Machine learning usage has skyrocketed in the automotive industry, as carmakers have found new ways to automatically run certain operations without involving the human factor.

Allstate Insurance, one of the largest insurers in the United States, has recently patented a technology that eliminates the need for an inspection appointment to assess the damage resulting from an accident.

The patent is called "machine learning-based accident assessment" and describes a system that automatically collects collision information from a vehicle.

Before delving into more details about the proposed technology, let's detail the process of accident damage assessment relying entirely on human power.

A driver involved in an accident must make an appointment for an inspection to determine the extent of damages. However, the inspection isn't typically possible on the spot and depends on the inspector's availability. Furthermore, drivers might have to transport their vehicles to the headquarters of an insurance company, resulting in additional costs, especially if towing is required.

The primary objective of the new technology is to determine whether the accident resulted in a total loss, eventually being able to provide information on the passengers' condition too. The system can help improve safety and reaction time, especially after severe collisions.

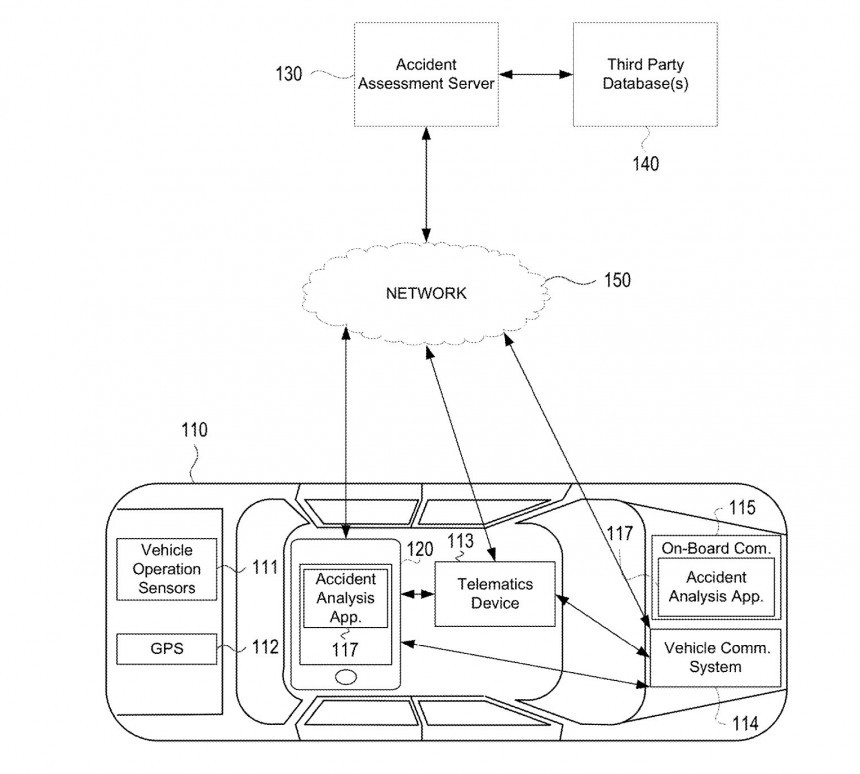

First, the insurance company explains that vehicles must be equipped with a telematics device to transmit information to an accident assessment server. When a collision occurs, the data transfer happens on the spot, allowing the server to run the data processing instantly. The analysis relies on machine learning for a more accurate assessment, as the server can compare the uploaded data with existing data obtained from previous accidents involving other similar vehicles.

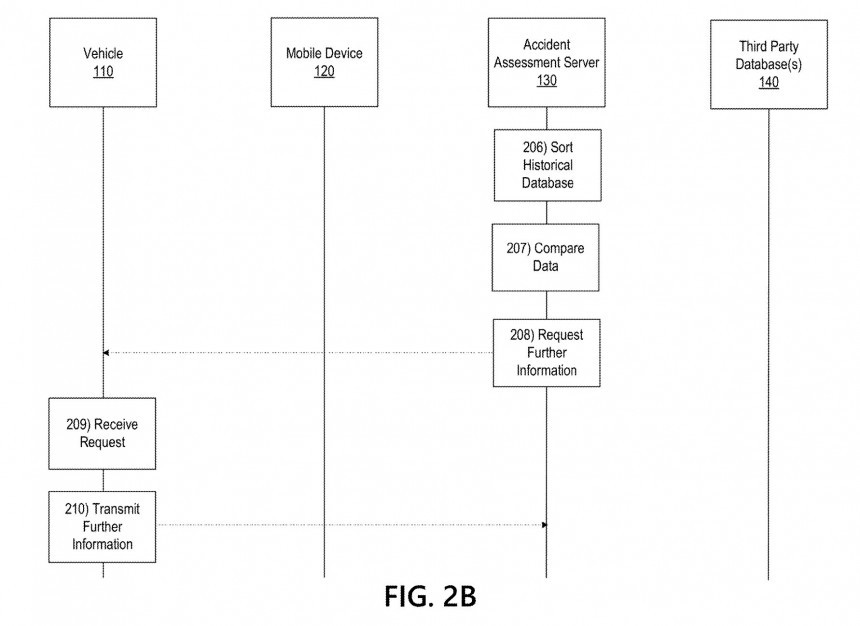

Eventually, the system can determine if the accident results in a total loss, though at the same time, it can also request the telematics system to provide data on certain vehicle damage. For example, if the server determines that the car was involved in a front collision, it can request additional data to assess the damage affecting the front of the vehicle.

