The European Automobile Manufacturers' Association (ACEA) publishes monthly European passenger car registration statistics. Starting from 2022, these statistics became more relevant because they take into account the major powertrain types. I challenge you to dive into the numbers and debunk the assertions that EV sales are on the verge of collapse.

First, we should acknowledge that registration numbers are different from sales numbers. Companies are normally more interested in how many cars they sell monthly or yearly because of the economic implications.

We all know that sales figures greatly impact Tesla's stock every quarter. It's almost the same for any other car company. However, registrations are the real deal regarding statistics because they show us how many cars are actually in use.

Most of the time, people don't just buy or lease an existing car from the dealership. Usually, there is a waiting list, especially for new and very promising cars, but mostly for electric cars. So, making statistics based solely on sales figures can lead to false conclusions regarding the actual state of the market.

For instance, customers tend to wait less for petrol or diesel cars or even for hybrids. In contrast, battery electric cars and plug-in hybrids take longer to be delivered, mainly because production facilities can't keep up the pace with the demand.

Of course, this might seem like nonsense in the first months of 2024, as the "EV market cooling down" scares everybody: carmakers complain sales are not on par with expectations, while the naysayers' anti-EV propaganda directly influences new customers. Consequently, the decision to buy an EV evaporates.

Add to the equation the harsh truth of governments slashing or eliminating EV incentives almost all over Europe. This is closely related to the fact that 2024 is a historical voting year and also to the very annoying political environment, which is under attack from Russia's hybrid war and China's economic ambitions.

Frankly, it was very easy for mass media and social media to create this environment of distrust in the transition to electromobility. However, while popular wisdom spreads this misinformation about "EV market doom," electric car expansion continues. Not enthusiastically, but showing strong progress.

Well, "quickly" is kind of slow in the car industry because of its sheer size and the many levels of authority needed to make decisions. By the way, the European auto industry employs almost 13 million workers (more than 5% of the EU's workforce) and generates over 7% of the EU's GDP. It can't be treated as a start-up…

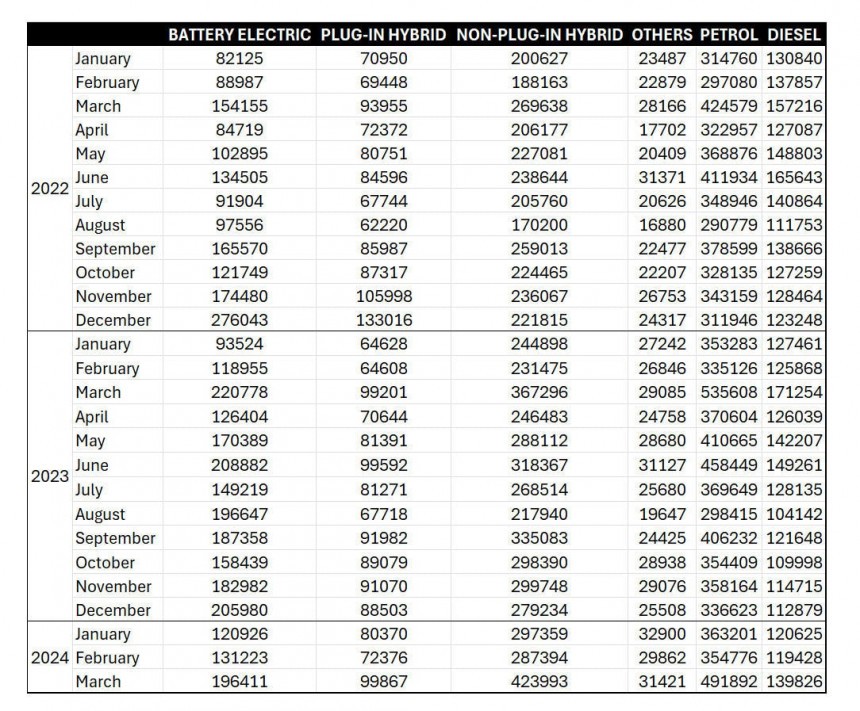

Now, the latest numbers on European electric passenger cars are definitely not optimistic. This March, less than 200,000 EVs were registered in Europe, as opposed to more than 220,000 last March. This is an 11% drop, and it's clearly a warning signal.

The main reason is that sales increased by 29% and 10% in January and February, respectively. Between you and me, carmakers were expecting this negative trend because, mind you, most of the cars registered in the first quarter of 2024 were actually sold in the last months of 2023 when everybody knew that governments would diminish the support for electromobility in 2024.

