Lucid's first-quarter financial results disappointed investors, as the EV startup missed all targets. Lucid burned through over one billion dollars in cash and delivered only 1,406 vehicles during the quarter. The company's cash reserves are also dwindling, prompting people to question its future.

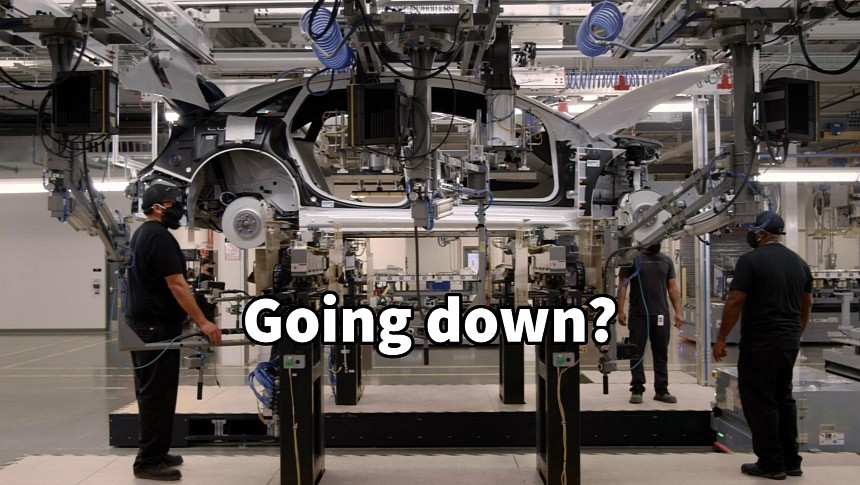

It's a tough week for EV startups as they report their first-quarter financial results. Once a promising company, Lucid Motors seems to be struggling for its life, with all the financials missing expectations. Last year, Elon Musk predicted that Lucid might be heading toward bankruptcy, and the numbers presented by Lucid on Tuesday sure look like its days are numbered. Despite the upbeat tone of the presentation, even Lucid executives had to admit that the company would only survive the following year.

Lucid Motors faces a dramatic 2023 as sales have plummeted and the startup is burning through money. The company was forced to cut the production forecast to "more than 10,000" units this year, down from an initial estimate of 10,000-14,000 EVs. However, the way things look now, investors are more worried about demand than production. With only 1,406 EVs delivered in the quarter, the company is far from reaching its 10,000-unit target for 2023. The worst part is that Lucid has more than $1 billion in inventory.

At the end of 2022, Lucid reported over 28,000 reservations, dropping faster than the sales numbers. In the first quarter of 2023, Lucid stopped reporting the number of reservations, which only means the numbers look really bad. Undoubtedly, many holders have canceled their reservations. Lucid Motors only sells the Air sedan with an average selling price above $100,000. Although the most affordable version starts at $87,400, it is not yet available to order. This makes the Air a tough sell, especially considering Tesla's massive price cuts for the competing Model S.

According to Lucid's earnings report, the company recorded $149.4 million in revenue versus the $209 million expected by investors. Lucid's net loss widened to $780 million from $605 million the year before. The cash and cash equivalents dropped to $900 million from the previous $1.74 billion in Q4 2022. Lucid also has $2 billion in short-term investments, with the total liquidity estimated at $4.1 billion. Lucid's CFO, Sherry House, said this should be enough to fund the operations into the second quarter of 2024.

People thought that Saudi PIF investing in Lucid guaranteed the EV startup a solid foundation. Still, Lucid's lackluster results make people question how long PIF would keep its stake in Lucid. The Saudis sold their 5% stake in Tesla in 2018, just before the company started making profits, and instead bought Lucid shares. They must be devastated that they now have a giant money pit instead of tens of billions of gains.

Lucid Motors faces a dramatic 2023 as sales have plummeted and the startup is burning through money. The company was forced to cut the production forecast to "more than 10,000" units this year, down from an initial estimate of 10,000-14,000 EVs. However, the way things look now, investors are more worried about demand than production. With only 1,406 EVs delivered in the quarter, the company is far from reaching its 10,000-unit target for 2023. The worst part is that Lucid has more than $1 billion in inventory.

At the end of 2022, Lucid reported over 28,000 reservations, dropping faster than the sales numbers. In the first quarter of 2023, Lucid stopped reporting the number of reservations, which only means the numbers look really bad. Undoubtedly, many holders have canceled their reservations. Lucid Motors only sells the Air sedan with an average selling price above $100,000. Although the most affordable version starts at $87,400, it is not yet available to order. This makes the Air a tough sell, especially considering Tesla's massive price cuts for the competing Model S.

According to Lucid's earnings report, the company recorded $149.4 million in revenue versus the $209 million expected by investors. Lucid's net loss widened to $780 million from $605 million the year before. The cash and cash equivalents dropped to $900 million from the previous $1.74 billion in Q4 2022. Lucid also has $2 billion in short-term investments, with the total liquidity estimated at $4.1 billion. Lucid's CFO, Sherry House, said this should be enough to fund the operations into the second quarter of 2024.

People thought that Saudi PIF investing in Lucid guaranteed the EV startup a solid foundation. Still, Lucid's lackluster results make people question how long PIF would keep its stake in Lucid. The Saudis sold their 5% stake in Tesla in 2018, just before the company started making profits, and instead bought Lucid shares. They must be devastated that they now have a giant money pit instead of tens of billions of gains.