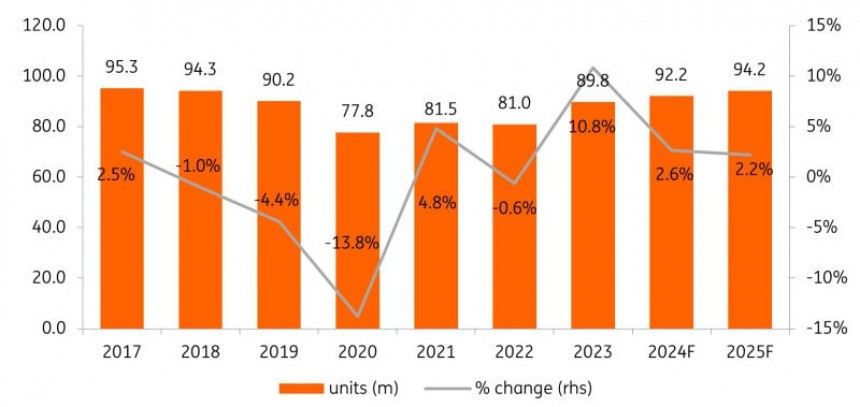

Most of the numbers are on, and it looks like the passenger car sales topped around 90 million units globally. This marks a 15% increase compared to the pandemic hit in 2020, but it's still 5% under the 2017 level. But what do all these numbers actually mean? Let's dive a little deeper into the details.

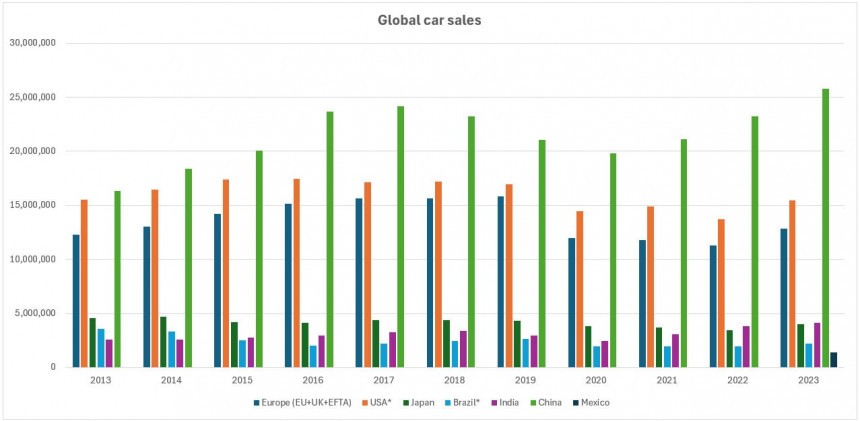

The VDA (German Association of the Automotive Industry) has monitored eight major markets for the last decade. But, as Russia started its unjust war on Ukraine two years ago, VDA excluded all data from this country. This may impact, to some degree, the big picture but not necessarily the overall trends.

It's a silent world war, and Western can't keep up

China being the Number One car market in the world is not the biggest news anymore, as it has held that title for some years now. While some could think that China surpassing the 25 million mark is notable, there's something else bothering the US, the EU, and Japan.

Traditionally, these three have been known as the most essential car markets for decades. But here's the thing: compared to 2013 figures (when these three regions saw combined sales of almost 28 million units), 2023 results are only 1.6% better.

Of course, you're partially right to blame the pandemic year, resetting the yearly sales increase (which was more than 32.7 million in 2019). But, hey, China and India were also hit by COVID-19, and the toll they had to pay was harsher.

Still, their emerging markets rebounded more vividly. Compared to 2013, in 2023, China and India's car sales jumped around 60%! Today, India is the fourth largest car market in the world, surpassing a very slow-recovering Japan.

Unfortunately, Russia's war on Ukraine has a significant impact on this worrying world order change. The US, Europe, Japan, and Australia imposed economic sanctions on Russia, and consequently, their economies were hurt.

As a reminder, Germany's recent "hole in the budget" (which also led to the sudden phase-out of EV subsidies) is based mainly on the country's dependency on low-cost natural gas supplies from Russia. Cutting down this advantage meant trouble for Europe's leading economy.

On the other hand, China and India seized the opportunity and became the main clients of Russian fossil fuels, which they now buy even cheaper than before. As a result, China's and India's industries have an important edge over Western's.

An utterly unfair and cynical advantage, if you ask me, as they simply support this terrible aggression from the shadows, which you and I couldn't believe possible in this new era. But, hey, the dark side of the global economy is that the need for more enormous profits sometimes justifies being on the wrong side.

The bottom line is that China's expected domination in all the major car markets is normal as long as fair play is gone. And this is especially true in the EV sector, where "the Chinese invasion" is helped by unexpected "Trojan horses."

EV stall? EV cooling? EV slowdown?

2023 will most likely be the most frustrating year of the 2020s for electric vehicle sales. Compared to 2022, there was a 60% increase in EV sales in 2023; however, both analysts and carmakers expect an increase in sales year-over-year of less than 20%, more realistically 10 to 15%.

