Hydrogen domination in the heavy transport sector seems to be slimmer by the day. The research company IDTechEx forecasts that road freight electrification is more likely to happen thanks to adopting the Megawatt Charging System (MCS) for electric trucks. This new high-power charging standard is seven times faster than the current super-fast chargers!

In 2021, the National Renewable Energy Laboratory (NREL) announced a leap in developing a high-power charging standard capable of charging capacity up to 3.75 megawatts. Today's most powerful DC fast-charging stations peak at 500 kilowatts, so a seven-fold increase is quite remarkable.

We know that the Tesla Semi can charge at a megawatt level, and the larger 800 kWh battery charges up to 70% in 30 minutes. Still, industries aim for a maximum 15-minute fast-charging standard for electrifying their fleets to become really competitive.

Weighing 40 tons, it traveled 530 km / 330 miles on steep segments of the road, from Stuttgart to South Tyrol, without the need to stop charging. It was a seven-hour journey, translating into a pretty impressive average speed of 75 kph / 46 mph.

Of course, we cannot omit that engineers drove the truck optimally, and the weather was also optimal. The high-performance recuperation system conveniently charged the battery when the truck descended hills. When going up, the efficient drive system limited the consumption of electricity, which by no means is very high when the truck is fully loaded.

Shortly after, on October 10, Mercedes-Benz Trucks celebrated the world premiere of the eActros 600, the production version of the eActros LongHaul prototype. Its designation comes from the "more than 600-kilowatt hours battery capacity," which basically consists of three battery packs providing a total capacity of 621 kWh.

It has two electric motors generating a continuous output of 536 HP and a peak output of 805 HP. It also has a four-speed transmission and an 800-volt electric axle, both developed in-house for electrical long-haul applications.

But the most important for fleet operators is the advertised range of 500 km / 310 miles, which indeed is considered by many an "Achilles heel." In real life and with regular truck drivers behind the wheel, the actual range is expected to be around 400-450 km / 250-280 miles.

The equivalent diesel Actros has a 400-liter tank; its average consumption is less than 30 liters per 100 km or 7-8 mpg. Its range is roughly 1,300 km / 800 miles, up to three times better than the eActros 600.

Batteries of the electric truck can fast-charge at up to 400kW, which means around an hour for charging from 20% to 80%, compared to around five-minute refueling of the diesel Actros. And the price of eActros is about two-and-a-half times higher. So, what's the catch?

Fleet operators ask, "Where's the profitability?"

According to Mercedes-Benz Trucks officials, around 60% of their European customers use long-haul trucks on less than 500 km / 310 miles journeys. A large part of charging can occur at the depot overnight or at the loading or unloading points, so using eActros won't pose (too many) problems.

Then we should take into account the regulations for drivers' breaks. In the EU, after a 4.5-hour driving period, the driver must take an uninterrupted break of at least 45 minutes. Driving an eActros for 4.5 hours depletes the fully charged batteries to around 25-30%, so three-quarters of an hour is enough to fast-charge to 80%.

This way, the eActros could travel 1,000 km / 620 miles with only one charge break needed, corresponding to the mandatory driver's break. Of course, this also requires a comprehensive fast-charging network for trucks and working efficiently.

How about the costs? While the eActros is more than twice as expensive as the correspondent diesel version, the savings come from governments' subsidization of e-trucks, lower costs of electricity compared to diesel fuel, and the planned CO2-based truck toll – especially in the large transit countries, like France and Germany.

Officials claim that eActros' ten-year lifecycle carbon footprint is up to 80% lower than the corresponding diesel variant when all the electricity used comes from renewables and around 40% lower with the current European energy mix.

This translates into CO2 savings between 350 to 780 tons, which means the eActros can compensate for its batteries manufacturing CO2 footprint in the second year of use. But more important for fleet operators is Mercedes-Benz Trucks' average scenario stating that the eActros becomes more profitable than the comparable diesel Actros after five years or around 600,000 km / 370,000 miles.