Allstate Insurance says the system can also compare the obtained data with a baseline value for each vehicle, and depending on the result, it can schedule a vehicle inspection appointment with the owner of the car.

The analysis can be further enhanced with data obtained from vehicle sensors, onboard cameras, and other technology supplying information for a correct assessment.

Furthermore, the insurance firm says vehicle sensors can detect, store, and transmit data relating to violations and certain car systems. For example, it can obtain data such as hazard light usage, turn signal usage, engine status, oil level, engine revolutions per minute, and so on.

In other words, the system can know precisely if your car was working properly before the accident, whether you tried to avoid the collision, and who was at fault for the crash. In some cases, the cameras can upload recordings and help detect conditions that might have favored the accident, such as the potential sources of driver distraction, including phone usage and pets. External cameras can contribute with other data, like traffic levels, road conditions and obstacles, and nearby vehicles.

The concept essentially proposes creating a big brother system whose role is to monitor the vehicle, traffic conditions, your behavior behind the wheels, and everything else that happens in the cabin and around you to correctly assess the damage resulting from an accident. Of course, the information helps obtain additional data critical for an insurance company, including the reasons for the crash and whether you were at fault for the collision.

Machine learning systems are in charge of the processing system, but the insurance company says an inspector could still have the final word if the analysis doesn't produce a relevant result. However, the appointment system is fully automatic, so you'll be provided with information on when and where to go to have your vehicle inspected. Inspectors could sometimes come to check out the vehicle on the spot.

In exchange, car owners can obtain information on the vehicle damage resulting from the crash, including a cost estimate to repair the car. Furthermore, they can even obtain an automatic appointment at a service center, with the assessment server in charge of generating payment information without user intervention.

The insurance firm wants to use machine learning not necessarily to ease the process of accident assessment but to obtain crash information that could help it monitor driver behavior and calculate the cost of car insurance more accurately. The system is still in the patent stage at this point, so before reaching mass production, the machine learning tech must receive additional polishing to work without human control.

You'd better not hold your breath for the whole thing to be adopted anytime soon, as companies like Allstate Insurance typically patent these ideas just in case others think of a similar approach for their businesses.

The patent is called "machine learning-based accident assessment" and describes a system that automatically collects collision information from a vehicle.

Before delving into more details about the proposed technology, let's detail the process of accident damage assessment relying entirely on human power.

A driver involved in an accident must make an appointment for an inspection to determine the extent of damages. However, the inspection isn't typically possible on the spot and depends on the inspector's availability. Furthermore, drivers might have to transport their vehicles to the headquarters of an insurance company, resulting in additional costs, especially if towing is required.

The primary objective of the new technology is to determine whether the accident resulted in a total loss, eventually being able to provide information on the passengers' condition too. The system can help improve safety and reaction time, especially after severe collisions.

Eventually, the system can determine if the accident results in a total loss, though at the same time, it can also request the telematics system to provide data on certain vehicle damage. For example, if the server determines that the car was involved in a front collision, it can request additional data to assess the damage affecting the front of the vehicle.

Allstate Insurance says the system can also compare the obtained data with a baseline value for each vehicle, and depending on the result, it can schedule a vehicle inspection appointment with the owner of the car.

The analysis can be further enhanced with data obtained from vehicle sensors, onboard cameras, and other technology supplying information for a correct assessment.

Furthermore, the insurance firm says vehicle sensors can detect, store, and transmit data relating to violations and certain car systems. For example, it can obtain data such as hazard light usage, turn signal usage, engine status, oil level, engine revolutions per minute, and so on.

In other words, the system can know precisely if your car was working properly before the accident, whether you tried to avoid the collision, and who was at fault for the crash. In some cases, the cameras can upload recordings and help detect conditions that might have favored the accident, such as the potential sources of driver distraction, including phone usage and pets. External cameras can contribute with other data, like traffic levels, road conditions and obstacles, and nearby vehicles.

Machine learning systems are in charge of the processing system, but the insurance company says an inspector could still have the final word if the analysis doesn't produce a relevant result. However, the appointment system is fully automatic, so you'll be provided with information on when and where to go to have your vehicle inspected. Inspectors could sometimes come to check out the vehicle on the spot.

In exchange, car owners can obtain information on the vehicle damage resulting from the crash, including a cost estimate to repair the car. Furthermore, they can even obtain an automatic appointment at a service center, with the assessment server in charge of generating payment information without user intervention.

The insurance firm wants to use machine learning not necessarily to ease the process of accident assessment but to obtain crash information that could help it monitor driver behavior and calculate the cost of car insurance more accurately. The system is still in the patent stage at this point, so before reaching mass production, the machine learning tech must receive additional polishing to work without human control.

You'd better not hold your breath for the whole thing to be adopted anytime soon, as companies like Allstate Insurance typically patent these ideas just in case others think of a similar approach for their businesses.