Tesla's struggles with insurance are not new. After the "legacy" companies in charge of that started asking very high premiums to protect these battery electric vehicles (BEVs), the American automaker decided to have its own insurance enterprise. Elon Musk promised in 2019 that Tesla Insurance would be "vastly better" than anything else on the market. Four years later, Reuters shows he and his BEV maker went to the other extreme. What customers shared paints Tesla Insurance as vastly worse than other solutions.

The news outlet talked to several customers and also to people involved with the BEV maker's insurance services and discovered some people were still paying for their totaled cars. That happened due to the time Tesla took to determine if the vehicle had to be written off or not. Ironically, Musk said the experience would be vastly better because there would be no arguments about the need to repair a BEV involved in a crash. Tesla would "repair it immediately."

Mark Bova hit a median that flipped the 2018 Model S he had bought days earlier with Tesla. At the time, he also hired insurance from the company, which would cost him only $93 per month. He was taken to the hospital with back injuries that required surgery. It was only seven months after the crash that he received the compensation for his totaled car, but he is still fighting to get around $50,000 in medical bills. Bova crashed after activating Autopilot.

Scott Sawyer's 2021 Model Y was rear-ended on a freeway in February 2022. The truck driver had no insurance, so Sawyer had to use the one he hired with Tesla to fix his BEV. It took him seven months to get his car repaired. As if that were not enough, a minivan crashed against his Model Y while it was parked outside on August 25, 2023.

If you check the pictures of the crash in Reuter's story, you'll say that it did not damage the SUV that much. Only the front left side of the BEV seems to have been affected: the fender, bumper, left door, and the side mirror on that door. Despite that, he would only hear from Tesla one month later – and only after he filed complaints with the Better Business Bureau and the California Department of Insurance.

Tesla's claim adjuster said the repair would cost $10,000, but Sawyer was not convinced. He wanted a body shop to take a look at the vehicle. When that happened, his car was totaled. That is only reasonable to expect if the battery pack was damaged or if his Model Y had a front casting. Tesla recently promised it would find ways to fix these components instead of having to replace them entirely – which is not economically feasible. The company offered Sawyer $44,852 to settle the claim, but Reuters did not mention if he accepted the offer. He just said he will never hire Tesla Insurance again.

Jonathan Garcia was traveling with his 2021 Model S for Thanksgiving in 2022 when a deer crossed his way. His car's hood and bumper got damaged. The Tesla Insurance customer tried to contact the company for three months without success. He only heard back from it after filing a complaint with the Ohio insurance department.

The company's excuse was that it "did not timely communicate and process the claim" because it was facing "some staffing adjustments" at the time. It took them six months to fix Garcia's Model S. On May 17, 2023, he canceled his policy and hired another insurance company at a higher premium. He told Reuters he "would have paid a very high amount of money to not go with Tesla Insurance again."

All these three customers had to wait way more time than reasonable to have their vehicles repaired or totaled. Another common trait was that they would email, call, or message Tesla Insurance daily for months, and none of these efforts made any difference. Filing complaints did the trick. According to Reuters, that has to do with "rushed and sloppy management."

The media outlet discussed the situation with people involved with Tesla Insurance management. The service started in California in partnership with State National. In the past three years, this insurance company has had the worst consumer complaint record in California among the 50 top auto insurers. It is not clear how much of that bad performance can be credited to Tesla because State National also works with other companies.

In the fall of 2021, Tesla hired around a dozen claim adjusters to work in an office in Draper, Utah. They would be in charge of claims from California and other states. After individually starting to work with four or five claims a day, these guys were soon having to deal with 24 cases each – or even more than that. The snowball turned into a backlog of hundreds of cases. It was "physically impossible" to handle all that with the team Tesla had. To make matters worse, several claim adjusters quit.