Thanks to the iron phosphate cell technology (LFP), the batteries provide a long service life of at least ten years and 1.2 million km / 740,000 miles. Moreover, these batteries are credited with at least 80% state of health after this period, and they will still be very valuable for other applications, like second-life energy storage or for powering less demanding vehicles such as forklifts and others.

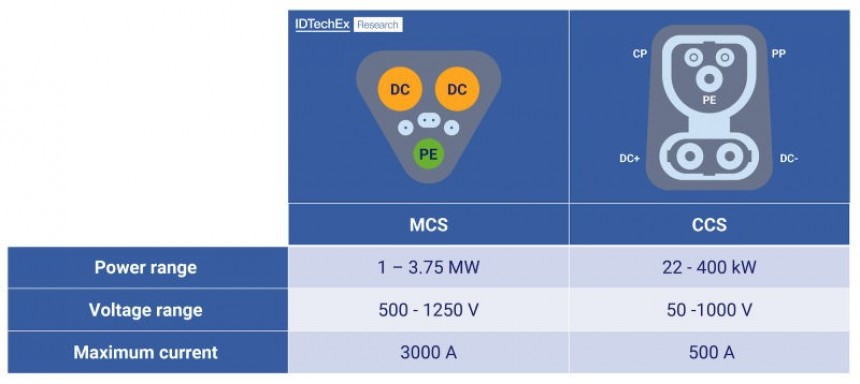

There is no word on more-than-one-megawatt charging capabilities for the eActros. Most likely because it requires a more-than-800V electrical architecture and more robust battery chemistries. For instance, the maximum rate of 3.75 MW charging means 3,000 amps at 1,250 volts DC.

Such power would allow eActros' depleted batteries to be charged to 80% in less than 10 minutes, on par with the diesel Actros. Once the MCS standard is published in 2024, the research company IDTechEx expects all companies involved in developing large-batteries technologies will start offering this ultra-fast charging capability.

But you would mistake to think that the MCS standard is valid only for long-haul trucking. There is also considerable interest in marine vessels, aeronautics, mining, and agricultural equipment. That is, most of the sectors that hydrogen fuel cell technology developers target.

According to IDTechEx, the MCS standard will make a big difference from hydrogen in terms of efficiency.

Producing electricity from renewables, storing it in energy storage systems based on batteries, feeding it to vehicles' batteries using high powers, and converting it into usable energy by electric motors translates into over 90% efficiency overall.

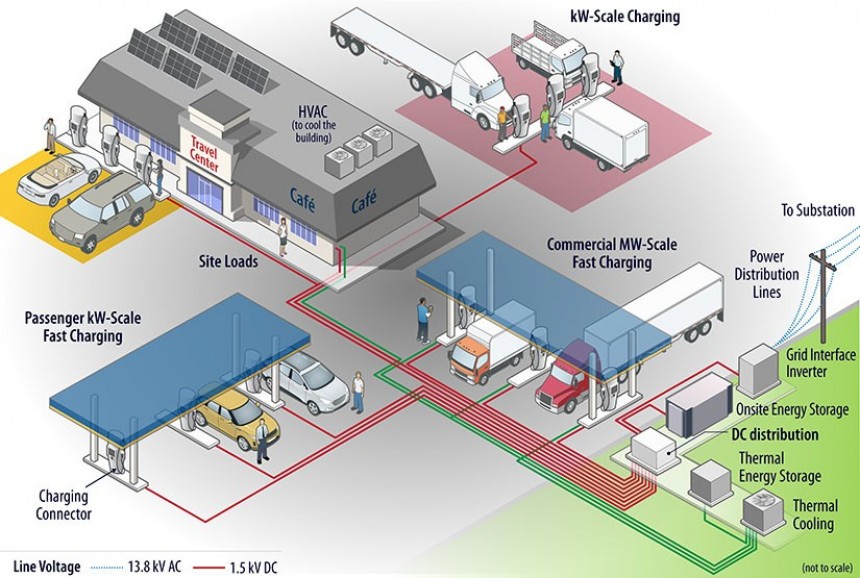

Only transporting energy long-distance by wires is affecting this high percentage efficiency a little. Then there's the downside of investment needed for megawatt chargers for electric vehicles and stations with such high-power needs.

