Volkswagen is taking the chip shortage bull by its horns and seeking to eliminate the supply chain's weak links. What’s the best way to be immune to the global parts-sourcing pandemic? Get in touch with the manufacturer and strike a deal.

According to Reuters, the German auto group announced it has begun purchasing critical chips (estimated to become a high-demand, short-supply product in the future) from ten manufacturers. The selected chipmakers’ group includes NXP Semiconductors, Infineon Technologies, and Renesas Electronics.

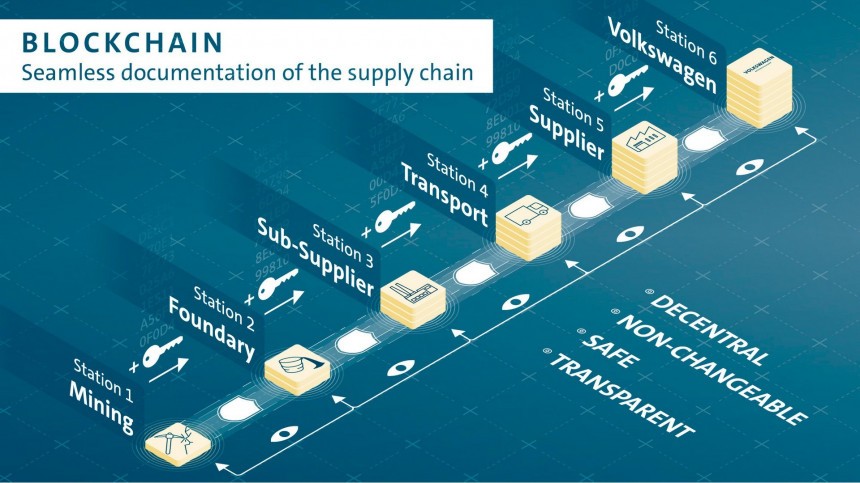

Volkswagen is distancing from its previous business paradigm that counted on parts suppliers to buy the much-needed chips. The German carmaker took the first steps last October, reaching deals for direct supply with chip-producing entities.

The auto giant has lost trust in the global market capacity to sustain the automotive industry’s needs – at least regarding chips. Since every new car system has at least one microprocessor to govern its function and operation, it’s obvious why the Germans want to blanket themselves from the inconsistencies of supply and distribution mishaps.

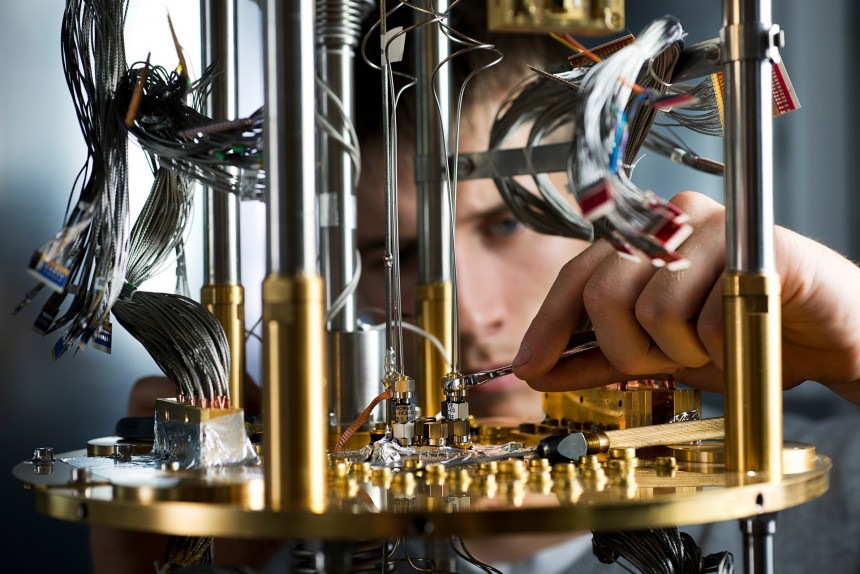

Since electric vehicle production began cutting ever larger slices of the global industry pie, demand for chips has sky-rocketed. However, the rate of growth reported in EV making – including the critical and increasingly complex software architectures developed for electrified automobiles – hasn’t been met by a symmetrical rise in chip manufacturing. Just factor this in: in 1978, only eight semiconductors were installed in a control unit of a Porsche 911. 45 years later, a Škoda Enyaq relies on some 90 control units with around 8,000 electronic components.