All those naysayers and detractors of electromobility will surely ring the bell on EV doom, but frankly, it's not the case. We are far from the demise of EVs – if this happens, it surely won't favor ICEs (despite e-fuels being marketed as the perfect solution to save ICEs…).

The simple truth is that the EV market has two issues to deal with. The first one is the infowar fueled by Big Oil interests (and no, I'm not trying to use conspiracy theories to rest my case). All the range-anxiety talk, all those battery-related pollution accusations, and all those anti-EV bits of so-called information serve no other purpose than to plant doubt in customers' minds.

The second one is the rise of extremism all over the world, but mainly in long-established democracies (and no, again, I'm not trying to lure you into a political debate). Unfortunately, any large-scale transition requires adaptation to change, and many people fear changing.

Frankly, this is a paradox. Most people don't want to give up their gasoline or diesel cars for a supposedly less practical EV. Still, they are very easily seduced by the idea of giving up democracy for utopic equalitarianism (that actually hides the real danger of sliding on the autocratic path). That's some food for thought if you're willing to dig deeper for yourself.

Back to extremism: it's closely related to "the new world order" concerning the raw materials needed for a zero-emissions economy. The primary resources of lithium, nickel, or cobalt (critical for batteries) and most rare-earth elements are located in some very sensitive areas where political turmoil is the norm.

Taiwan is the epicenter of the world's semiconductor production, but it's under pressure from China's territorial claims (which oddly resembles a lot of Russia's so-called reasons to invade Ukraine). The world already experienced a semiconductor crisis, and a new one will be much worse (that's why Western powers invest big in such facilities).

Governments are afraid to seriously tax pollution because this would tremendously impact economies and social stability. That's why they chose instead to build EV subsidy programs, which are now attacked – can you guess by whom? – extremist movements that appeal to more and more voters lately.

Having said all this, I guess you can better understand why EV forecasts are pessimistic. But you should not ignore one thing: it's only the pace of EV sales to decline, not the EV sales. So, the slowdown of EV sales is the right angle.

Europe's example: plug-in sales were strong, mainly thanks to more costly SUVs

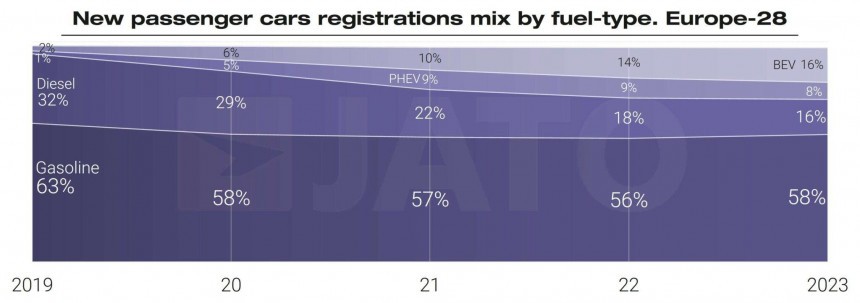

JATO's analysis of the European passenger car market highlights several ideas. The first one is that the 12.8 million new car registrations (in 28 European countries) marked the highest level since the pandemic. However, it's still a couple of million less than the 15.8 million units sold in 2019 and at almost the same level as 2014.

The second one – and, in my opinion, the most important – is that battery electric vehicles (BEVs) and plug-in hybrids (PHEVs) were the main drivers for the sales increase. Moreover, 2023 was the first year BEVs surpassed the 2 million mark, almost at the same level as the shrinking diesel segment. I bet that in 2024, BEVs will sell better than diesels in Europe.

However, a little detail should be of considerable concern for policymakers: last year, less than half of the electric cars were bought by private buyers. Around 60% of them were from fleets and business registrations. This means companies purchased 1.22 million EVs, a 50% increase compared to 2022.

This has a lot to do with TCO (total cost of ownership), and this is a hint for governments and local authorities on what to focus on to haste EV adoption. On the other hand, carmakers must change their strategy – at this point, private buyers are the most profitable for carmakers, and this is where Chinese EV makers gain momentum.

Of course, the so-called "cheap Chinese cars invasion" is still partly a false warning, partly a subversive blackmail from the European car industry to force politicians to pour more money into their pockets. Of course, we should not underestimate Chinese carmakers, but there's no doubt that European carmakers must do more.

