Volkswagen was the biggest carmaker in the world for some time, but things went downhill in 2020. This coincides with the rise of electric vehicles, a wave that the German company was supposed to ride like a pro. However, a series of bad decisions brought the giant company to its knees, and the cost-cutting measures announced recently might not be enough to save it.

When Volkswagen was caught red-handed in the 2015 emission scandal, many thought it would have a tough time recovering. To anyone's surprise, the German carmaker navigated the troubled waters masterfully while getting to the other side stronger than ever before. In 2018, Herbert Diess was named the Volkswagen Group's CEO, and a grandiose plan was set in motion to turn the company into the largest EV manufacturer in the world.

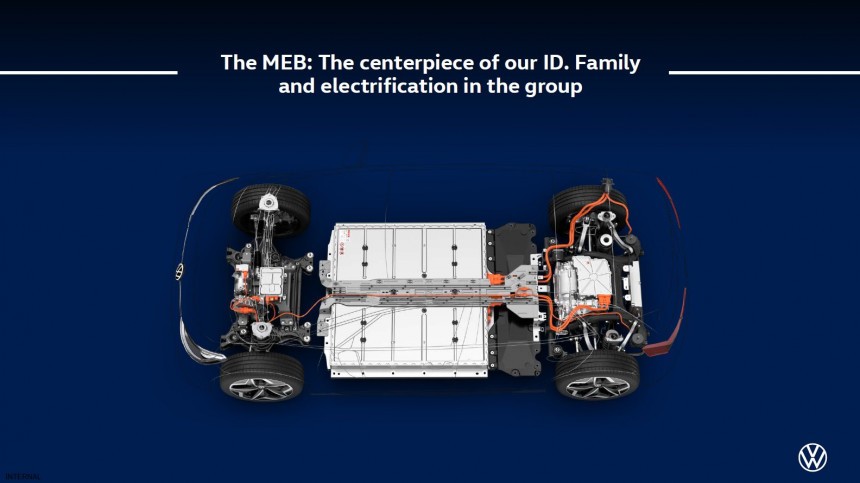

Everyone, including yours truly, knew that Diess was the right man to turn Volkswagen's fortunes around. And so he did, with the MEB platform as the first EV-dedicated architecture to spawn a large number of EV models across Volkswagen's many brands. The plan was to slowly replace all ICE vehicles with electric equivalents by 2030. Volkswagen also announced a new ID. branding for its electric vehicles to better differentiate them from their ICE counterparts.

The MEB platform wasn't perfect, but it was the first step in a long-term strategy with the end goal of surpassing Tesla as the world's EV leader. Diess was a visionary and also a fan of Elon Musk, which helped him draw a good plan to bring the Volkswagen Group in pole position in the EV race. However, executing this plan was more difficult than Diess had imagined.

Diess was never a popular leader, and his decisions rattled a lot of people, from those on the Volkswagen Group's board to the influential German Unions. Going electric was a necessary step to keep Volkswagen relevant in the years to come, but that also meant Volkswagen would've needed fewer factories, fewer workers, and a leaner structure. However, it wasn't electric vehicles that brought Diess's demise, it was software.

Cariad botched the ID.3 and ID.4 software, which is still not up to snuff today after four years of tinkering. Worse, Cariad's failure led to the delay of the group's Premium Platform Electric (PPE) architecture, with the Porsche Macan EV, Audi Q6 e-tron, and Audi A6 e-tron as the affected models. These EVs are still not production-ready, software-wise, even though the hardware development was completed a long time ago. That was the last straw that caused Diess to lose his job, but that didn't end Volkswagen's troubles.

The new management put a hard stop to all the plans that Diess started, including a multi-billion EV factory in Wolfsburg. Volkswagen Group also halted all EV-dedicated platform development. Although the PPE is still in the works because the vehicles it underpins are too close to production, the Scalable Systems Platform (SSP) is now on the back burner. SSP is a more advanced EV architecture set to replace both the MEB and PPE and give Volkswagen Group an edge over its competitors, including Tesla.

However, the pause that Oliver Blume, currently Volkswagen Group's CEO, imposed on the EV plans is harming the company. The aging MEB platform will continue its career with minor improvements despite already being outdated. Halting EV plans at a time when other carmakers are stepping up their EV game risks getting Volkswagen steamrolled by the competition in the near future.

As the ID.7, Volkswagen's electric flagship model, launched in China, it became clear that the German carmaker was heading for disaster. The ID.7 is still using Volkswagen's outdated MEB architecture and has few qualities to lure buyers who are more impressed with the advanced EVs built by BYD, Zeekr, NIO, or Tesla. It's no wonder that the ID.7 looks like a major flop, with only 300 orders received after its first 72 hours on the market.

According to the Chinese consumer research agency CarFans, the consumers are put off by the ID.7's high price and perceived lack of value. Undoubtedly, the latter must have weighed more in the buying decision since the similarly-priced Zeekr 007 received 25,000 preorders in nine days. It's hard to believe that Volkswagen ID.7 will match this if given six more days. It's not only the ID.7 sales that disappoint because Volkswagen was forced to also offer deep discounts on the ID.3 and ID.4 models.