However, you'd be surprised to find out that EV sales in the first three months of this year were 3.5 percent better than the same period in 2023. This is not much consolation for salespeople, but regular customers must understand the context. This way, they can understand that the "EV cooling down" is not a disaster.

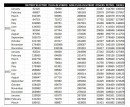

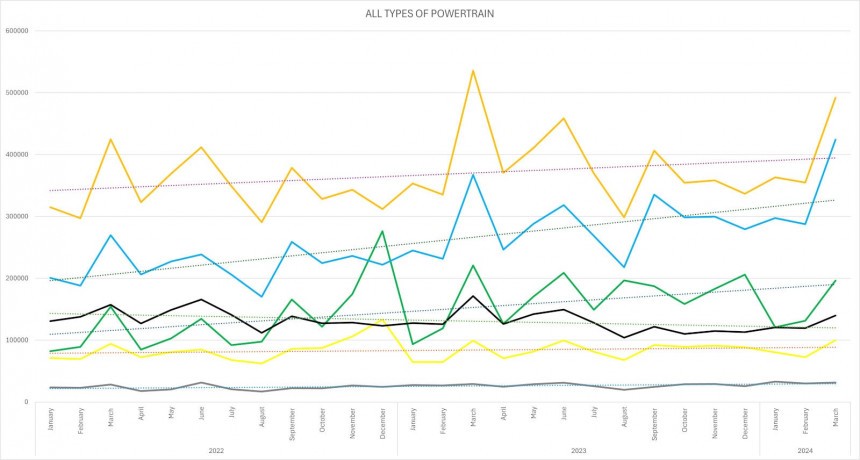

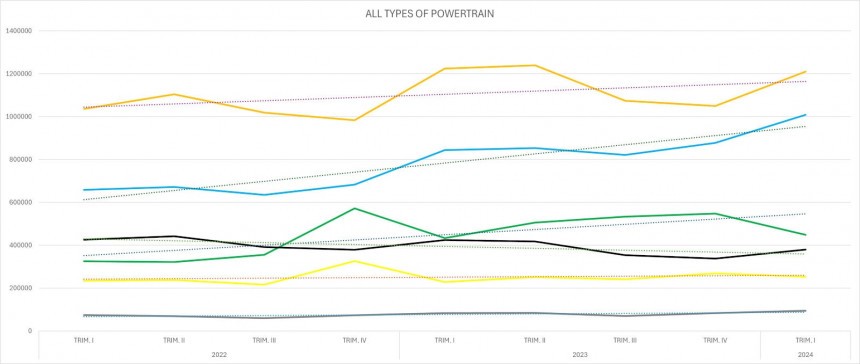

How about looking at the registrations in all the months starting from 2022? And how about splitting the values into powertrain types? This way, we can see different trends, regardless of monthly variation in some particular periods - for instance, it's clear that in summer time or on winter holidays, one can't expect people to be interested in purchasing cars.

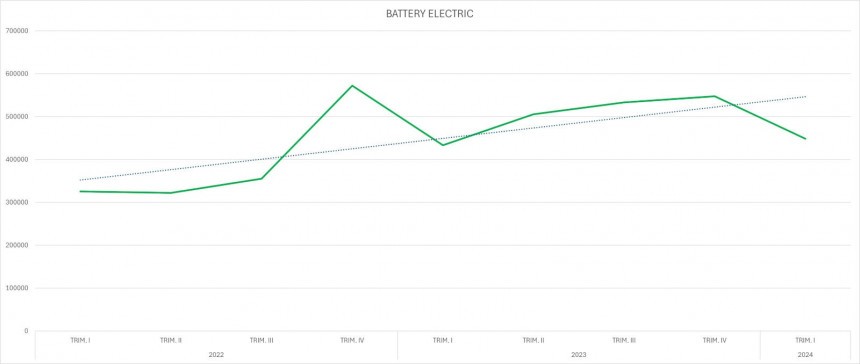

The "jigsaw" graph for battery electric cars shows large variations but is far from a pessimistic trend. Yes, there's a "hole" in January and February, but the same was true last year and the year before. Likewise, the end of 2022 marked a spike in registrations, mostly because of season rebates and stock discounts. A similar spike, although smaller, can be seen at the end of 2023.

