Blaming the U.S. for luring many battery manufacturers from Europe is more like a lousy excuse. Almost a year after the Inflation Reduction Act came into effect in the United States, the EU Commission will respond with the new Net Zero Industrial Act. But T&E NGO fears that ‘NZIA’ won’t be as attractive as the ‘IRA’ for companies investing in European battery manufacturing. These are their key findings.

As many of you know, at the last moment, Germany blew up the vote for the 2035 European ICE ban. In the EU, there are other countries reluctant to internal combustion engines phasing-out, but Germany’s move surprised everyone.

The main headline was about e-fuels and how the German car industry requested, using the voice of politicians, regulations post-2035 for ICE cars. However, this was only one of the issues. Germany also pointed out that the ‘Fit for 55’ package of proposals isn’t robust enough to match the U.S. IRA.

Americans are pouring some $150 billion (more than €140 billion) into financing aids for local battery manufacturing and locally sourced raw materials. This is almost free money for large-scale investments in battery production, and several companies already made plans to move operations from Europe to the United States to benefit from these subsidies.

According to T&E, the main companies weighing up investing in the U.S. instead of the EU are Tesla in Berlin, Northvolt in Germany, and Italvolt in Italy. And it’s not only about the money, as the EU already granted dozens of billions of euros for cleantech investments.

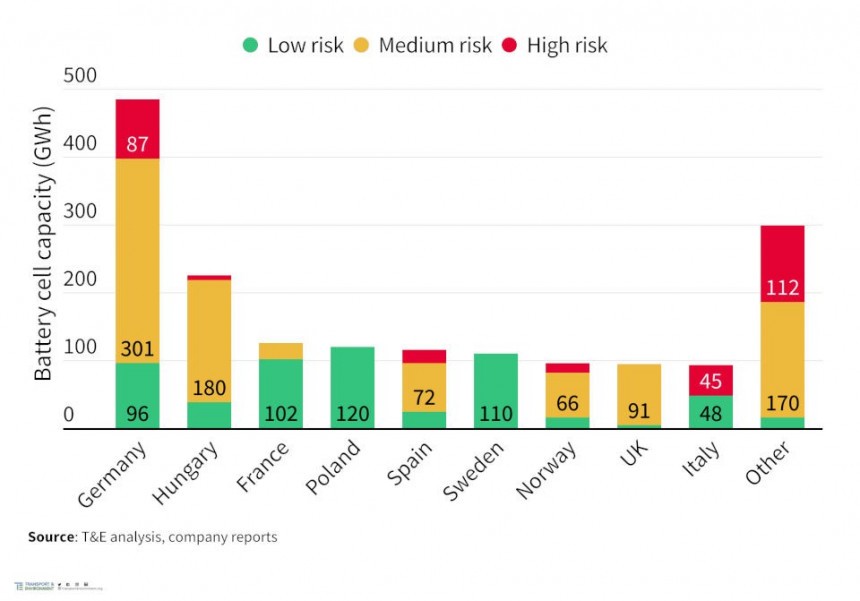

It's more of an investment uncertainty T&E is emphasizing. Although there are close to 50 battery manufacturing plants planned to be constructed and operational by 2030, the NGO asserts that two-thirds of them are at risk of being delayed, scaled down, or simply canceled.

In short, batteries for about 18 million electric vehicles might not be produced in the EU. Or a potential of 1.2 TWh capacity might be lost. All of these are because of bureaucracy, but T&E is shy about using this term. They prefer this instead: “to be effective Europe’s response should mirror the US IRA in focus, simplicity, and visibility.”

Maybe you remember how Elon Musk was fed up with all the delays at the Gigafactory in Berlin, mainly because of environmental concerns. Although the company was following the rules, somehow new problems were emerging, and Tesla’s production plans were postponed. And we all know how those delays impact Tesla’s shares.

T&E is pointing out that the EU should simplify permitting and approval processes. Then it requests for simplifying the tax brake system, although this is a challenge in such a fragmented legal framework because of the individual national legislations of each of the EU members.

Of course, they state that additional funding is needed, but also new efficient rules for prioritizing these funds. This is a subtle reference to generous funding for hydrogen development or other green or green-ish technologies that don’t seem to bring a better value chain than batteries.

