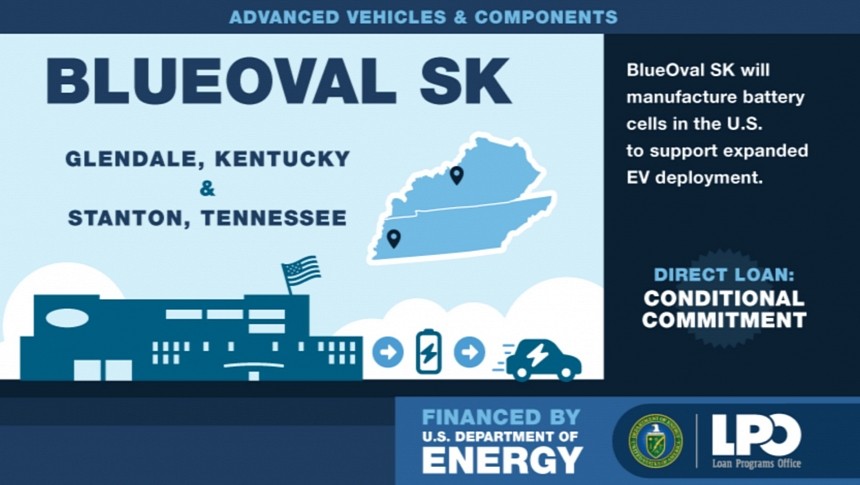

Ford and SK Innovation's battery division (SK On) established a joint venture to build three factories in the US: two in Kentucky and one in Tennessee. BlueOval SK has its eyes on quite an incentive to get these plants done: $9.2 billion. That's how much the Department of Energy's (DOE) Loan Programs Office (LPO) may grant the joint venture to speed things up if everything goes according to the plan. While most articles are treating the loan as a done deal, that is not the case.

This DOE branch stressed that "this conditional commitment demonstrates DOE's intent to finance the project." Although goodwill is always welcome, LPO clarified that "several steps remain for the project to reach critical milestones, and certain conditions must be satisfied before DOE issues a final loan." In other words, we're talking about perspectives, not a fact – at least for the time being.

What BlueOval SK has is called a term sheet, a document that can have up to 30 pages with all the prerequisites for the loan to be granted. Reaching this point was already a long process that involved receiving the application, reviewing it, and having third parties help the DOE in the due diligence that will tell the department if the project will be able to repay its debt or not.

After that, the companies asking for the credit will have to prove they can meet the established conditions for the loan. Such conditions can include obtaining the permissions necessary for the project to proceed. When these "conditions precedent" are fulfilled, the loan documents are signed, and the money is transferred. BlueOval SK asked for the money under the Advanced Technology Vehicles Manufacturing (ATVM) Loan Program.

While the LDO is not new to this game, the Inflation Reduction Act (IRA) certainly helped make plans for new battery factories more urgent. The American government believes battery electric vehicles (BEVs) are the future and does not want them to depend on China to make that happen. Nowadays, raw material refining for lithium-ion cells comes mostly from that country, while some of the world's largest battery companies are Chinese.

Although three battery factories will not change that, they are seen as an important step in that direction. The LDO even calculated how many gallons of gasoline the three plants will help the country save: 455 million with 120 GWh per year in cells. Ford has a different number: it aims to deliver 129 GWh annually, with each factory providing 43 GWh per year. The disparity probably has to do with the BEVs that Ford plans to export. Ideally, American companies should develop the same skills Chinese companies have in processing raw materials and building cells. SK On is from South Korea, a long-time American ally.

According to the ATVM, the Biden administration is working for BEVs to "represent at least 50% of all new car sales in the US by 2030, reach net-zero electricity by 2035, and a net-zero economy by 2050." Another objective of the hypothetical loan is to help disadvantaged communities (DACs). The Tennessee facility will be located in one of these communities, while the plants in Kentucky are surrounded by them. The 5,000 construction jobs and 7,500 direct jobs available at the three plants when they are fully operational should give these folks high-paying jobs in factories that will be crucial for the government's plans.

If the conditional loan becomes something concrete, it will be one of the largest given to automakers after the 2008 financial crisis that led General Motors and Chrysler to file for bankruptcy under Chapter 11 in 2009. Before that, the ATVM also lent money to Tesla, Nissan, and, more recently, Redwood Materials. As the guys from The Verge remembered, Ford also benefitted from money from the DOE in 2009, but it only finished repaying it this year. Ironically, the compact vehicles the previous loan allowed Ford to build are no longer produced. That demonstrates how aggressively the automotive industry has changed in less than 15 years.

At this point, talking about the conditional loan represents more of a liability than something to celebrate – one of the strongest reasons for Ford to have kept quiet about the "achievement." If BlueOval SK fails to comply with the "conditions precedent," that will represent a major reputation blow to Ford and SK On. It will also raise questions about the project: was it conditioned to obtaining the conditional loan, or do Ford and SK have the money to get the factories going regardless of the DOE credit help?

Although only BlueOval SK will be able to answer that, the Wall Street Journal published that Ford is preparing for a new round of layoffs among its salaried workers. The previous rounds aimed at reducing structural costs by up to $3 billion. Considering the new plants will demand three times that much, the first hypothesis is the most plausible. That turns the loan into something mandatory: Ford and SK On cannot afford to miss it.

What BlueOval SK has is called a term sheet, a document that can have up to 30 pages with all the prerequisites for the loan to be granted. Reaching this point was already a long process that involved receiving the application, reviewing it, and having third parties help the DOE in the due diligence that will tell the department if the project will be able to repay its debt or not.

While the LDO is not new to this game, the Inflation Reduction Act (IRA) certainly helped make plans for new battery factories more urgent. The American government believes battery electric vehicles (BEVs) are the future and does not want them to depend on China to make that happen. Nowadays, raw material refining for lithium-ion cells comes mostly from that country, while some of the world's largest battery companies are Chinese.

According to the ATVM, the Biden administration is working for BEVs to "represent at least 50% of all new car sales in the US by 2030, reach net-zero electricity by 2035, and a net-zero economy by 2050." Another objective of the hypothetical loan is to help disadvantaged communities (DACs). The Tennessee facility will be located in one of these communities, while the plants in Kentucky are surrounded by them. The 5,000 construction jobs and 7,500 direct jobs available at the three plants when they are fully operational should give these folks high-paying jobs in factories that will be crucial for the government's plans.

At this point, talking about the conditional loan represents more of a liability than something to celebrate – one of the strongest reasons for Ford to have kept quiet about the "achievement." If BlueOval SK fails to comply with the "conditions precedent," that will represent a major reputation blow to Ford and SK On. It will also raise questions about the project: was it conditioned to obtaining the conditional loan, or do Ford and SK have the money to get the factories going regardless of the DOE credit help?

Although only BlueOval SK will be able to answer that, the Wall Street Journal published that Ford is preparing for a new round of layoffs among its salaried workers. The previous rounds aimed at reducing structural costs by up to $3 billion. Considering the new plants will demand three times that much, the first hypothesis is the most plausible. That turns the loan into something mandatory: Ford and SK On cannot afford to miss it.