Setting up a high-precision micro-component factory isn’t as easy as snapping fingers. VW is not waiting to see whether it is left among the living half of the automotive universe in case a supply-chain Thanos decides to wreak havoc in the automobile universe. According to VW's estimates, the value of electronic components for cars will likely more than double by 2030, from the 2023 average of 600 euros per vehicle

As we speak, the automotive industry ranks 5th among the major semiconductors buyers, with an overall purse of 47 billion dollars. Seven years from now, the carmaking business will leap two places up and $100 billion in value .

Besides securing a direct sourcing channel for its critical components, Volkswagen and Franco-Italian chipmaker STMicroelectronics join efforts to co-develop a new semiconductor. The announcement – made last month - marks VW's first direct relationship with a second and third-rank semiconductor supplier.

The German automaker’s initiative didn’t just come out of the blue. Federal authorities in Berlin have been trying to attract some of the world's largest contract chipmakers with billions of euros’ worth in subsidies. The giants from Intel and the Taiwanese TSMC made public earlier this year their plans to build production factories in Germany.

TSMC is the world's biggest contract manufacturer of semiconductors, so the fiscal state aid proposal offered by Germany makes complete sense, given that the auto industry is one of the country’s main economic pillars. Volkswagen has yet to strike a deal for a direct supply relationship with TSMC. Still, the two enterprises keep in close contact.

According to Karsten Schnake, head of Volkswagen’s COMPASS (Cross Operational Management Parts & Supply Security) task force for component supply founded in 2022, representatives from the two companies regularly meet for updates on chip demands. Additionally, the automobile constructor plans to use a narrower variety of chips in its vehicles - to release some of the tension on the supply chain – meaning it simplifies its software offering, too, Schnake added, cited by Reuters.

Volkswagen is distancing from its previous business paradigm that counted on parts suppliers to buy the much-needed chips. The German carmaker took the first steps last October, reaching deals for direct supply with chip-producing entities.

The auto giant has lost trust in the global market capacity to sustain the automotive industry’s needs – at least regarding chips. Since every new car system has at least one microprocessor to govern its function and operation, it’s obvious why the Germans want to blanket themselves from the inconsistencies of supply and distribution mishaps.

Setting up a high-precision micro-component factory isn’t as easy as snapping fingers. VW is not waiting to see whether it is left among the living half of the automotive universe in case a supply-chain Thanos decides to wreak havoc in the automobile universe. According to VW's estimates, the value of electronic components for cars will likely more than double by 2030, from the 2023 average of 600 euros per vehicle

As we speak, the automotive industry ranks 5th among the major semiconductors buyers, with an overall purse of 47 billion dollars. Seven years from now, the carmaking business will leap two places up and $100 billion in value .

Besides securing a direct sourcing channel for its critical components, Volkswagen and Franco-Italian chipmaker STMicroelectronics join efforts to co-develop a new semiconductor. The announcement – made last month - marks VW's first direct relationship with a second and third-rank semiconductor supplier.

TSMC is the world's biggest contract manufacturer of semiconductors, so the fiscal state aid proposal offered by Germany makes complete sense, given that the auto industry is one of the country’s main economic pillars. Volkswagen has yet to strike a deal for a direct supply relationship with TSMC. Still, the two enterprises keep in close contact.

According to Karsten Schnake, head of Volkswagen’s COMPASS (Cross Operational Management Parts & Supply Security) task force for component supply founded in 2022, representatives from the two companies regularly meet for updates on chip demands. Additionally, the automobile constructor plans to use a narrower variety of chips in its vehicles - to release some of the tension on the supply chain – meaning it simplifies its software offering, too, Schnake added, cited by Reuters.