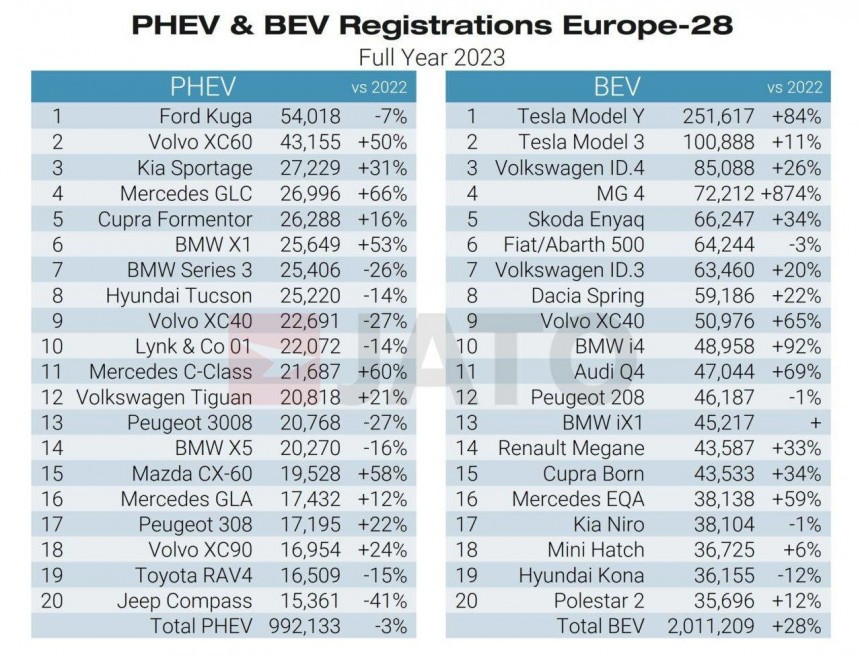

As for 2023, the 30 Chinese brands available in Europe almost doubled their share compared to 2022. The 322.000 units accounted for 2.6% of the overall market, and two-thirds of the cars were sold by MG – a UK brand owned by Chinese SAIC Motor. For now, only eight of the Chinese brands sold more than 1,000 units in 2023, so they are hardly a menace.

However, Chinese EVs accounted for around 8% of the European electric car market in 2023, and this is something of concern. EU is already looking into allegations of unfair dumping prices, and some countries – France, for instance – excluded Made in China's EVs from subsidies.

Around 86,000 Chinese EVs were sold in Europe in 2023, and more than 72,000 (almost 85%!) were MG4. How's that possible? Well, according to a Deloitte study, 55% of clients in Germany (by far Europe's biggest car market) prioritize the price for the next car they want to buy.

So, it's only natural for people to go for cheaper EVs if they offer a similar level of space and equipment as more expensive European counterparts. Moreover, while Dacia Spring is the cheapest electric car in Europe (by the way, it's also made in China…), it was only the eighth best-selling EV in 2023, and the MG4 was the fourth!

While many European carmakers emphasize the need for very cheap EVs to counter the "Chinese cheap EV invasion," the best-selling top tells another story. Tesla claimed the first two sweet spots with Model Y and Model 3, but it's striking that the SUV sold twice as much as the sedan.

Actually, the best-selling EV in the world had a more than 10% share in the European EV market in 2023. Moreover, its sales were 84% higher than in 2022, and you can easily see that four out of the first five EVs in the 2023 top were SUVs. Do I need to say more about European's hunger for this type of car?

Well, yes. Nine out of the first ten best-selling cars were SUVs in the plug-in hybrid sector. Overall, the first three best-selling cars in Europe in 2023 were Tesla Model Y, Dacia Sandero Stepway, and Volkswagen T-Roc – they are all SUVs, even if Sandero and T-Roc are more like raised city cars.

Is there something to be learned from the 2023 numbers?

It's more complicated than ever to make credible predictions in the actual geo-political global environment. It all comes down to the elections that will take place in 2024 worldwide. If extremism and populism will prevail, you can bet all the measures to curb emissions will stall.

Fighting climate change requires too many sacrifices for modern people, especially those in developing countries who simply want the same level of comfort as the Westerns. Unfortunately, in the bigger context, EVs and electromobility became the bad guys because the shift from fossil fuels is presented (by you know who) as a sure path to destroying society.

In the meantime, China will expand its influence using cheap products. Yes, the Chinese EVs will most likely invade emerging markets in South America, Africa, and even many parts of Asia, which it will share with Indian carmakers.

As for the US and EU, we will have to wait and see if their protectionism programs will suffice to counter the so-called Chinese invasion. Nevertheless, Europe will most likely ease its decarbonization plans, partly because of carmakers' pressure and partly because of others like farmers in agriculture or the energy companies in the renewables push.

Car sales are expected to increase globally in 2024, not by much, but mainly because of China. EV sales will also grow but at a much slower pace. BYD overtaking Tesla as the global EV leader hints at the ever-growing domination of the Chinese car industry. Which, frankly, is bad news for Western companies but not necessarily for the transition to electromobility.

Probably the most important thing for you is that if you plan to buy a new car in 2024, there are slim chances it will be an electric one. Deloitte's study shows a slight increase in the preference for ICEs in the US (67% compared to last year's 58%), Germany (49% from 45%) or South-East Asia (52% from 50%).

In the end, I really believe that we can have a serious discussion about the importance of electromobility – or even for a zero-emission hydrogen-based society – only when the global political scene comes to stability.

Immediate worries about wars' uncertainties outpace future concerns about climate change by far. So, while it's not a logical conclusion, postponing EV's optimistic expectations is simply instinctive – like a "fight-or-flight" stress response.