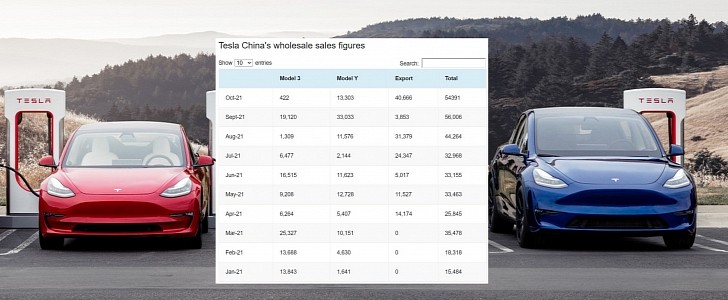

In times when people question institutions and media for taking sides instead of fulfilling their functions, an interesting example of why that's so emerged with Tesla sales in China in October. You will read that Tesla sold 13,303 units of the Model Y on some websites (a good result). In others, you will just see that Tesla sold only 422 Model 3s. The truth is not on any of these extremes, but between them, even if closer to one side than to another.

There’s no doubt that selling only 422 cars in a market such as the Chinese one is terrible. On the other hand, the Model Y’s sales numbers place it as the second best-selling pure EV in China, only below the Wuling Hongguang Mini EV, which had 47,834 units sold.

In official tables from CPCA (China Passenger Car Association), you will see the Tesla behind the BYD Qin Plus DM-i, a plug-in hybrid that is also considered as a NEV (new energy vehicle). BYD sold 17,393 units of the PHEV. The Qin Plus EV – the derivative powered only by a battery pack – sold 8,405 units.

In an attempt to make Tesla look better, some publications will say that the company had fantastic sales in October: 54,391 cars. That’s the second-highest number the company ever achieved in China, behind only September, when Tesla made 56,006 cars meet new customers. Wait a minute: wasn’t the number 13,725? Yes, it indeed was.

The 54,391 “sales” number includes exports: 40,666 units, or almost three times as many cars sold in the Chinese market. If we were talking about South Korea or another country with a relatively small internal market and a big car industry, perhaps it would be ok. Nonetheless, China is the largest market for cars in the world. And the Model 3 never sold so few units there.

Before October, the least number of Model 3s sold was in August: 1,309 cars, or more than three times the worst result. That may explain Tesla’s recent campaign with zero down payments in China. Demand there clearly was much weaker than the company is willing to admit.

Yet, Tesla does not help us get a clear view of its sales: its website informs us that people have to wait for 6 to 10 weeks to take delivery of a Model 3, which gives the impression that customers are desperate to get one. All 422 clients in October, mind you. There may indeed be people waiting in line, but what Tesla is telling us when it exports 40,666 cars is that it is artificially creating these queues. Either that, or it prefers to sell abroad rather than in China.

BYD had better results than Tesla, with 81,040 NEVs when you sum up sales and exports. With only 1,026 of these electric and plug-in hybrid vehicles sent abroad, 80,014 were purchased by Chinese customers. For the ones expecting most of these sales to be for plug-in hybrids, surprise: these cars represented 38,771 of the total, while 41,232 were BEVs (battery electric vehicles).

You’ll notice 1,037 cars missing, but they were commercial vehicles. We have no idea about how many BEVs or PHEVs BYD exported. However, even if all of the 1,026 were BEVs, the Chinese company would still have sold 40,406 EVs in China, way more than the 13,275 Tesla managed to deliver to Chinese clients.

Balancing the available information shows that things are far from being as positive as Tesla investors, fans, and the sycophant websites like to advertise. They will come up with the excuse that the first month of the quarter is dedicated to exports. If that was really the case, the Model 3 should have kept the same numbers it had in January (13,843), April (6,264), and July (6,477).