However, fleet operators and utilities are expected to invest more in on-site energy storage and solar-supplemented solutions (also benefiting from subsidies) than in costly grid upgrades. Tesla's example is the best, as the company plans to install its own battery storage systems in locations for megawatt-charging requirements.

Producing hydrogen from renewables is very energy intensive, while using fossil fuels has a harsh toll on emissions, and the cost will only be higher. Transporting and storing hydrogen is very costly, and the infrastructure needed is not expected to significantly lower the costs because it's not just an upgrade of current fossil fuels infrastructure.

Converting hydrogen into useful energy in fuel cell systems involves multiple energy conversion steps and more significant energy losses than batteries. Adding all these efficiency issues results in much higher prices of hydrogen. Moreover, in the foreseeable future, there's no scenario for hydrogen to come to parity with electricity in terms of costs and efficiency.

That's why IDTechEx concludes: "MCS will be the factor that pushes electric to be the first choice for trucks." According to the research company, until 2030, fleet operators in Europe will use a combination of both MCS and CCS technology.

Currently, at least 12 projects for MW charging are underway or set to begin construction by the end of 2023, with a total investment of more than €1 billion / $1.2 billion. IDTechEx forecasts a compound annual growth rate of 43% for MW charging projects in the next decade.

That's much more than the average 14% CAGR predicted for the whole electric vehicle charging infrastructure industry between 2024-2034, which will be worth more than €110 billion / $123 billion by 2034.

I'm not saying that hydrogen won't be feasible for some applications. It's only that, in the race for rapid decarbonization, we must efficiently prioritize the solutions to replace fossil fuels. MCS standard is just another strong argument in favor of batteries.

We know that the Tesla Semi can charge at a megawatt level, and the larger 800 kWh battery charges up to 70% in 30 minutes. Still, industries aim for a maximum 15-minute fast-charging standard for electrifying their fleets to become really competitive.

Current situation: range is still a hot topic

At the beginning of October, a prototype of the Mercedes-Benz eActros LongHaul semi-truck successfully completed a test run across the Alps. The demanding topography made this test more important than usual tests on flat highways, where coasting is very useful for low consumption.Weighing 40 tons, it traveled 530 km / 330 miles on steep segments of the road, from Stuttgart to South Tyrol, without the need to stop charging. It was a seven-hour journey, translating into a pretty impressive average speed of 75 kph / 46 mph.

Of course, we cannot omit that engineers drove the truck optimally, and the weather was also optimal. The high-performance recuperation system conveniently charged the battery when the truck descended hills. When going up, the efficient drive system limited the consumption of electricity, which by no means is very high when the truck is fully loaded.

It has two electric motors generating a continuous output of 536 HP and a peak output of 805 HP. It also has a four-speed transmission and an 800-volt electric axle, both developed in-house for electrical long-haul applications.

But the most important for fleet operators is the advertised range of 500 km / 310 miles, which indeed is considered by many an "Achilles heel." In real life and with regular truck drivers behind the wheel, the actual range is expected to be around 400-450 km / 250-280 miles.

The equivalent diesel Actros has a 400-liter tank; its average consumption is less than 30 liters per 100 km or 7-8 mpg. Its range is roughly 1,300 km / 800 miles, up to three times better than the eActros 600.

Batteries of the electric truck can fast-charge at up to 400kW, which means around an hour for charging from 20% to 80%, compared to around five-minute refueling of the diesel Actros. And the price of eActros is about two-and-a-half times higher. So, what's the catch?

Fleet operators ask, "Where's the profitability?"

According to Mercedes-Benz Trucks officials, around 60% of their European customers use long-haul trucks on less than 500 km / 310 miles journeys. A large part of charging can occur at the depot overnight or at the loading or unloading points, so using eActros won't pose (too many) problems.

Then we should take into account the regulations for drivers' breaks. In the EU, after a 4.5-hour driving period, the driver must take an uninterrupted break of at least 45 minutes. Driving an eActros for 4.5 hours depletes the fully charged batteries to around 25-30%, so three-quarters of an hour is enough to fast-charge to 80%.