T&E considers recycling batteries is not perceived at its true potential. The NGO estimates that recycling used batteries from electronics and EVs could source as much needed materials as domestic extraction. This, by the way, is another sensitive topic, as the EU is not among the world’s top mining power.

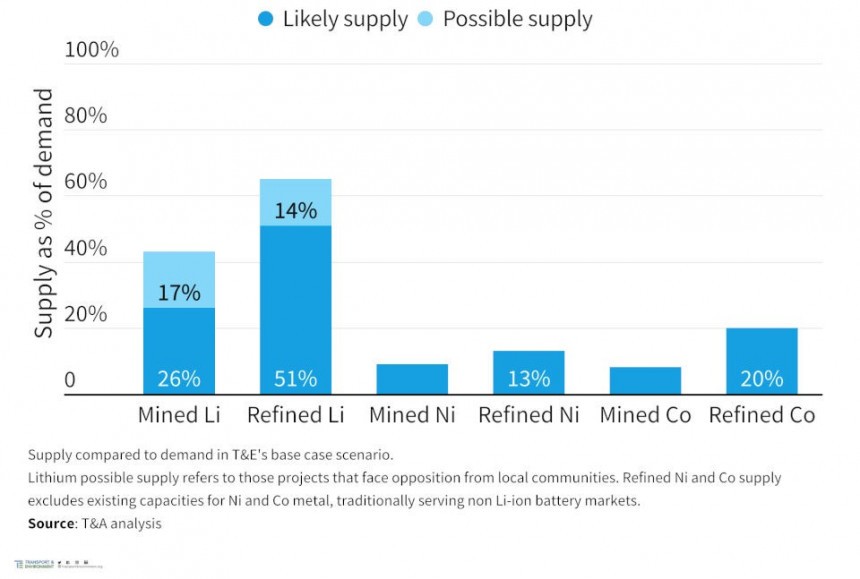

T&E forecasts Europe can meet half of the lithium needs by 2030 thanks to cleaner new technologies of extraction. But in the case of nickel and cobalt, it can secure only 10% of its needs by 2030 from local mining. For all these critical metals, the EU’s dependency on global imports is a weakness.

The U.S. Geological Survey estimates that identified lithium resources in the world total about 98 million tons, but feasible reserves are more like 26 million tons. The biggest reserves are currently in Chile (9.3 mil. tons), Australia (6.2 mil. tons), Argentina (2.7 mil. tons), and China (2 mil. tons).

The U.S. accounts for roughly one million tons of reserves. Meanwhile, Portugal has the most lithium reserves in Europe, with a mere 60,000 tons. Recently, Iran claimed to have discovered a huge reserve of about 8.2 tons of lithium, which would rank this country second in the world’s top countries.

For most analysts, it’s clear that Europe will be reliant upon imports of lithium at least through this decade. Currently, its biggest suppliers are from South America, while partnerships with major producers in Australia and Africa are in the works.

However, the global market is not only competitive but also strongly influenced by geo-political issues. For instance, the United States vs China economic war escalation will put more pressure on Europe’s raw materials sourcing and refining.

In that respect, T&E is right to urge EU officials for prioritizing refining and recycling as ‘strategic projects’. Also, the NGO suggests that in the short term, a reallocation of EU recovery funds is needed for scaling up production and supporting the faster deployment of renewables and smart grids.

The bottom line is the EU’s position in the fast race for lithium-ion batteries investments has alarmingly weakened. EU’s share in global investments dropped from 41% in 2021 to an outrageous 2% in 2022. That’s because China’s ambitious goals are fueled by more than generous government funds and frameworks, while the U.S. has put in place its huge IRA plan.

One can say that it’s easy for a “clean transport campaign group” to criticize the EU’s frameworks and plans regarding the transition to a zero-emissions economy. Indeed, the bureaucrats and politicians in Bruxelles have to deal with other economical and socially stringent issues at the same time.

But it’s also true that in a fast-changing global environment, the EU can’t afford to base its decision on inertia. We can only hope that T&E’s observations and warnings will be answered in the new Net-Zero Industry Act and Critical Raw Materials Act soon to be unveiled by EU Commission later this month.

In the end, we should answer the question in the headline: do the U.S. multi-billion battery subsidies put the European battery production at risk? Yes and no. Yes, they are an important factor, but no, they are not the main driver. It’s up to the EU to find the optimal way to compete with the U.S. and China. After all, it's a free global market, and investors follow the best opportunities.

