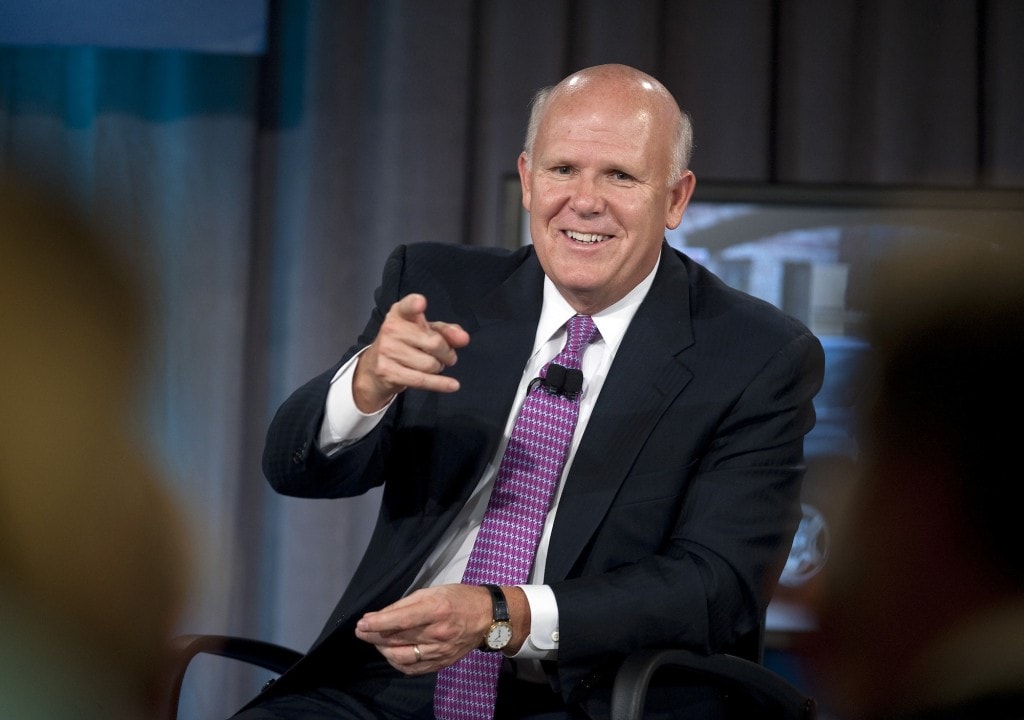

Dan Akerson, General Motors Chairman and CEO, said that the US government is taking into consideration some factors in order to find the right time to sell its remaining GM shares.

According to the Detroit Free Press, although GM had a successful IPO in November 2010, the government remains the major stakeholder, with almost 26% of the company. The automaker’s stock has declined from $39.48 in January to $29.39 in mid April trading.

“I think there are many, many variables in their consideration and they don’t share that with us,” Akerson said in New York at a conference sponsored by IHS Automotive and the National Automobile Dealers Association.

Gas prices was the main cause that managed to affect the carmaker’s stock. Industry production postponements caused by the earthquake that shook Japan contributed to the decline of GM’s stock prices.

Akerson explained that General Motors is far better prepared to deal with this kind of situation than it was back in 2008 when US gas prices last increased dramatically.

“In 2008, GM did not have a world class small car on the market,” Akerson said.

Akerson said that General Motors Corporation is not involved in the government’s decision concerning the remaining shares. “They will tell us when they are getting out. I will not tell them,” he said.“

Another problem that GM had to deal with was its dealer network relationship which suffered quite severe when the automaker chose to close hundreds of dealerships from its network.

“The hard truth is it was a hard thing to right size our dealer network,” Akerson said. “It was also a necessary component of GM’s transformation and it is making a real difference for us today,” he concluded.

According to the Detroit Free Press, although GM had a successful IPO in November 2010, the government remains the major stakeholder, with almost 26% of the company. The automaker’s stock has declined from $39.48 in January to $29.39 in mid April trading.

“I think there are many, many variables in their consideration and they don’t share that with us,” Akerson said in New York at a conference sponsored by IHS Automotive and the National Automobile Dealers Association.

Gas prices was the main cause that managed to affect the carmaker’s stock. Industry production postponements caused by the earthquake that shook Japan contributed to the decline of GM’s stock prices.

Akerson explained that General Motors is far better prepared to deal with this kind of situation than it was back in 2008 when US gas prices last increased dramatically.

“In 2008, GM did not have a world class small car on the market,” Akerson said.

Akerson said that General Motors Corporation is not involved in the government’s decision concerning the remaining shares. “They will tell us when they are getting out. I will not tell them,” he said.“

Another problem that GM had to deal with was its dealer network relationship which suffered quite severe when the automaker chose to close hundreds of dealerships from its network.

“The hard truth is it was a hard thing to right size our dealer network,” Akerson said. “It was also a necessary component of GM’s transformation and it is making a real difference for us today,” he concluded.