Transport and Environment released a study that defends €25,000 small electric cars will be profitable by 2025. That reminded me of Tesla fans being anxious about the $25,000 little battery electric vehicle (BEV) that will take the company to the masses. BEV and Tesla advocates pursue this as the Holy Grail of electric mobility, but it dawned on me that it is actually a failure that people may try to conceal in the worst way possible.

Just think about it: we are talking about B-segment vehicles that cost €25,000 or $25,000. Carmakers used to charge much less than that for these products. Despite inflation and the supply chain crisis, they still do. In the US, a Nissan Kicks starts at $20,590, and a Chevrolet Trax is slightly cheaper ($20,400), but the Hyundai Venue undercuts both at $19,650. Someone after the cheapest Nissan Versa will spend $15,980, currently the most affordable vehicle for sale on American soil. That's a discount of $5,000 to a bit more than $9,000 compared to what small BEVs would cost.

Cross the ocean, and you'll have a market that likes small vehicles much more than the US. In Europe, you can buy a Nissan Juke for €17,170 ($18,430 at the current exchange rate) in Germany. A Skoda Fabia there starts at €18,300 ($19,643), but there is an even better deal in that market: the Dacia Sandero. Technically speaking, it is a C-segment vehicle – with a wheelbase of 2.59 meters (101.9 inches) – even if its length makes it look like a small car. You can get a new one in Germany for €11,300 ($12,129). Curiously, the Sandero is crucial for this discussion.

In Europe, a B-segment car with an internal combustion engine (ICE) costs around €5,000 ($5,367) less than the promised price tag for these small electric cars. The Dacia is more than €10,000 ($10,734) cheaper. Renault's success recipe with this car was born with the Dacia Logan, a C-segment car sold for the price of a B-segment vehicle. Europeans loved it because it offered more room for less money. The affordable and profitable B-segment BEV inverts that logic: it charges prices of C-segment cars for a small one. Not long ago, they used to cost around €25,000 in Europe, but prices are now much higher. Even so, it is worth checking the market environment that €25,000 small electric cars will face.

A Skoda Scala still costs €23,070 in Germany. A Volkswagen T-ROC – one of the best-sellers there – starts at €27,085 (including taxes), which is closer to €25,000 than it is to €30,000. Although it belongs to the B-segment, a Toyota Yaris Cross costs €25,340 and offers more room and a higher driving position than a regular B-segment car. These are the vehicles customers may get for the same amount of money. For years, compact vehicles dominated the sales charts in Europe. In the US, the best-sellers are even larger, but let's stick to C-segment cars.

If you check the prices on the other side of the pond, the situation for a small BEV is even worse. A Chevrolet Equinox starts at $26,600, while that's $23,300 for a Toyota Corolla Hybrid. Nissan charges $24,960 for the cheapest Nissan Rogue Sport, while such a derivative of the Sentra will demand $20,200. All these compact vehicles will cost the same or much less than the hypothetically profitable $25,000 small electric car. Is that really something for the advocates to celebrate or pursue?

We already have $25,000 or €25,000 electric cars. The Chevrolet Bolt EV starts at $26,500 without the federal tax credit. The cheapest Nissan LEAF costs $28,140. In Germany, Dacia asks €22,750 for the entry-level Spring. They are not even close to the best-selling BEVs because they already face fierce competition from ICE cars. While customers have legal options that offer more, forget about an EV transition: it is not going to happen. And that's the dangerous part of the story.