Most of the Teslas exported from China were sent to Europe. What will happen when Giga Grünheide starts to work? Will Giga Shanghai try to sell its production internally? Will it present a vehicle developed in China and try to export it? Why isn’t Tesla selling more in the Chinese market? These are the questions that people concerned with the company’s financial health should be asking, instead of presenting just the numbers they like.

Whatever the explanation for the 422 Model 3s sold in China in October is, it does not mean the Model Y is not doing well there. It already had better results before (33,033 units in September), but selling 13,303 was not bad. Exporting most of the production when China could have all those cars is the worrying bit.

For anyone to make a proper assessment of the situation, they have to have access to all data in the appropriate context. Beware of the narratives that try to present you only one side of the story. Statistics can be helpful, but also incredibly deceiving.

In official tables from CPCA (China Passenger Car Association), you will see the Tesla behind the BYD Qin Plus DM-i, a plug-in hybrid that is also considered as a NEV (new energy vehicle). BYD sold 17,393 units of the PHEV. The Qin Plus EV – the derivative powered only by a battery pack – sold 8,405 units.

In an attempt to make Tesla look better, some publications will say that the company had fantastic sales in October: 54,391 cars. That’s the second-highest number the company ever achieved in China, behind only September, when Tesla made 56,006 cars meet new customers. Wait a minute: wasn’t the number 13,725? Yes, it indeed was.

The 54,391 “sales” number includes exports: 40,666 units, or almost three times as many cars sold in the Chinese market. If we were talking about South Korea or another country with a relatively small internal market and a big car industry, perhaps it would be ok. Nonetheless, China is the largest market for cars in the world. And the Model 3 never sold so few units there.

Before October, the least number of Model 3s sold was in August: 1,309 cars, or more than three times the worst result. That may explain Tesla’s recent campaign with zero down payments in China. Demand there clearly was much weaker than the company is willing to admit.

Yet, Tesla does not help us get a clear view of its sales: its website informs us that people have to wait for 6 to 10 weeks to take delivery of a Model 3, which gives the impression that customers are desperate to get one. All 422 clients in October, mind you. There may indeed be people waiting in line, but what Tesla is telling us when it exports 40,666 cars is that it is artificially creating these queues. Either that, or it prefers to sell abroad rather than in China.

BYD had better results than Tesla, with 81,040 NEVs when you sum up sales and exports. With only 1,026 of these electric and plug-in hybrid vehicles sent abroad, 80,014 were purchased by Chinese customers. For the ones expecting most of these sales to be for plug-in hybrids, surprise: these cars represented 38,771 of the total, while 41,232 were BEVs (battery electric vehicles).

You’ll notice 1,037 cars missing, but they were commercial vehicles. We have no idea about how many BEVs or PHEVs BYD exported. However, even if all of the 1,026 were BEVs, the Chinese company would still have sold 40,406 EVs in China, way more than the 13,275 Tesla managed to deliver to Chinese clients.

Balancing the available information shows that things are far from being as positive as Tesla investors, fans, and the sycophant websites like to advertise. They will come up with the excuse that the first month of the quarter is dedicated to exports. If that was really the case, the Model 3 should have kept the same numbers it had in January (13,843), April (6,264), and July (6,477).

Most of the Teslas exported from China were sent to Europe. What will happen when Giga Grünheide starts to work? Will Giga Shanghai try to sell its production internally? Will it present a vehicle developed in China and try to export it? Why isn’t Tesla selling more in the Chinese market? These are the questions that people concerned with the company’s financial health should be asking, instead of presenting just the numbers they like.

Whatever the explanation for the 422 Model 3s sold in China in October is, it does not mean the Model Y is not doing well there. It already had better results before (33,033 units in September), but selling 13,303 was not bad. Exporting most of the production when China could have all those cars is the worrying bit.

For anyone to make a proper assessment of the situation, they have to have access to all data in the appropriate context. Beware of the narratives that try to present you only one side of the story. Statistics can be helpful, but also incredibly deceiving.