Despite all odds, Tesla ended 2022 with a bang, reporting its most impressive financial results. Tesla’s 2022 financial data impressed on every metric, but executives took a more cautious approach toward 2023, while Elon Musk continued to hint at a “deep recession” coming.

If we’re to take it from the last months of 2022, Tesla was in deep trouble, and the shares’ price dropped significantly, reflecting the negative investor sentiment. Tesla sales were down, demand was dwindling, and its famous gigafactories were filling the overflow parking lots across the globe with hard-to-sell electric vehicles. Or so everybody thought, except die-hard Tesla fans. Nevertheless, despite all odds, Tesla’s results in Q4 2022 impressed everyone, beating expectations on every metric.

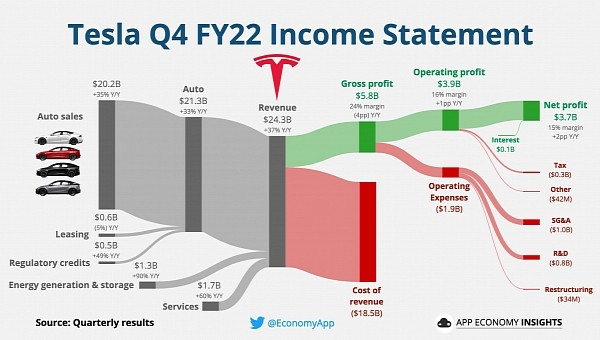

Net profit for the Q4 2022 was $3.69 billion, or $1.07 per share, up 59% from the $2.32 billion or $.68 per share in Q4 2021. Revenue was $24.32 billion for the last three months of 2022, beating the analyst consensus by $160 million. Tesla sold 405,278 vehicles in the quarter, as revealed earlier. The automotive operation margin for the quarter dropped to 25.9%, the lowest in two years, but still impressive compared to the industry’s average.

Throughout 2022, Tesla reported $81.5 billion in revenue, 51% more than the previous year. Net profit last year totaled $20.85 billion, with a gross margin for the automotive business at 28.5%, down from 29.3% in 2021. Free cash flow increased in 2022 to $7.57 billion from $5.02 billion in 2021. Tesla now has $22.19 billion in its coffers, a 25% increase over the $17.71 billion at the end of 2021.

The margins were likely affected by the discounts offered in several markets at the end of 2022. Tesla has enjoyed solid margins throughout 2022 thanks to huge demand, which has allowed it to increase prices. Elon Musk has blamed the “radical interest rate changes” for the sluggish demand. Nevertheless, the recent price cuts in January have accelerated demand to the highest level in Tesla’s history, as Musk said during the earnings call meeting with investors. According to Tesla’s CEO, current orders are two times higher than production capacity, which made analysts bullish for 2023.

Nevertheless, Musk took a more cautious approach when providing 2023 guidance. Tesla is expected to grow sales to 1.8 million vehicles this year, representing a 37% increase. This is much slower than earlier Tesla estimates of 50% growth year over year for the foreseeable future. Musk is still expecting a deep recession, making him sound bearish on Tesla’s prospects in 2023.

Although various factors could impact the numbers, Tesla’s long-term goal remains a 50% growth rate. “In some years we may grow faster and some we may grow slower, depending on a number of factors,” Tesla reps said during the earnings call. The EV maker could push for 2 million vehicles in 2023 if economic conditions don’t deteriorate.

Net profit for the Q4 2022 was $3.69 billion, or $1.07 per share, up 59% from the $2.32 billion or $.68 per share in Q4 2021. Revenue was $24.32 billion for the last three months of 2022, beating the analyst consensus by $160 million. Tesla sold 405,278 vehicles in the quarter, as revealed earlier. The automotive operation margin for the quarter dropped to 25.9%, the lowest in two years, but still impressive compared to the industry’s average.

Throughout 2022, Tesla reported $81.5 billion in revenue, 51% more than the previous year. Net profit last year totaled $20.85 billion, with a gross margin for the automotive business at 28.5%, down from 29.3% in 2021. Free cash flow increased in 2022 to $7.57 billion from $5.02 billion in 2021. Tesla now has $22.19 billion in its coffers, a 25% increase over the $17.71 billion at the end of 2021.

The margins were likely affected by the discounts offered in several markets at the end of 2022. Tesla has enjoyed solid margins throughout 2022 thanks to huge demand, which has allowed it to increase prices. Elon Musk has blamed the “radical interest rate changes” for the sluggish demand. Nevertheless, the recent price cuts in January have accelerated demand to the highest level in Tesla’s history, as Musk said during the earnings call meeting with investors. According to Tesla’s CEO, current orders are two times higher than production capacity, which made analysts bullish for 2023.

Nevertheless, Musk took a more cautious approach when providing 2023 guidance. Tesla is expected to grow sales to 1.8 million vehicles this year, representing a 37% increase. This is much slower than earlier Tesla estimates of 50% growth year over year for the foreseeable future. Musk is still expecting a deep recession, making him sound bearish on Tesla’s prospects in 2023.

Although various factors could impact the numbers, Tesla’s long-term goal remains a 50% growth rate. “In some years we may grow faster and some we may grow slower, depending on a number of factors,” Tesla reps said during the earnings call. The EV maker could push for 2 million vehicles in 2023 if economic conditions don’t deteriorate.

$TSLA Tesla Q4 FY22:

— App Economy Insights (@EconomyApp) January 25, 2023

• Revenue +37% Y/Y to $24.3B (in-line).

• Gross margin 24% (-4pp Y/Y).

• Operating margin 16% (+1pp Y/Y).

• Capex +3% Y/Y to 1.9B.

• Free cash flow -49% to $1.4B.

• EPS $1.19 ($0.08 beat). pic.twitter.com/dFn1lHnWq9