The main headline was about e-fuels and how the German car industry requested, using the voice of politicians, regulations post-2035 for ICE cars. However, this was only one of the issues. Germany also pointed out that the ‘Fit for 55’ package of proposals isn’t robust enough to match the U.S. IRA.

Americans are pouring some $150 billion (more than €140 billion) into financing aids for local battery manufacturing and locally sourced raw materials. This is almost free money for large-scale investments in battery production, and several companies already made plans to move operations from Europe to the United States to benefit from these subsidies.

According to T&E, the main companies weighing up investing in the U.S. instead of the EU are Tesla in Berlin, Northvolt in Germany, and Italvolt in Italy. And it’s not only about the money, as the EU already granted dozens of billions of euros for cleantech investments.

It's more of an investment uncertainty T&E is emphasizing. Although there are close to 50 battery manufacturing plants planned to be constructed and operational by 2030, the NGO asserts that two-thirds of them are at risk of being delayed, scaled down, or simply canceled.

In short, batteries for about 18 million electric vehicles might not be produced in the EU. Or a potential of 1.2 TWh capacity might be lost. All of these are because of bureaucracy, but T&E is shy about using this term. They prefer this instead: “to be effective Europe’s response should mirror the US IRA in focus, simplicity, and visibility.”

T&E is pointing out that the EU should simplify permitting and approval processes. Then it requests for simplifying the tax brake system, although this is a challenge in such a fragmented legal framework because of the individual national legislations of each of the EU members.

Of course, they state that additional funding is needed, but also new efficient rules for prioritizing these funds. This is a subtle reference to generous funding for hydrogen development or other green or green-ish technologies that don’t seem to bring a better value chain than batteries.

T&E considers recycling batteries is not perceived at its true potential. The NGO estimates that recycling used batteries from electronics and EVs could source as much needed materials as domestic extraction. This, by the way, is another sensitive topic, as the EU is not among the world’s top mining power.

T&E forecasts Europe can meet half of the lithium needs by 2030 thanks to cleaner new technologies of extraction. But in the case of nickel and cobalt, it can secure only 10% of its needs by 2030 from local mining. For all these critical metals, the EU’s dependency on global imports is a weakness.

The U.S. Geological Survey estimates that identified lithium resources in the world total about 98 million tons, but feasible reserves are more like 26 million tons. The biggest reserves are currently in Chile (9.3 mil. tons), Australia (6.2 mil. tons), Argentina (2.7 mil. tons), and China (2 mil. tons).

The U.S. accounts for roughly one million tons of reserves. Meanwhile, Portugal has the most lithium reserves in Europe, with a mere 60,000 tons. Recently, Iran claimed to have discovered a huge reserve of about 8.2 tons of lithium, which would rank this country second in the world’s top countries.

For most analysts, it’s clear that Europe will be reliant upon imports of lithium at least through this decade. Currently, its biggest suppliers are from South America, while partnerships with major producers in Australia and Africa are in the works.

However, the global market is not only competitive but also strongly influenced by geo-political issues. For instance, the United States vs China economic war escalation will put more pressure on Europe’s raw materials sourcing and refining.

In that respect, T&E is right to urge EU officials for prioritizing refining and recycling as ‘strategic projects’. Also, the NGO suggests that in the short term, a reallocation of EU recovery funds is needed for scaling up production and supporting the faster deployment of renewables and smart grids.

One can say that it’s easy for a “clean transport campaign group” to criticize the EU’s frameworks and plans regarding the transition to a zero-emissions economy. Indeed, the bureaucrats and politicians in Bruxelles have to deal with other economical and socially stringent issues at the same time.

But it’s also true that in a fast-changing global environment, the EU can’t afford to base its decision on inertia. We can only hope that T&E’s observations and warnings will be answered in the new Net-Zero Industry Act and Critical Raw Materials Act soon to be unveiled by EU Commission later this month.

In the end, we should answer the question in the headline: do the U.S. multi-billion battery subsidies put the European battery production at risk? Yes and no. Yes, they are an important factor, but no, they are not the main driver. It’s up to the EU to find the optimal way to compete with the U.S. and China. After all, it's a free global market, and investors follow the best opportunities.