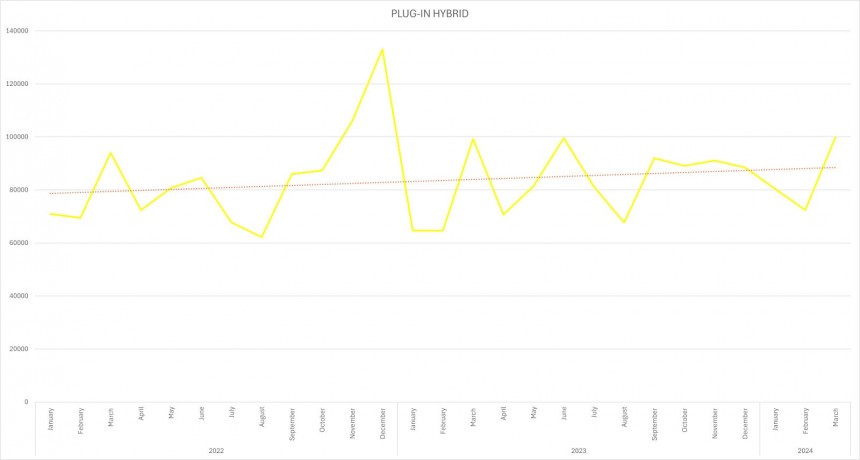

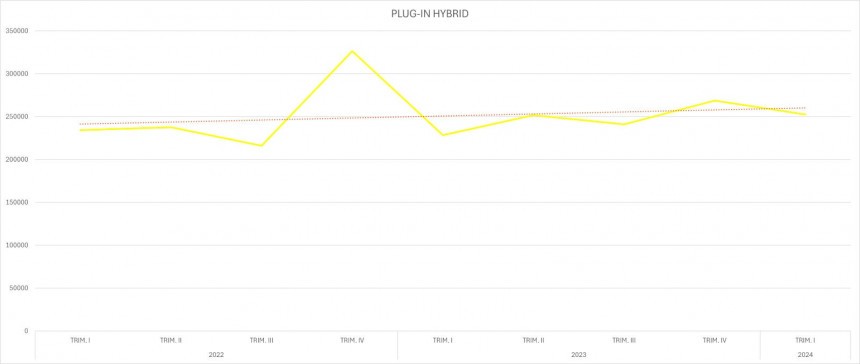

The trend for plug-in hybrid registrations is also positive, but the rise is very slow. This is mainly because plug-in hybrids are generally expensive – in many cases, a similar full-hybrid car is much more affordable. The recent EV "price war" led to similar electric cars being more interesting for prospective customers.

The bottom line is that plug-in passenger car sales steadily grow. Of course, from a salesperson's point of view, 2024 will result in a "blood bath" because of governmental subsidy cuts, but don't expect the "electrified vehicles" market to collapse. Sorry, petrolheads, it simply won't happen.

