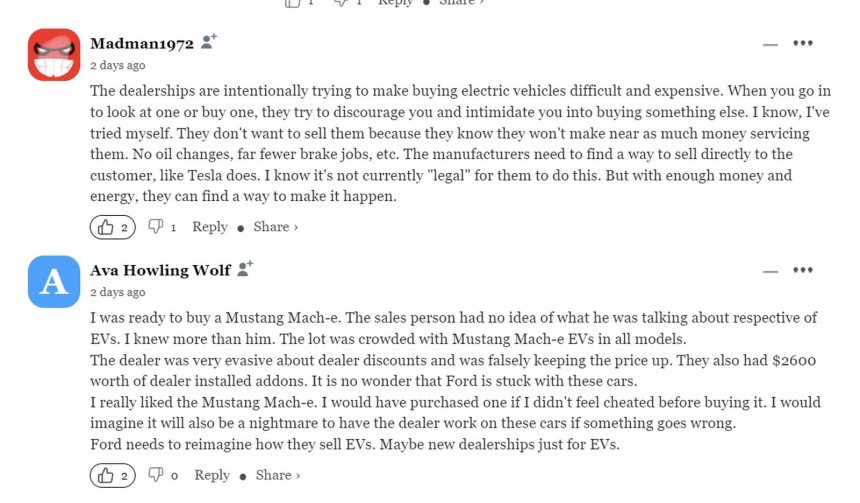

Many people reported that they were put off by dealership personnel when they tried to buy an electric vehicle. They felt as if they didn't even want to sell them despite having the lot crowded with unsold EVs. Here are two testimonials from our readers commenting on an article about Ford's struggles with unsold Mustang Mach-Es. I imagine other brands' dealers are no different.

"The dealerships are intentionally trying to make buying electric vehicles difficult and expensive," writes Madman1972. "When you go in to look at one or buy one, they try to discourage you and intimidate you into buying something else. They don't want to sell them because they know they won't make nearly as much money servicing them. No oil changes, far fewer brake jobs, etc. The manufacturers need to find a way to sell directly to the customer, like Tesla does."

Ava Howling Wolf was ready to buy a Mustang Mach-E, but her experience was pretty much identical. "The lot was crowded with Mustang Mach-e EVs in all models," she remembers. "The dealer was very evasive about dealer discounts and was falsely keeping the price up. They also had $2,600 worth of dealer-installed add-ons. It is no wonder that Ford is stuck with these cars. I really liked the Mustang Mach-E. I would have purchased one if I didn't feel cheated before buying it. Ford needs to reimagine how they sell EVs. Maybe new dealerships just for EVs."

The dealer sales model is obsolete

I can't imagine how that would work. The truth is that the dealer sales model is obsolete. Dealers have proven nothing but a burden for carmakers trying to sell EVs. They have become increasingly vocal and recently have started openly protesting against federal policies that promote electrification. Federal and state targets could require a two-thirds EV share or more of the US market by 2035, and dealer organizations like NADA want the White House to hit the brake on EVs.

Tesla has shown the way with its direct sales model. Controlling the entire chain, from materials to customers, is an incredible feat that no legacy carmaker enjoys. Tesla started small and expanded tremendously, selling almost two million EVs per year with no dealer involved. For carmakers, this is hardly an option. They are stuck with selling through their dealer networks, and circumventing that would be difficult.

To be fair, some carmakers have tried hard to follow Tesla's way. Mercedes-Benz is testing a so-called "agency sales model" in Europe, although bringing it to the US won't be easy. Ford launched a digital purchase platform, trying to mirror Tesla's business model. How successful these initiatives will prove is not clear yet. What's clear is that the clock is ticking, and the dealers are to carmakers like a heavy stone hung on a swimmer's neck.

