Sadly, the reality is that you are acquiring a depreciating asset, and you are paying interest on it if you lend money to buy it. Depending on how much you have to pay in total, a new car or even a used vehicle might mean a genuine financial disaster for you.

While the best possible idea would be to buy a car with the money you already have, while also keeping a buffer for emergencies and rainy days, so to speak, it is difficult to achieve such a balance in today's world. Fortunately, you can read books on that matter.

As you may be aware, the financial world is a complicated place, and banks often hand out loans to people who will end up struggling to pay them.

Second, you should always shop around before getting your next vehicle, regardless if it is your first car, your second, or your tenth. It does not matter; just learn to not fall in love with a vehicle you see online and do not imagine it to be the best in the world, as well as the only option for you. It is not, even if it was, and it may be a poor deal waiting to happen if you do not open your eye before signing papers.

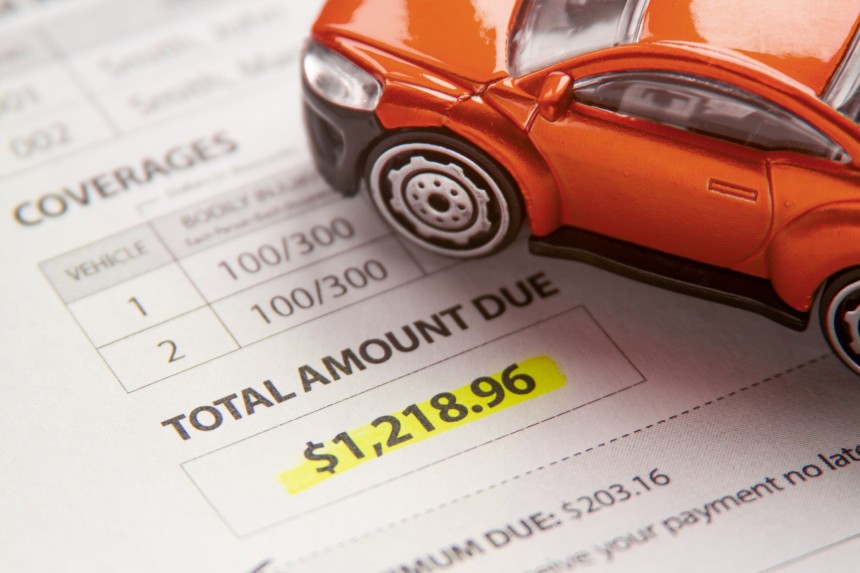

Third, if you are buying a vehicle with a loan, you are not just getting a vehicle but also a loan. Both can (and should) be negotiated. The loan should definitely be discussed in detail, and you should get a detailed payment plan from your lender before you even sign up for it.

Do not hesitate to keep the papers that the lender has printed out for you, and read the fine print. Always read the fine print on any contract you sign. Ask a friend who is familiar with accounting or finance to take a look at it, and then shop around at financial institutions.

If it is the first time you are about to sign something this important, have a friend who is more experienced or even one of your parents come with you to read it again and ask more questions. It may feel embarrassing at first, but if it helps you avoid a fee or high interest, it will be worth it.

At the very least, they may help you avoid a foolish leap into a massive loan for an impulse purchase. Those are the ones that make you happy instantly, but you start to regret them in years, months, days, or even hours, depending on how bad the deal was. Having financial stability will beat having a car you overpaid for any day.

Be careful, though, as having your credit score inspected by multiple financial institutions may lower it in many countries. Just ask about a car loan, and do your best to have a bigger down payment as possible.

I was watching a video about APR the other day, and the YouTuber who made it explains how the system works. You can watch it below and understand why it is not in your favor to only focus on having the lowest possible monthly payment on a car loan. Instead, check out details like APR, as well as interest rates and other essential information.

Yes, the extended warranty, chassis waxing, and windshield fluid refill charges are not the only tricks that some vehicle sales businesses deploy to get more money out of unsuspecting customers. By the way, 82% of Americans paid over MSRP for a new car in January. Should we also take into account the fact that you should shop around when looking for car insurance? Please do that.

In most car loan situations, especially those with a higher APR, you will be underwater with it the second you sign it. Why? Because the vehicle will not be worth what you financed it for if you think of your total payments.

So, instead of thinking about how much you have to pay each month, figure out and get confirmation of how much you have to pay in total. If the APR is high enough or the interest is high, you will pay significantly more than that vehicle is worth.

Otherwise, you will sign up to be a "slave to debt" for a vehicle that you might not even like as much as you thought you did when you first saw it.

I have a few friends who were "slaves of their debt" because they bought a car and paid for it with money they lent from the bank. All have regretted their purchase, and some have paid incredible amounts over the final sale price due to interest that was spread out over too many years.

You can see interest as water piling up in a clogged drain. If you have too much all of a sudden, you will get wet. If you widen the drain and collect more, the drain may fall on you, and you will get hurt.