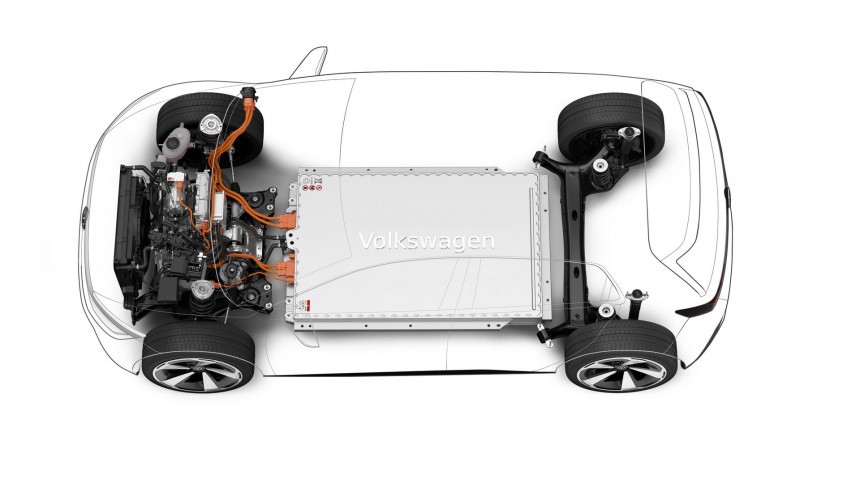

Automakers are not managing to offer more affordable electric cars due to the current technology and supply of raw materials. Batteries still cost a fortune. Making battery packs smaller will not help because very few people are willing to pay 25,000 monies on a vehicle that will not travel very far and will demand precious time to charge – if you are lucky enough to find a charger. If you have a bigger car that is more convenient and versatile for the same price, that's a no-brainer unless you don't have that option. The easy solution for that is killing the competition.

Banning any vehicle with an ICE is a goal several countries have already established. They want to eliminate even the hybrid vehicles that Toyota defends will cut carbon emissions faster than pure electric cars. Another option is cutting subsidies on fossil fuels, but that would automatically impact the prices of all goods transported by vehicles with ICEs – such as trucks, planes, ships, and trains. Before cars ditch engines, all other transportation means will have to do that. That's the only way to eliminate the impact of charging market prices for oil products on the cost of living.

While that does not happen, celebrating a €25,000 or $25,000 B-segment electric car makes no sense. Perhaps they should be craving a 25,000-whatever C-segment BEV. Better yet, price and size parity would be the ideal target. Electric vehicles would still face charging and repair-cost challenges, but at least customers would not dismiss buying them right off the bat for evident price and size disadvantages.

Cross the ocean, and you'll have a market that likes small vehicles much more than the US. In Europe, you can buy a Nissan Juke for €17,170 ($18,430 at the current exchange rate) in Germany. A Skoda Fabia there starts at €18,300 ($19,643), but there is an even better deal in that market: the Dacia Sandero. Technically speaking, it is a C-segment vehicle – with a wheelbase of 2.59 meters (101.9 inches) – even if its length makes it look like a small car. You can get a new one in Germany for €11,300 ($12,129). Curiously, the Sandero is crucial for this discussion.

In Europe, a B-segment car with an internal combustion engine (ICE) costs around €5,000 ($5,367) less than the promised price tag for these small electric cars. The Dacia is more than €10,000 ($10,734) cheaper. Renault's success recipe with this car was born with the Dacia Logan, a C-segment car sold for the price of a B-segment vehicle. Europeans loved it because it offered more room for less money. The affordable and profitable B-segment BEV inverts that logic: it charges prices of C-segment cars for a small one. Not long ago, they used to cost around €25,000 in Europe, but prices are now much higher. Even so, it is worth checking the market environment that €25,000 small electric cars will face.

If you check the prices on the other side of the pond, the situation for a small BEV is even worse. A Chevrolet Equinox starts at $26,600, while that's $23,300 for a Toyota Corolla Hybrid. Nissan charges $24,960 for the cheapest Nissan Rogue Sport, while such a derivative of the Sentra will demand $20,200. All these compact vehicles will cost the same or much less than the hypothetically profitable $25,000 small electric car. Is that really something for the advocates to celebrate or pursue?

We already have $25,000 or €25,000 electric cars. The Chevrolet Bolt EV starts at $26,500 without the federal tax credit. The cheapest Nissan LEAF costs $28,140. In Germany, Dacia asks €22,750 for the entry-level Spring. They are not even close to the best-selling BEVs because they already face fierce competition from ICE cars. While customers have legal options that offer more, forget about an EV transition: it is not going to happen. And that's the dangerous part of the story.

Banning any vehicle with an ICE is a goal several countries have already established. They want to eliminate even the hybrid vehicles that Toyota defends will cut carbon emissions faster than pure electric cars. Another option is cutting subsidies on fossil fuels, but that would automatically impact the prices of all goods transported by vehicles with ICEs – such as trucks, planes, ships, and trains. Before cars ditch engines, all other transportation means will have to do that. That's the only way to eliminate the impact of charging market prices for oil products on the cost of living.

While that does not happen, celebrating a €25,000 or $25,000 B-segment electric car makes no sense. Perhaps they should be craving a 25,000-whatever C-segment BEV. Better yet, price and size parity would be the ideal target. Electric vehicles would still face charging and repair-cost challenges, but at least customers would not dismiss buying them right off the bat for evident price and size disadvantages.