Tesla posted disappointing sales in this year's first quarter. The EV maker is already trying to address the drop in demand by offering exceptional incentives. In China, one of the most affected markets, Tesla now provides zero-interest loans for up to five years to energize sales.

The EV adoption seems to have slowed down significantly as all carmakers have seen their EV sales plummeting. First to complain about this were traditional carmakers, which were already losing money on every EV sold. The recent price war Tesla started in January 2023 made the situation even more difficult for them. Unsurprisingly, GM and Ford took measures to reduce production, delay new models, and curb EV-related investments. Instead, they pivoted toward hybrid powertrains, following Stellantis in this regard.

Predictably, Tesla fans made fun of these setbacks, considering that legacy carmakers can't sell their electric cars because they are not competitive. However, the same thing is happening now to Tesla. The EV maker reported disappointing sales in the first quarter. In fact, the numbers were beyond disappointing. If we disregard Q2 2020, when factories were closed during the pandemic, Tesla hasn't recorded a single YoY sales drop since 2012. Even worse, Tesla deliveries in the quarter missed even the most pessimistic estimates.

Tesla explained the bad results, citing upgrade works at the Fremont factory, shipping diversions caused by the Red Sea conflict, and the arson attack at Giga Berlin. However, they mostly address the supply side, which was not under scrutiny. As many analysts pointed out, production numbers were within estimates. However, the delivery numbers were much lower than predicted, leaving a huge gap between production and deliveries. This amounts to 46.6K units or about 24 days of supply, 9 days more than at the beginning of the year.

This shows that Tesla's problem is not production, which is a new reality for the EV maker. The real problem is demand, and it will take more than price cuts and freebies to solve. In fact, price cuts seem to have lost their potential, at least for the Model Y. The electric crossover is now the black sheep of Tesla's lineup and the main reason deliveries were so low last quarter. Intriguingly, Tesla raised the Model Y prices on April 1 despite the burgeoning inventory.

To help move the metal, Tesla has several options, with more price cuts only one of them. The fact that Tesla went in the opposite direction shows that price cuts were already deemed inefficient. Instead, Tesla will probably try increasing margins to compensate for the lost volumes. The $1,000 price increase for the Model Y might signal this already. However, Tesla has more tricks up its sleeve to energize sales.

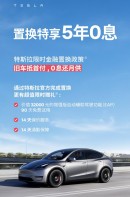

One of them has been deployed in China, one of the most important markets for Tesla. For the first time, the carmaker is offering zero-interest financing for three years on Model 3 and Model Y. The offer is extended to five years when the buyer trades in another vehicle for a Tesla Model 3 or Model Y. To benefit from this offer, buyers must pay an 80,000 yuan (about $11,000) downpayment until April 30 and have their cars delivered by June 30.

It's not the first time Tesla sweetened the financing deals in China, having offered interest rates as low as 1.99% in the past. However, this is the first time it offers 0% interest rates. Tesla fans have appreciated the offer and wondered why Tesla doesn't provide similar incentives in the US. Many think interest rates are an important barrier for people wanting to buy a Tesla. Lower interest rates would be more enticing than a price cut for them.

Predictably, Tesla fans made fun of these setbacks, considering that legacy carmakers can't sell their electric cars because they are not competitive. However, the same thing is happening now to Tesla. The EV maker reported disappointing sales in the first quarter. In fact, the numbers were beyond disappointing. If we disregard Q2 2020, when factories were closed during the pandemic, Tesla hasn't recorded a single YoY sales drop since 2012. Even worse, Tesla deliveries in the quarter missed even the most pessimistic estimates.

Tesla explained the bad results, citing upgrade works at the Fremont factory, shipping diversions caused by the Red Sea conflict, and the arson attack at Giga Berlin. However, they mostly address the supply side, which was not under scrutiny. As many analysts pointed out, production numbers were within estimates. However, the delivery numbers were much lower than predicted, leaving a huge gap between production and deliveries. This amounts to 46.6K units or about 24 days of supply, 9 days more than at the beginning of the year.

This shows that Tesla's problem is not production, which is a new reality for the EV maker. The real problem is demand, and it will take more than price cuts and freebies to solve. In fact, price cuts seem to have lost their potential, at least for the Model Y. The electric crossover is now the black sheep of Tesla's lineup and the main reason deliveries were so low last quarter. Intriguingly, Tesla raised the Model Y prices on April 1 despite the burgeoning inventory.

To help move the metal, Tesla has several options, with more price cuts only one of them. The fact that Tesla went in the opposite direction shows that price cuts were already deemed inefficient. Instead, Tesla will probably try increasing margins to compensate for the lost volumes. The $1,000 price increase for the Model Y might signal this already. However, Tesla has more tricks up its sleeve to energize sales.

One of them has been deployed in China, one of the most important markets for Tesla. For the first time, the carmaker is offering zero-interest financing for three years on Model 3 and Model Y. The offer is extended to five years when the buyer trades in another vehicle for a Tesla Model 3 or Model Y. To benefit from this offer, buyers must pay an 80,000 yuan (about $11,000) downpayment until April 30 and have their cars delivered by June 30.

It's not the first time Tesla sweetened the financing deals in China, having offered interest rates as low as 1.99% in the past. However, this is the first time it offers 0% interest rates. Tesla fans have appreciated the offer and wondered why Tesla doesn't provide similar incentives in the US. Many think interest rates are an important barrier for people wanting to buy a Tesla. Lower interest rates would be more enticing than a price cut for them.

$TSLA

— Tsla Chan (@Tslachan) April 3, 2024

BREAKING: Tesla China is launching its first interest-free policy promotion.

Buyers can enjoy three years of interest-free benefits with a down payment of RMB 80,000 ($11,000), if they order the Model 3/Y before April 30th! pic.twitter.com/wqxNXqnU2h