This way, the eActros could travel 1,000 km / 620 miles with only one charge break needed, corresponding to the mandatory driver's break. Of course, this also requires a comprehensive fast-charging network for trucks and working efficiently.

Officials claim that eActros' ten-year lifecycle carbon footprint is up to 80% lower than the corresponding diesel variant when all the electricity used comes from renewables and around 40% lower with the current European energy mix.

This translates into CO2 savings between 350 to 780 tons, which means the eActros can compensate for its batteries manufacturing CO2 footprint in the second year of use. But more important for fleet operators is Mercedes-Benz Trucks' average scenario stating that the eActros becomes more profitable than the comparable diesel Actros after five years or around 600,000 km / 370,000 miles.

Thanks to the iron phosphate cell technology (LFP), the batteries provide a long service life of at least ten years and 1.2 million km / 740,000 miles. Moreover, these batteries are credited with at least 80% state of health after this period, and they will still be very valuable for other applications, like second-life energy storage or for powering less demanding vehicles such as forklifts and others.

Isn't hydrogen more convenient in terms of range and short refueling times?

Glad you ask. The eActros was designed to enable megawatt charging when the standard becomes available. Clients will have the option of retrofitting the MCS system, which promises only 30 minutes for the 20-to-80-percent charging at megawatt output.There is no word on more-than-one-megawatt charging capabilities for the eActros. Most likely because it requires a more-than-800V electrical architecture and more robust battery chemistries. For instance, the maximum rate of 3.75 MW charging means 3,000 amps at 1,250 volts DC.

Such power would allow eActros' depleted batteries to be charged to 80% in less than 10 minutes, on par with the diesel Actros. Once the MCS standard is published in 2024, the research company IDTechEx expects all companies involved in developing large-batteries technologies will start offering this ultra-fast charging capability.

But you would mistake to think that the MCS standard is valid only for long-haul trucking. There is also considerable interest in marine vessels, aeronautics, mining, and agricultural equipment. That is, most of the sectors that hydrogen fuel cell technology developers target.

According to IDTechEx, the MCS standard will make a big difference from hydrogen in terms of efficiency.

Only transporting energy long-distance by wires is affecting this high percentage efficiency a little. Then there's the downside of investment needed for megawatt chargers for electric vehicles and stations with such high-power needs.

However, fleet operators and utilities are expected to invest more in on-site energy storage and solar-supplemented solutions (also benefiting from subsidies) than in costly grid upgrades. Tesla's example is the best, as the company plans to install its own battery storage systems in locations for megawatt-charging requirements.

Producing hydrogen from renewables is very energy intensive, while using fossil fuels has a harsh toll on emissions, and the cost will only be higher. Transporting and storing hydrogen is very costly, and the infrastructure needed is not expected to significantly lower the costs because it's not just an upgrade of current fossil fuels infrastructure.

Converting hydrogen into useful energy in fuel cell systems involves multiple energy conversion steps and more significant energy losses than batteries. Adding all these efficiency issues results in much higher prices of hydrogen. Moreover, in the foreseeable future, there's no scenario for hydrogen to come to parity with electricity in terms of costs and efficiency.

The main reason for fleet operators to embrace batteries over hydrogen

Everything I mentioned directly impacts the TCO (total cost of ownership), the most crucial metric for fleet operators, no matter what type of vehicles they operate: truck, ship, or airplane. This TCO is ultimately reflected in the cost per km/cost per mile, and batteries have a clear edge over hydrogen.That's why IDTechEx concludes: "MCS will be the factor that pushes electric to be the first choice for trucks." According to the research company, until 2030, fleet operators in Europe will use a combination of both MCS and CCS technology.

That's much more than the average 14% CAGR predicted for the whole electric vehicle charging infrastructure industry between 2024-2034, which will be worth more than €110 billion / $123 billion by 2034.

I'm not saying that hydrogen won't be feasible for some applications. It's only that, in the race for rapid decarbonization, we must efficiently prioritize the solutions to replace fossil fuels. MCS standard is just another strong argument in favor of batteries.