Volkswagen's EV sales in Europe don't look much better, a new reality that was reflected by the recent production halts at its main EV plants. Volkswagen brand's CEO Thomas Schaefer warned earlier this year that "the roof is on fire," and drastic measures needed to be taken to save the company. Although Volkswagen acknowledged the problems, it took almost half a year until a cost-cutting plan was announced.

Volkswagen also aims to save 320 million euros per year by squeezing its suppliers and another 200 million euros by improving production times. By reorganizing its after-sales business, Volkswagen also wants to generate over 250 million euros per year. All these measures aim to bring more than 10 billion euros ($11 billion) in savings by 2026, with 4 billion euros ($4.4 billion) in 2024 alone. The plan also includes selective layoffs across the company to reduce headcount if deemed necessary.

Although the savings will probably keep Volkswagen afloat for the time being, nothing about this plan makes me believe it will turn the brand into an industry leader again. The cuts will likely lead to worse vehicles while also hampering the development of more advanced electric models. This is not Volkswagen promising to lead the way. It's more like rearranging the deckchairs on the Titanic.

Everyone, including yours truly, knew that Diess was the right man to turn Volkswagen's fortunes around. And so he did, with the MEB platform as the first EV-dedicated architecture to spawn a large number of EV models across Volkswagen's many brands. The plan was to slowly replace all ICE vehicles with electric equivalents by 2030. Volkswagen also announced a new ID. branding for its electric vehicles to better differentiate them from their ICE counterparts.

The MEB platform wasn't perfect, but it was the first step in a long-term strategy with the end goal of surpassing Tesla as the world's EV leader. Diess was a visionary and also a fan of Elon Musk, which helped him draw a good plan to bring the Volkswagen Group in pole position in the EV race. However, executing this plan was more difficult than Diess had imagined.

Diess was never a popular leader, and his decisions rattled a lot of people, from those on the Volkswagen Group's board to the influential German Unions. Going electric was a necessary step to keep Volkswagen relevant in the years to come, but that also meant Volkswagen would've needed fewer factories, fewer workers, and a leaner structure. However, it wasn't electric vehicles that brought Diess's demise, it was software.

A great EV plan that was badly executed

Diess saw how Tesla leveraged software to make its vehicles state-of-the-art computers on wheels. The software-defined vehicle (SDV) concept was in its infancy at the time, but Volkswagen wanted to lead the way. In 2019, Diess established a dedicated subsidiary, Cariad, to develop and manage the software for all-electric vehicles produced by Volkswagen Group's brands. However, Cariad failed monumentally, providing Diess's enemies with enough ammunition to topple him.The new management put a hard stop to all the plans that Diess started, including a multi-billion EV factory in Wolfsburg. Volkswagen Group also halted all EV-dedicated platform development. Although the PPE is still in the works because the vehicles it underpins are too close to production, the Scalable Systems Platform (SSP) is now on the back burner. SSP is a more advanced EV architecture set to replace both the MEB and PPE and give Volkswagen Group an edge over its competitors, including Tesla.

However, the pause that Oliver Blume, currently Volkswagen Group's CEO, imposed on the EV plans is harming the company. The aging MEB platform will continue its career with minor improvements despite already being outdated. Halting EV plans at a time when other carmakers are stepping up their EV game risks getting Volkswagen steamrolled by the competition in the near future.

Volkswagen ID.7 Chinese sales disappoint

Volkswagen's EV sales are quickly losing steam in all core markets, but especially in China, its biggest single-country market. China accounts for 40% of Volkswagen's global sales, and losing the grip on this market is very bad news. China is adopting electric vehicles faster than any other country on earth except Norway. However, this market is now dominated by Tesla and Chinese carmakers. Volkswagen invested in Xpeng Motors as a desperate measure to remain relevant, but that might not be enough.As the ID.7, Volkswagen's electric flagship model, launched in China, it became clear that the German carmaker was heading for disaster. The ID.7 is still using Volkswagen's outdated MEB architecture and has few qualities to lure buyers who are more impressed with the advanced EVs built by BYD, Zeekr, NIO, or Tesla. It's no wonder that the ID.7 looks like a major flop, with only 300 orders received after its first 72 hours on the market.

Volkswagen's EV sales in Europe don't look much better, a new reality that was reflected by the recent production halts at its main EV plants. Volkswagen brand's CEO Thomas Schaefer warned earlier this year that "the roof is on fire," and drastic measures needed to be taken to save the company. Although Volkswagen acknowledged the problems, it took almost half a year until a cost-cutting plan was announced.

Rearranging the deckchairs on the Titanic

According to this plan, Volkswagen aims to cut development time for new models from 50 to 36 months to bring them to the market faster. This will save Volkswagen over 1 billion euros ($1.1 billion) per year over the next five years. This will be further boosted by cutting the number of test prototypes in half. More tests will be simulated in software, saving the company another 400 million euros per year.Although the savings will probably keep Volkswagen afloat for the time being, nothing about this plan makes me believe it will turn the brand into an industry leader again. The cuts will likely lead to worse vehicles while also hampering the development of more advanced electric models. This is not Volkswagen promising to lead the way. It's more like rearranging the deckchairs on the Titanic.