Ford paused work on its $3.5 billion battery factory in Michigan as it tries to limit spending in light of the recent UAW strike. Ford implied that rising costs would affect its "ability to competitively operate the plant." The Blue Oval insisted that no final decision has been made, which might indicate the Michigan plant is a bargaining chip in Ford's negotiations with the UAW.

As US car buyers become more open to buying electric vehicles, carmakers are investing in new production facilities. These cover both car manufacturing and battery plants, which need different supply chains and capabilities. Battery cells are the new gold, with car companies trying to secure as many as possible for their EV production.

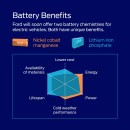

Like other traditional carmakers, Ford is in a rush to establish its own battery supply chain, from mineral processing to cell production and battery pack assembly. In February, Ford was the first carmaker to announce a US production facility for LFP cells. The lithium-iron-phosphate (LFP) battery cells use cheaper and more abundant materials, although they are heavier and thus have lower energy density than ternary cells.

LFP cells are almost exclusively produced by Chinese battery manufacturers like CATL and BYD. Establishing local factories was a sensitive matter, considering the deteriorating relations between China and the US. When Ford announced its LFP factory in February, it made it clear that it would be the sole owner of the factory, although it would use CATL technology. Even so, the investment has been heavily criticized, with the Republicans in Congress voicing concerns that the Chinese company will benefit from the US tax subsidies on offer.

The battery plant in Michigan has been a significant talking point in the negotiations between Ford and the UAW. The UAW wanted the workers at the plant to be paid higher wages, similar to those at assembly and engine plants. On the other hand, Ford announced in July that its Model e EV division would lose $4.5 billion this year. This is 50% more than it predicted in January. The LFP cell plant was instrumental in Ford Model e plans to break even by 2026.

What we're seeing here is a game of 3D chess between the Republicans in Congress, who would want the plant project shelved, Ford, which wants to squeeze the most benefits, and the UAW, which wants to eat the cake and still have it. On the one hand, UAW has been vocal against switching to electric vehicles. It knows this means fewer parts and thus fewer workers not only on the production line but throughout the supply chain, too. On the other hand, the Michigan plant also employs union members, and the UAW would not want them unemployed.

Ford made its move by announcing it's pausing the work at the Michigan plant and will limit spending on construction until it's "confident about the ability to competitively operate the plant." Ford's announcement is a jab at the raises the UAW is asking. The carmaker insists that no final decision has been made about the planned investment. This indicates that Ford is willing to negotiate and will do it fiercely.

Ford planned to invest $3.5 billion in its future LFP cell plant in Michigan to tap into the generous US battery manufacturing subsidies offered through the Inflation Reduction Act (IRA). The Blue Oval already uses LFP cells in some of its electric vehicles, like the Mustang Mach-E and F-150 Lightning.

Like other traditional carmakers, Ford is in a rush to establish its own battery supply chain, from mineral processing to cell production and battery pack assembly. In February, Ford was the first carmaker to announce a US production facility for LFP cells. The lithium-iron-phosphate (LFP) battery cells use cheaper and more abundant materials, although they are heavier and thus have lower energy density than ternary cells.

LFP cells are almost exclusively produced by Chinese battery manufacturers like CATL and BYD. Establishing local factories was a sensitive matter, considering the deteriorating relations between China and the US. When Ford announced its LFP factory in February, it made it clear that it would be the sole owner of the factory, although it would use CATL technology. Even so, the investment has been heavily criticized, with the Republicans in Congress voicing concerns that the Chinese company will benefit from the US tax subsidies on offer.

The battery plant in Michigan has been a significant talking point in the negotiations between Ford and the UAW. The UAW wanted the workers at the plant to be paid higher wages, similar to those at assembly and engine plants. On the other hand, Ford announced in July that its Model e EV division would lose $4.5 billion this year. This is 50% more than it predicted in January. The LFP cell plant was instrumental in Ford Model e plans to break even by 2026.

What we're seeing here is a game of 3D chess between the Republicans in Congress, who would want the plant project shelved, Ford, which wants to squeeze the most benefits, and the UAW, which wants to eat the cake and still have it. On the one hand, UAW has been vocal against switching to electric vehicles. It knows this means fewer parts and thus fewer workers not only on the production line but throughout the supply chain, too. On the other hand, the Michigan plant also employs union members, and the UAW would not want them unemployed.

Ford made its move by announcing it's pausing the work at the Michigan plant and will limit spending on construction until it's "confident about the ability to competitively operate the plant." Ford's announcement is a jab at the raises the UAW is asking. The carmaker insists that no final decision has been made about the planned investment. This indicates that Ford is willing to negotiate and will do it fiercely.

Ford planned to invest $3.5 billion in its future LFP cell plant in Michigan to tap into the generous US battery manufacturing subsidies offered through the Inflation Reduction Act (IRA). The Blue Oval already uses LFP cells in some of its electric vehicles, like the Mustang Mach-E and F-150 Lightning.