Good news! The EV tax credit can be applied at the point of sale for qualifying vehicles and eligible Americans starting next year. However, you should be aware of a couple of things before getting ready for a purchase as soon as dealerships open their doors in January. Here's the gist of it.

First things first, the eligibility rules remain the same for individuals. The plug-in hybrid or all-electric vehicle you intend to buy must be completely new (not registered or titled before the acquisition) and used mainly in the US and for your mobility purposes, not for resale. If the Internal Revenue Service (IRS) finds out you got a Tesla Model Y or a Chrysler Pacifica PHEV for which the EV tax credit was applied just so you could sell it later for a profit of $7,500, trouble will surely come your way.

Prospective EV or PHEV buyers must earn a maximum of $150,000 as single tax filers, $225,000 as heads of households (i.e., single parents or people taking care of elderly relatives who pay more than half of the cost of supporting and housing for one or more dependants), and $300,000 as a married couple filing their taxes together. If you're above these yearly income figures, you do not qualify.

If you plan on buying a sedan, the MSRP must not exceed the $55,000 threshold. If you're eyeing a van, an SUV, or a pickup truck, the MSRP cannot exceed $80,000. Do note that popular crossovers like the Tesla Model Y or the Ford Mustang Mach-E are considered SUVs per the Inflation Reduction Act (IRA).

Plug-in hybrids and all-electric vehicles must also meet certain requirements to be eligible for the full $7,500. They need a battery of at least seven kWh and weigh less than 14,000 lb. Starting in 2024, they must also be assembled in North America (Mexico, Canada, or the US) and have batteries that contain at least 50% critical mineral extracted or processed in the United States or in any country with which the United States has a free trade agreement.

If one of the last two requirements isn't met (i.e., the vehicle isn't assembled in the US but has the right critical minerals in its high-voltage battery), only half of the EV tax credit will be awarded.

The Chrysler Pacifica, which is also a PHEV, is eligible for the full EV tax credit because it meets both requirements – it is assembled in the US, and the battery it uses to temporarily run on electricity is made of at least 40% critical minerals that have been extracted or processed in the United States or in any country with which the United States has a free trade agreement.

Fret not; you will not have to make all these tricky verifications yourself. The Department of Energy and the IRS will have a list of qualifying vehicles, and dealers will have access to them.

Then, there's the used EV tax credit of up to $4,000. But that one only applies to cars that are at least two years old and cost less than $25,000. It's not going to be very popular, at least until 2025. Even though Tesla kept cutting prices this year, zero-emission vehicles, be they new or used, are still pricey.

The problem with the EV tax credit for new autos in 2023 is that the qualifying buyer of an eligible vehicle must have a tax liability of at least $7,500 in 2023 or in 2022 to get the whole federal perk. That essentially established an income minimum for consumers who wanted the entire EV tax credit. It wasn't fair and will remain as such until the current year ends.

Happily, that will not happen in 2024 because tax liability will no longer matter.

The selling party will either apply a $7,500 discount or give you the sum in cash if you choose not to pay less for the "clean vehicle" (i.e., a PHEV or a BEV and even a fuel-cell auto). The buyer's tax liability will not be an important factor any longer.

The Treasury says that "eligible consumers may transfer the full value of the new or previously owned vehicle credit regardless of their individual tax liability."

Suppose this remains true until the final provisions are in. In that case, qualifying buyers can get an eligible EV starting next year without waiting until 2025 to receive the federal perk.

The Treasury confirms that "consumers will need to directly repay the full value of a transferred tax credit to the IRS when filing their taxes if they exceed the applicable modified adjusted gross income limitation." There's nothing in there about the tax liability! You could have a tax burden of $3,000 (in 2023 or 2024), buy a Tesla Model 3 next year, get the EV tax credit of $7,500 (based on your income from 2023 or 2024), and call it a day. You just pocketed an extra $4,500.

This recent move essentially transforms the nonrefundable EV tax credit into a refundable one. Let's see if it sticks because the IRS still says the federal perk is nonrefundable, meaning you "can't get back more on the credit than you owe in taxes." Probably, the wording will change as we're inching closer to 2024.

However, that might not be enough. Buyers could end up in a situation where they will be surprised to find out that not having enough liability in 2024 turns into having to pay the IRS back in 2025. The application of the EV tax credit at the point of sale remains a mystery until the final rules are in. As such, it would be wise to wait a little longer before making all those calculations. We will inform you when it's time to do the math.

Dealers might not be so keen on making customers double-check their financial situation because, no matter what, they're not hemorrhaging money. They get the sale, which might not have happened without the EV tax credit.

On top of that, price hikes might negate the federal perk.

Then, there's the issue of some salespeople who might tell customers that they do qualify for the EV tax credit, even though the unsuspecting buyers' incomes could be above the yearly gross income limits.

Unless the IRS finds a good way to stop shady middlemen from doing their thing, it'll all be up to the customer.

Finally, keep in mind that it's always a good idea to talk to a tax professional about your situation. We must also wait for the official rules to be published. The existing guidelines aren't enough to make us cheer in excitement.

Prospective EV or PHEV buyers must earn a maximum of $150,000 as single tax filers, $225,000 as heads of households (i.e., single parents or people taking care of elderly relatives who pay more than half of the cost of supporting and housing for one or more dependants), and $300,000 as a married couple filing their taxes together. If you're above these yearly income figures, you do not qualify.