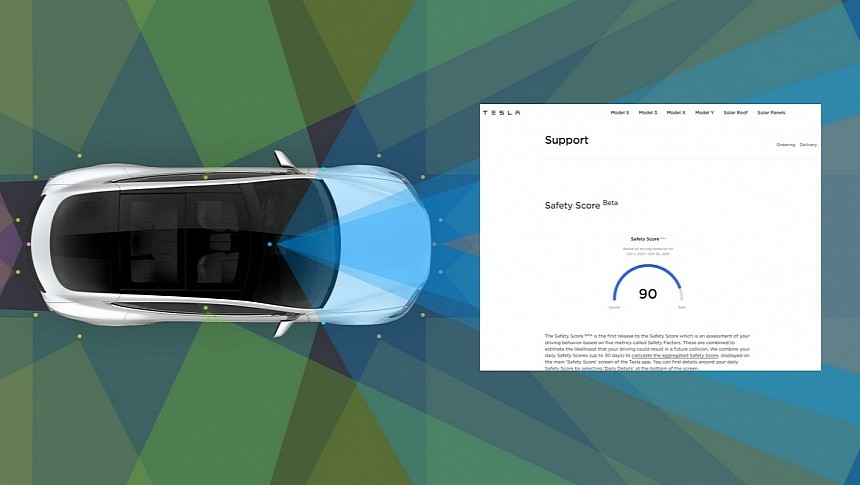

These are not the only issues Tesla Insurance presents. Customers also complain about the use of Safety Score Beta to determine their premiums. Although they start low, the software eventually makes it rise with phantom braking and warnings about false safety risks, both probably deriving from the Tesla Vision's approach. In May 2022, I wrote about how Tesla was being sued precisely for that. Chanda Santiago told Reuters a technician drove her car without fastening the seat belt, which was recorded as another penalty for her. The media outlet tried to confirm that with Tesla but it never got any answers.

In the end, the story demonstrates that the "revolutionary" insurance policy Elon Musk promised on the Q2 2020 earnings call proved to be just bad traditional service, aggravated by technological flaws. Make sure you check it for more details. The core issue Tesla Insurance was supposed to tackle remained there, undisturbed. I will talk about this in another discussion.

Mark Bova hit a median that flipped the 2018 Model S he had bought days earlier with Tesla. At the time, he also hired insurance from the company, which would cost him only $93 per month. He was taken to the hospital with back injuries that required surgery. It was only seven months after the crash that he received the compensation for his totaled car, but he is still fighting to get around $50,000 in medical bills. Bova crashed after activating Autopilot.

Scott Sawyer's 2021 Model Y was rear-ended on a freeway in February 2022. The truck driver had no insurance, so Sawyer had to use the one he hired with Tesla to fix his BEV. It took him seven months to get his car repaired. As if that were not enough, a minivan crashed against his Model Y while it was parked outside on August 25, 2023.

Tesla's claim adjuster said the repair would cost $10,000, but Sawyer was not convinced. He wanted a body shop to take a look at the vehicle. When that happened, his car was totaled. That is only reasonable to expect if the battery pack was damaged or if his Model Y had a front casting. Tesla recently promised it would find ways to fix these components instead of having to replace them entirely – which is not economically feasible. The company offered Sawyer $44,852 to settle the claim, but Reuters did not mention if he accepted the offer. He just said he will never hire Tesla Insurance again.

Jonathan Garcia was traveling with his 2021 Model S for Thanksgiving in 2022 when a deer crossed his way. His car's hood and bumper got damaged. The Tesla Insurance customer tried to contact the company for three months without success. He only heard back from it after filing a complaint with the Ohio insurance department.

All these three customers had to wait way more time than reasonable to have their vehicles repaired or totaled. Another common trait was that they would email, call, or message Tesla Insurance daily for months, and none of these efforts made any difference. Filing complaints did the trick. According to Reuters, that has to do with "rushed and sloppy management."

The media outlet discussed the situation with people involved with Tesla Insurance management. The service started in California in partnership with State National. In the past three years, this insurance company has had the worst consumer complaint record in California among the 50 top auto insurers. It is not clear how much of that bad performance can be credited to Tesla because State National also works with other companies.

These are not the only issues Tesla Insurance presents. Customers also complain about the use of Safety Score Beta to determine their premiums. Although they start low, the software eventually makes it rise with phantom braking and warnings about false safety risks, both probably deriving from the Tesla Vision's approach. In May 2022, I wrote about how Tesla was being sued precisely for that. Chanda Santiago told Reuters a technician drove her car without fastening the seat belt, which was recorded as another penalty for her. The media outlet tried to confirm that with Tesla but it never got any answers.

In the end, the story demonstrates that the "revolutionary" insurance policy Elon Musk promised on the Q2 2020 earnings call proved to be just bad traditional service, aggravated by technological flaws. Make sure you check it for more details. The core issue Tesla Insurance was supposed to tackle remained there, undisturbed. I will talk about this in another discussion.