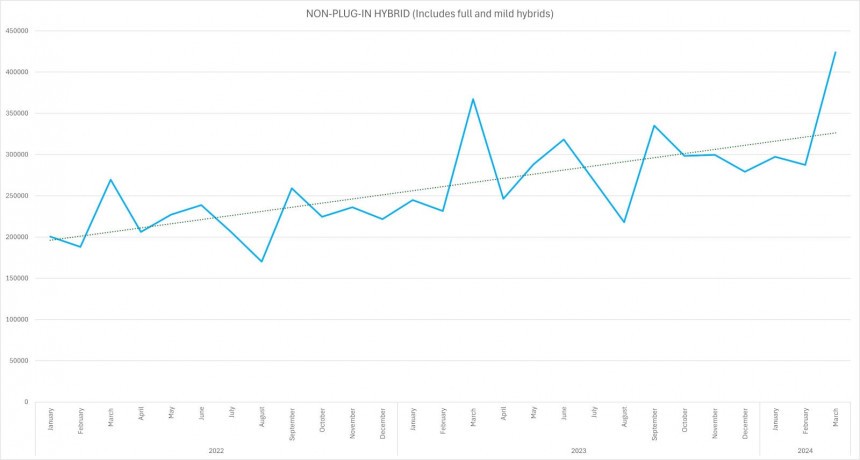

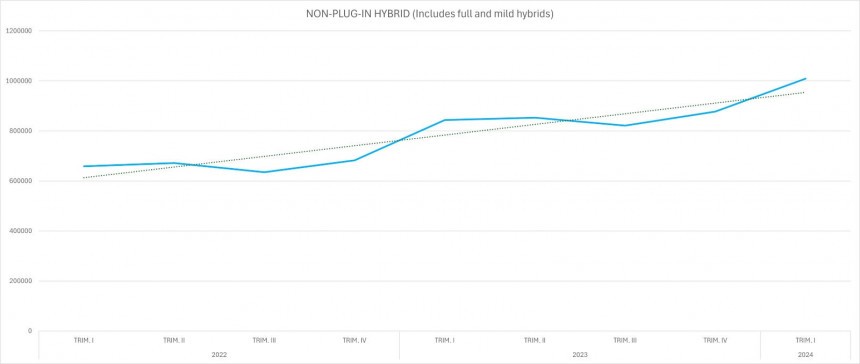

But here's the thing: the ICE does not retire without a fight. The latest trick carmakers and ACEA have found is to lump "full hybrid" and "mild hybrid" powertrains into the same basket. This is just wrong because a mild hybrid system consists of a very small battery and a shy electric motor that only helps the internal combustion engine to be slightly less polluting.

On the contrary, a full hybrid system really impacts an ICE vehicle's consumption and pollution values. In many circumstances, the electric motor powers the car, while the ICE works like an electricity generator for the battery. Frankly, mild hybrids are just a fraud, err, a marketing stunt.

So, the fast-rising trend of hybrid car registrations is actually due to the fancier petrol and diesel powertrains that are badged "mild hybrid." As there are almost no incentives for hybrids, customers' interest is sparked thanks to lower consumption values, especially in cities, compared to regular petrol and diesel engines.

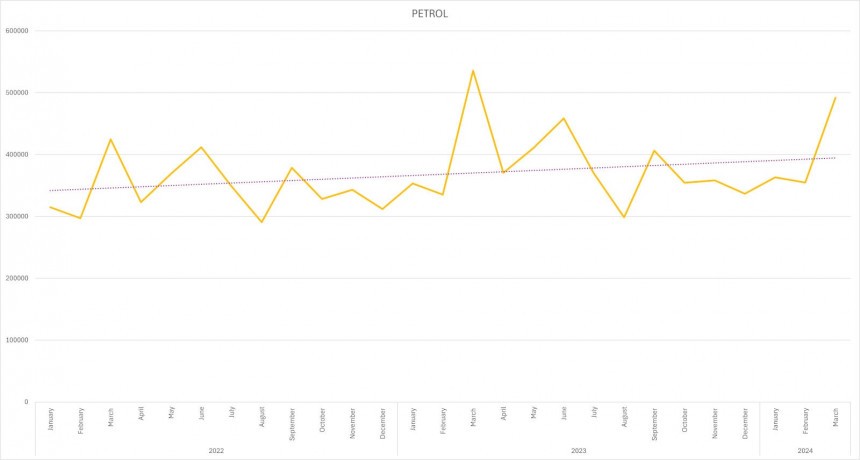

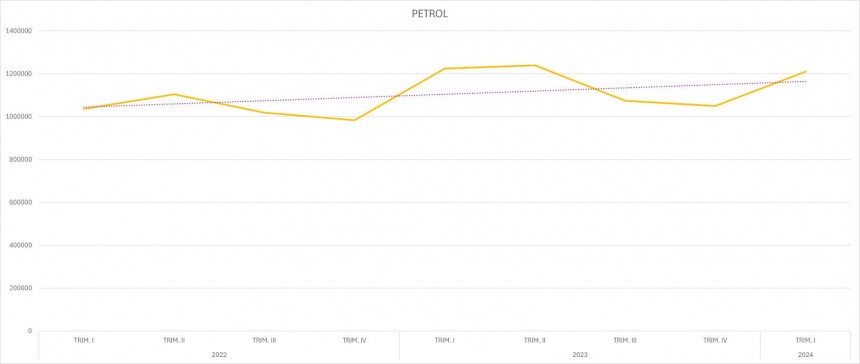

You can easily see that the trend is related to the recent high oil price. Interestingly, the petrol car registration trend is also rising, but at a slower pace. This has to do a lot with much lower prices compared to "electrified cars" and the lack of range anxiety (which naysayers greatly emphasize regarding EVs).