EV adoption has accelerated in the post-pandemic years, and it has now reached a tipping point when replacing gas-powered vehicles with EVs has become not only possible but inevitable. Governments offered incentives, and once the Inflation Reduction Act entered into effect, everyone wanted to flood the market with electric vehicles. Volkswagen, GM, Ford, and, to a lesser extent, Stellantis pledged billions in Li-ion battery plants and EV production facilities.

Still, after a couple of years vowing to surpass Tesla, legacy carmakers had to admit this was not possible. Even though Tesla's margins have shrunk in 2023, the EV market leader is still turning a considerable profit, while other carmakers continue to lose billions. This is, of course, unsustainable, and something has to change. Still, the way things developed, I'm not sure what carmakers want to change are what they SHOULD change.

Electric vehicles are piling up at dealer lots

Ford, for instance, discovered that its electric vehicles, despite their qualities, are a tough sell. Thousands of Mustang Mach-E and F-150 Lightning EVs are piling up at dealer lots, and building more doesn't make sense. Ford was forced to throttle production, with the F-150 Lightning output cut in half for 2024. The Mustang Mach-E is in an even more precarious situation, considering that its design is already aged and performance-wise is not competitive with newer EVs on the market.GM has been cleverer by pacing its EV production just enough to still exist but not enough to make a hole in the company's profits. The only EV models produced in significant numbers were the Bolt EV/Bolt EUV, which I suspect were made with a substantial battery discount from LGES. There's no other explanation for the low price and increased production compared to the Ultium EVs.

While stalling for time, legacy carmakers have started talking about a slowdown of EV sales and how customers don't really want them. This couldn't be further from the truth, considering that the entire growth in the automotive industry is owed to EV sales. Combustion car sales peaked in 2019 and have been going downhill ever since, as recent BloomberNEF intelligence shows. Still, no carmaker has been so active in pushing back against electrification as their dealers.

The dealers don't want to sell EVs because they don't make money servicing them

The electric vehicles were only good for dealers as long as they were in high demand during the 2021-2022 supply-chain bottlenecks. Back then, "market adjustment" fees, sometimes as high as the MSRP, were not unusual. People were so desperate to buy a car, literally any car, that they paid without blinking huge markups. Unfortunately for dealers, the situation didn't last, and now they want nothing to do with EVs.Many people reported that they were put off by dealership personnel when they tried to buy an electric vehicle. They felt as if they didn't even want to sell them despite having the lot crowded with unsold EVs. Here are two testimonials from our readers commenting on an article about Ford's struggles with unsold Mustang Mach-Es. I imagine other brands' dealers are no different.

"The dealerships are intentionally trying to make buying electric vehicles difficult and expensive," writes Madman1972. "When you go in to look at one or buy one, they try to discourage you and intimidate you into buying something else. They don't want to sell them because they know they won't make nearly as much money servicing them. No oil changes, far fewer brake jobs, etc. The manufacturers need to find a way to sell directly to the customer, like Tesla does."

The dealer sales model is obsolete

I can't imagine how that would work. The truth is that the dealer sales model is obsolete. Dealers have proven nothing but a burden for carmakers trying to sell EVs. They have become increasingly vocal and recently have started openly protesting against federal policies that promote electrification. Federal and state targets could require a two-thirds EV share or more of the US market by 2035, and dealer organizations like NADA want the White House to hit the brake on EVs.

Tesla has shown the way with its direct sales model. Controlling the entire chain, from materials to customers, is an incredible feat that no legacy carmaker enjoys. Tesla started small and expanded tremendously, selling almost two million EVs per year with no dealer involved. For carmakers, this is hardly an option. They are stuck with selling through their dealer networks, and circumventing that would be difficult.

To be fair, some carmakers have tried hard to follow Tesla's way. Mercedes-Benz is testing a so-called "agency sales model" in Europe, although bringing it to the US won't be easy. Ford launched a digital purchase platform, trying to mirror Tesla's business model. How successful these initiatives will prove is not clear yet. What's clear is that the clock is ticking, and the dealers are to carmakers like a heavy stone hung on a swimmer's neck.