If you plan on buying a sedan, the MSRP must not exceed the $55,000 threshold. If you're eyeing a van, an SUV, or a pickup truck, the MSRP cannot exceed $80,000. Do note that popular crossovers like the Tesla Model Y or the Ford Mustang Mach-E are considered SUVs per the Inflation Reduction Act (IRA).

Plug-in hybrids and all-electric vehicles must also meet certain requirements to be eligible for the full $7,500. They need a battery of at least seven kWh and weigh less than 14,000 lb. Starting in 2024, they must also be assembled in North America (Mexico, Canada, or the US) and have batteries that contain at least 50% critical mineral extracted or processed in the United States or in any country with which the United States has a free trade agreement.

It sounds tricky, but don't worry too much about it

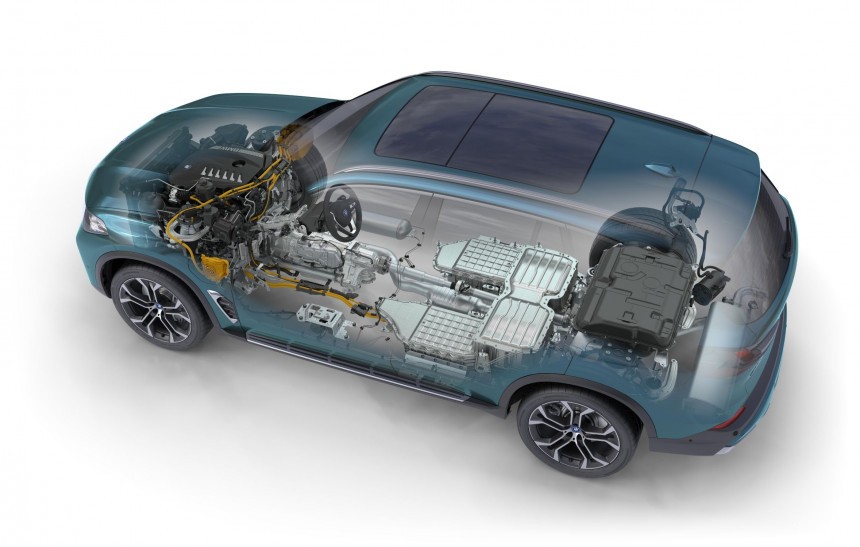

The BMW X5 xDrive50e, for example, qualifies for only half of the federal perk. The plug-in hybrid SUV is made in Spartanburg, South Carolina, but the high-voltage energy storage unit doesn't contain at least 40% (the threshold available until the end of 2023) critical minerals that have been extracted or processed in the United States or in any country with which the United States has a free trade agreement.The Chrysler Pacifica, which is also a PHEV, is eligible for the full EV tax credit because it meets both requirements – it is assembled in the US, and the battery it uses to temporarily run on electricity is made of at least 40% critical minerals that have been extracted or processed in the United States or in any country with which the United States has a free trade agreement.

Fret not; you will not have to make all these tricky verifications yourself. The Department of Energy and the IRS will have a list of qualifying vehicles, and dealers will have access to them.

The problem with the EV tax credit for new autos in 2023 is that the qualifying buyer of an eligible vehicle must have a tax liability of at least $7,500 in 2023 or in 2022 to get the whole federal perk. That essentially established an income minimum for consumers who wanted the entire EV tax credit. It wasn't fair and will remain as such until the current year ends.

Happily, that will not happen in 2024 because tax liability will no longer matter.

Now comes the tricky part

Starting next year, buyers and dealerships (including direct sellers like Tesla or Rivian who register on a special platform called Energy Credits online) can work together to figure out the simplest way to apply Uncle Sam's incentive at the point of sale, essentially lowering the customer's payment. In simpler words, you don't need to wait until 2025 to get your hands on the money.The Treasury says that "eligible consumers may transfer the full value of the new or previously owned vehicle credit regardless of their individual tax liability."

Suppose this remains true until the final provisions are in. In that case, qualifying buyers can get an eligible EV starting next year without waiting until 2025 to receive the federal perk.

The Treasury confirms that "consumers will need to directly repay the full value of a transferred tax credit to the IRS when filing their taxes if they exceed the applicable modified adjusted gross income limitation." There's nothing in there about the tax liability! You could have a tax burden of $3,000 (in 2023 or 2024), buy a Tesla Model 3 next year, get the EV tax credit of $7,500 (based on your income from 2023 or 2024), and call it a day. You just pocketed an extra $4,500.

However, that might not be enough. Buyers could end up in a situation where they will be surprised to find out that not having enough liability in 2024 turns into having to pay the IRS back in 2025. The application of the EV tax credit at the point of sale remains a mystery until the final rules are in. As such, it would be wise to wait a little longer before making all those calculations. We will inform you when it's time to do the math.

Potential issues

The same source tells us prospective buyers can transfer the EV tax credit if they "attest that they believe they are eligible." It seems like the responsibility falls on the buyer. If they somehow get it wrong and earn more than the limits set forward by the Inflation Reduction Act and mentioned above, they will have to pay back the $7,500 in 2025.Dealers might not be so keen on making customers double-check their financial situation because, no matter what, they're not hemorrhaging money. They get the sale, which might not have happened without the EV tax credit.

Then, there's the issue of some salespeople who might tell customers that they do qualify for the EV tax credit, even though the unsuspecting buyers' incomes could be above the yearly gross income limits.

Unless the IRS finds a good way to stop shady middlemen from doing their thing, it'll all be up to the customer.

Finally, keep in mind that it's always a good idea to talk to a tax professional about your situation. We must also wait for the official rules to be published. The existing guidelines aren't enough to make us cheer in excitement.