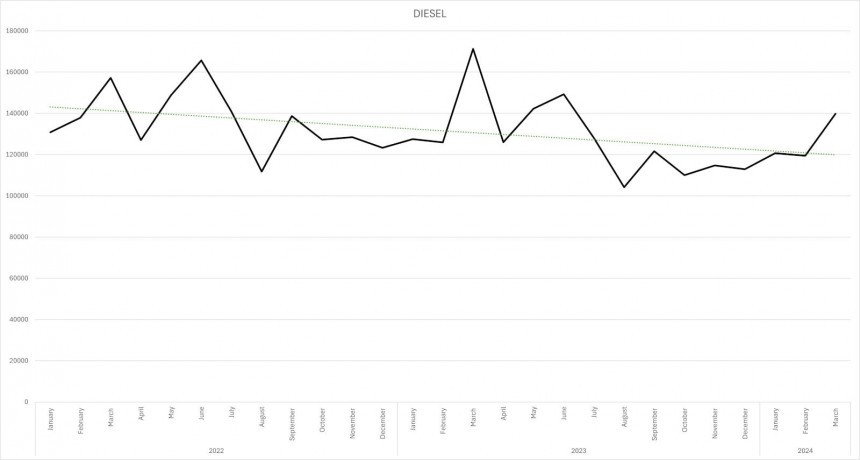

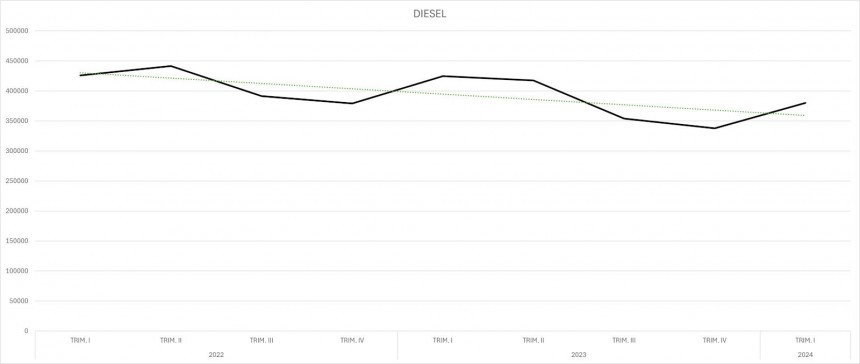

The diesel trend is negative, but this is nothing new in the aftermath of Dieselgate. I think the trend should decline faster, but European carmakers - especially German premium carmakers - still manage to convince customers that this option is valid. Well, I must reckon those heavy SUVs are less thirsty if diesel engines power them.

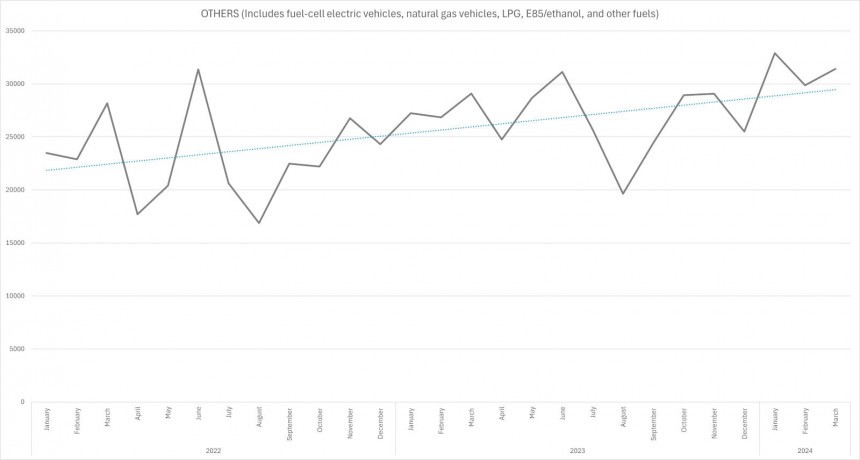

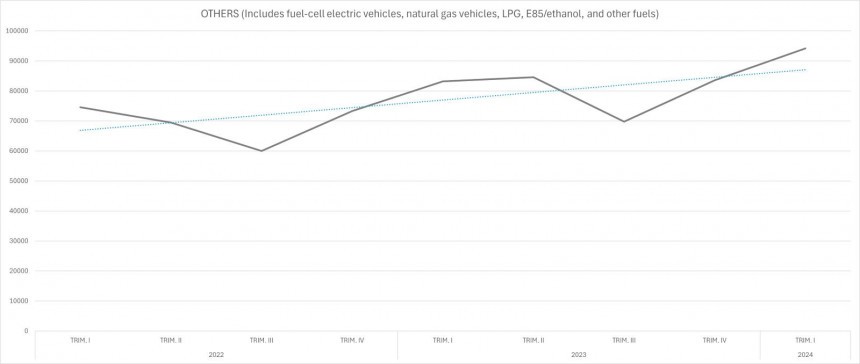

Interestingly, fuel-cell cars are mixed with ICE cars that don't run on conventional petrol or diesel. They're all under the "others" moniker, even though fuel-cell cars are real zero-emission vehicles. While the trend is rising, the number of these vehicles is so low that they don't really impact the big picture. In my opinion, those with an ICE under the hood should have stayed in the "petrol" area.

Oh, let me show you the big picture. You can see that hybrids will soon be neck-on-neck with petrol cars, and the last two years show a better trend for hybrids. Of course, one cannot expect the same evolution for electric cars, especially given the harsh context of geopolitical and global economic issues. Still, EVs are far from going down in flames.

So, you see that EV registrations dropped in the first quarter of this year, right? Well, it was the same last year. The real question is how slowly they will rebound in the next quarter because of fewer subsidies or even a complete shutdown of governmental programs.

But get this: the evolution of 2023 EV registrations - on a quarter-base - was much better than in 2022, despite the fewer subsidies. We're yet to see if the electric car market is self-sustainable. Still, all the signs show that people will continue to buy electric cars despite the lower increase rate, which is disappointing for economists.

As expected, hybrids show a constant rise, but in the petrol cars sector, the quarter-based graph shows much better the slow down. As battery prices get lower, the price gap between hybrids and similar petrol cars only shrinks.

Of course, we must not omit that mild hybrids are unjustly considered hybrids. So, both graphs are somehow flawed: the trend for hybrids is not actually that steep, while petrol cars don't really stagnate.

One thing is certain: cars sporting petrol ICEs under the hood will still reign the auto industry, at least until 2030. Of course, diesel cars will exit the scene at some point, as the trend in the graph clearly shows. But in the meantime, they will do enough harm to offset the benefits EVs could bring.

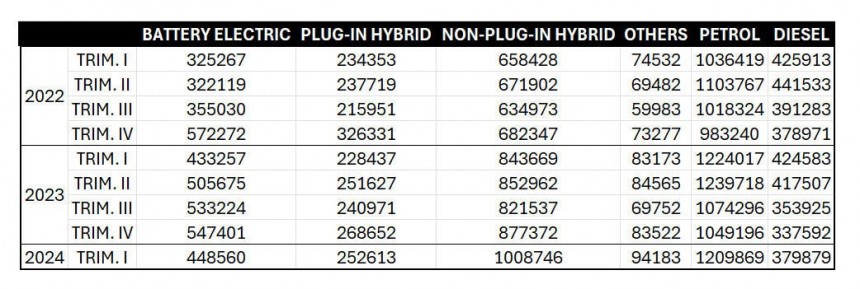

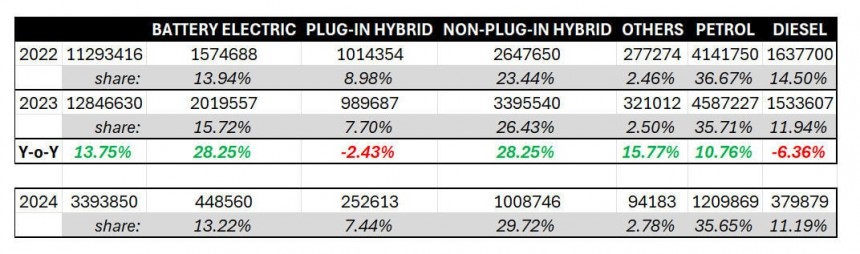

Let's compare 2023 and 2022, shall we? Overall, European car registrations rose by 13.75%, and the biggest influence came from hybrids and EVs. Of course, you'd be right to consider that petrol cars were the main factor, accounting for over a third of the registrations. But just wait a minute.

In 2023, around 450,000 more petrol cars were registered than in 2022, but also some 100,000 fewer diesel cars were registered. So, conventional ICE car registrations rose only by almost 350,000 units.

In the meantime, almost 750,000 more non-plug-in hybrid cars were registered in 2023 than in 2022. Of course, we keep in mind that they are also mild hybrids, but the higher increase rate still tells us something. The same goes for EVs, with almost 450,000 more registrations in 2023 than in 2022.

There's a strange coincidence that both hybrids and EVs rose by 28.25%, but what's more important is that their respective shares were a little higher in 2023 compared to 2022, while the petrol and diesel shares diminished. It's a pretty clear image, although a longer period would be necessary to draw better conclusions.

Still, the first quarter of 2024 gives us an interesting glimpse: The EV share is almost the same as two years ago - around 13% (compared to 15% last year). This is understandable because of the much lower support from subsidy schemes all over Europe.

But get this: the number of EVs registered in the first three months of 2024 is higher than in the same period of last year. This is partly because many of those 448,000 EVs were bought in the previous year when they still benefited from some form of subsidies.

More importantly, this is partly because an increasing number of customers are willing to buy EVs without subsidies. That kind of demolishes the assumption that EV sales would collapse without subsidies. Meanwhile, price cuts and more affordable EVs ease the pain of high volumes carmakers are used to in order to thrive.

How about plug-in hybrids and hybrids? While there have been no major changes for plug-in hybrids, the hybrids' share is clearly on the rise, as expected. As for petrol and diesel, the optimistic stance is that their share is somewhat steady. For the moment.

For now, I think it's clear that all those debates about EV sales' demise are simply propaganda. Of course, taking some things or values out of context can easily create a grim picture regarding the near future of electric vehicles. But only ignorants or ill-intended persons can think of this.

There are so many facts to debunk this nonsense, ranging from the benefits of electric cars to the hundreds of billions invested by carmakers and governments in electrification. But, hey, there's no space for that now.

The fact is that numbers, tables, and graphs have spoken. Their story is quite easy to understand. And by no means is it a different story than the one we're bombarded with each day: EVs are not the right choice, and we should ditch them. We should acknowledge that this is just an alternative fact in a broader infowar.

We all know that sales figures greatly impact Tesla's stock every quarter. It's almost the same for any other car company. However, registrations are the real deal regarding statistics because they show us how many cars are actually in use.

Most of the time, people don't just buy or lease an existing car from the dealership. Usually, there is a waiting list, especially for new and very promising cars, but mostly for electric cars. So, making statistics based solely on sales figures can lead to false conclusions regarding the actual state of the market.

For instance, customers tend to wait less for petrol or diesel cars or even for hybrids. In contrast, battery electric cars and plug-in hybrids take longer to be delivered, mainly because production facilities can't keep up the pace with the demand.

Of course, this might seem like nonsense in the first months of 2024, as the "EV market cooling down" scares everybody: carmakers complain sales are not on par with expectations, while the naysayers' anti-EV propaganda directly influences new customers. Consequently, the decision to buy an EV evaporates.

Frankly, it was very easy for mass media and social media to create this environment of distrust in the transition to electromobility. However, while popular wisdom spreads this misinformation about "EV market doom," electric car expansion continues. Not enthusiastically, but showing strong progress.

The plug-in cars trend in the last two years is strikingly clear

Analysts usually need a benchmark to determine whether a month is good or bad for car sales. That's why they relate to the same month or period of the prior year. Of course, without context, conclusions risk being flawed. Any other information helps to carve a clear image of the market so that carmakers can adapt quickly.Well, "quickly" is kind of slow in the car industry because of its sheer size and the many levels of authority needed to make decisions. By the way, the European auto industry employs almost 13 million workers (more than 5% of the EU's workforce) and generates over 7% of the EU's GDP. It can't be treated as a start-up…

Now, the latest numbers on European electric passenger cars are definitely not optimistic. This March, less than 200,000 EVs were registered in Europe, as opposed to more than 220,000 last March. This is an 11% drop, and it's clearly a warning signal.

The main reason is that sales increased by 29% and 10% in January and February, respectively. Between you and me, carmakers were expecting this negative trend because, mind you, most of the cars registered in the first quarter of 2024 were actually sold in the last months of 2023 when everybody knew that governments would diminish the support for electromobility in 2024.

However, you'd be surprised to find out that EV sales in the first three months of this year were 3.5 percent better than the same period in 2023. This is not much consolation for salespeople, but regular customers must understand the context. This way, they can understand that the "EV cooling down" is not a disaster.

The "jigsaw" graph for battery electric cars shows large variations but is far from a pessimistic trend. Yes, there's a "hole" in January and February, but the same was true last year and the year before. Likewise, the end of 2022 marked a spike in registrations, mostly because of season rebates and stock discounts. A similar spike, although smaller, can be seen at the end of 2023.

Hybrids are on the rise, but there's a slick catch

Toyota's hybrid cars are probably the first thing that comes to mind when you hear "hybrid." Of course, other carmakers already offer a variety of hybrid models, and petrol and diesel cars will most likely be replaced by hybrids soon. Soon, as in "somewhere between 2030 and 2040."But here's the thing: the ICE does not retire without a fight. The latest trick carmakers and ACEA have found is to lump "full hybrid" and "mild hybrid" powertrains into the same basket. This is just wrong because a mild hybrid system consists of a very small battery and a shy electric motor that only helps the internal combustion engine to be slightly less polluting.

On the contrary, a full hybrid system really impacts an ICE vehicle's consumption and pollution values. In many circumstances, the electric motor powers the car, while the ICE works like an electricity generator for the battery. Frankly, mild hybrids are just a fraud, err, a marketing stunt.

So, the fast-rising trend of hybrid car registrations is actually due to the fancier petrol and diesel powertrains that are badged "mild hybrid." As there are almost no incentives for hybrids, customers' interest is sparked thanks to lower consumption values, especially in cities, compared to regular petrol and diesel engines.

How about a "quarter trend" point of view?

But get this: the evolution of 2023 EV registrations - on a quarter-base - was much better than in 2022, despite the fewer subsidies. We're yet to see if the electric car market is self-sustainable. Still, all the signs show that people will continue to buy electric cars despite the lower increase rate, which is disappointing for economists.

As expected, hybrids show a constant rise, but in the petrol cars sector, the quarter-based graph shows much better the slow down. As battery prices get lower, the price gap between hybrids and similar petrol cars only shrinks.

Of course, we must not omit that mild hybrids are unjustly considered hybrids. So, both graphs are somehow flawed: the trend for hybrids is not actually that steep, while petrol cars don't really stagnate.

One thing is certain: cars sporting petrol ICEs under the hood will still reign the auto industry, at least until 2030. Of course, diesel cars will exit the scene at some point, as the trend in the graph clearly shows. But in the meantime, they will do enough harm to offset the benefits EVs could bring.

The "EV share" conundrum

One metric analysts are very fond of is the sales shares different powertrain types have. A decade ago, the EV share was under one percent, so a double-digit share today is a great achievement. But again, it needs some context to be relevant.Let's compare 2023 and 2022, shall we? Overall, European car registrations rose by 13.75%, and the biggest influence came from hybrids and EVs. Of course, you'd be right to consider that petrol cars were the main factor, accounting for over a third of the registrations. But just wait a minute.

In 2023, around 450,000 more petrol cars were registered than in 2022, but also some 100,000 fewer diesel cars were registered. So, conventional ICE car registrations rose only by almost 350,000 units.

In the meantime, almost 750,000 more non-plug-in hybrid cars were registered in 2023 than in 2022. Of course, we keep in mind that they are also mild hybrids, but the higher increase rate still tells us something. The same goes for EVs, with almost 450,000 more registrations in 2023 than in 2022.

There's a strange coincidence that both hybrids and EVs rose by 28.25%, but what's more important is that their respective shares were a little higher in 2023 compared to 2022, while the petrol and diesel shares diminished. It's a pretty clear image, although a longer period would be necessary to draw better conclusions.

Still, the first quarter of 2024 gives us an interesting glimpse: The EV share is almost the same as two years ago - around 13% (compared to 15% last year). This is understandable because of the much lower support from subsidy schemes all over Europe.

But get this: the number of EVs registered in the first three months of 2024 is higher than in the same period of last year. This is partly because many of those 448,000 EVs were bought in the previous year when they still benefited from some form of subsidies.

More importantly, this is partly because an increasing number of customers are willing to buy EVs without subsidies. That kind of demolishes the assumption that EV sales would collapse without subsidies. Meanwhile, price cuts and more affordable EVs ease the pain of high volumes carmakers are used to in order to thrive.

How about plug-in hybrids and hybrids? While there have been no major changes for plug-in hybrids, the hybrids' share is clearly on the rise, as expected. As for petrol and diesel, the optimistic stance is that their share is somewhat steady. For the moment.

Instead of conclusion

This wasn't meant to be a cold-hard sales analysis. I just wanted to see if I could fight the anti-EV movement using cold-hard numbers. After all, the ACEA consists of 15 carmakers, so one can hardly suspect this organization of being pro-EVs…For now, I think it's clear that all those debates about EV sales' demise are simply propaganda. Of course, taking some things or values out of context can easily create a grim picture regarding the near future of electric vehicles. But only ignorants or ill-intended persons can think of this.

There are so many facts to debunk this nonsense, ranging from the benefits of electric cars to the hundreds of billions invested by carmakers and governments in electrification. But, hey, there's no space for that now.

The fact is that numbers, tables, and graphs have spoken. Their story is quite easy to understand. And by no means is it a different story than the one we're bombarded with each day: EVs are not the right choice, and we should ditch them. We should acknowledge that this is just an alternative fact in a broader infowar.