When the Tesla Q1 2023 earnings call was immediately followed by a 7% stock price slide, its investors and advocates either pretended to be surprised or really failed to grasp why that happened. The answer is that the successive price reductions the company performed did not provoke the desired effects and caused some negative ones. However, it probably has to do even more with what Elon Musk said and how he dealt with these effects in the event.

First, Tesla's narrative of infinite demand was definitely put to rest. The company lowered prices for its vehicles six times since January, which did not make it deliver or produce many more cars. The BEV maker built 439,701 vehicles in Q4 2022 and only 440,808 in Q1 2023. With two new factories scaling up and everyone supposedly wanting to buy a Tesla, only 1,107 more cars do not confirm that is the case.

As you may remember from my analysis when Q1 2023 numbers were out, Tesla is yet to sell 84,583 vehicles, considering the balance between what it produced and delivered since 2018. Dan Levy analyzed the last three quarters and came up with more conservative numbers: he wrote for Barclays that Tesla made around 75,000 more vehicles than it sold in this period. The precise figure is 74,449 BEVs. That's relevant because it shows most of the production excess occurred in the last nine months.

It is also crucial to note that this is the number of vehicles yet to sell after the increase in deliveries from 405,278 in Q4 2022 to 422,875 in Q1 2023 was computed. In other words, Tesla delivered 17,597 BEVs more than it did in Q4 2022 but produced only 1,107 more than in the previous quarter. And it still had an inventory that its own numbers suggest to be higher than 74,449 vehicles. If demand were not an issue, the BEV maker could have handed more than 500,000 cars to customers, especially with six discount rounds, one right after the other.

Still trying to deny the obvious problem, Musk tweeted an explanation for that subject that initially looked like a mockery. The Tesla CEO said that "demand at scale is limited by affordability." His advocates took that as a touch of his genius, even if that is just elementary: cheaper cars will naturally appeal to more people.

The issue is that Tesla achieved high-scale sales without that concern with price reduction. It was right the opposite. The company promised to sell the Model 3 for $35,000, and it only briefly had a derivative for that price. That never prevented the company from selling thousands of units of the electric sedan because people wanted it regardless of the cost. If affordability were the only component to drive a larger sales scale, the Nissan Kicks would sell more than the Toyota RAV4 in the US. It is right the opposite: for each Kicks sold in the American market, people bought almost eight RAV4s (7.3, to be precise).

To add insult to injury, Musk also tweeted that "there is plenty of demand" for Tesla's products, "but if the price is more money than people have, that demand is irrelevant." Rolls-Royce and Ferrari could say the same thing: if they offered their vehicles for $30,000 or even less, they would sell millions of cars every year. The difference is that neither carmaker has ever lowered their prices. Yet, they still have plenty of customers interested in purchasing their goods. Tesla doesn't, at least not in the market segments where it sells cars. Lowering prices is an artificial attempt to play in lower segments where Tesla does not compete. What investors and analysts tried to ask Musk at the earnings call was: at what cost?

The BEV maker claims to have one of the highest profit margins in the industry. When it cut prices, it was forced to acknowledge that these gains were reduced. For Musk, that does not matter: his company "could sell for zero profit for now and then yield actually tremendous economics in the future through autonomy." He also said he didn't know how many would "appreciate the profundity" of these words but that it was "extremely significant."

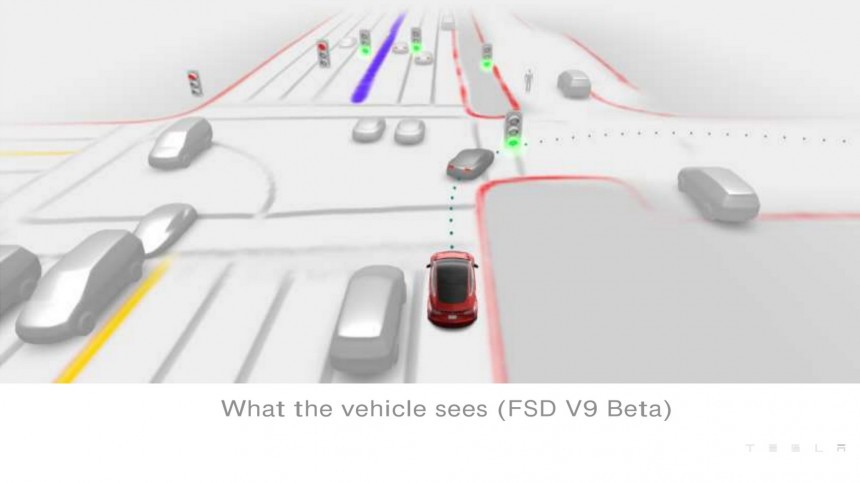

Indeed: Musk believes Tesla can operate with no profits while waiting for Full Self-Driving (FSD) to turn its vehicles into appreciating assets. This is why Tesla shares melted down after the earnings call. They are 11.4% lower in the last five days. For the record, the Tesla CEO said the BEV maker would have 1 million robotaxis on the road by 2020.

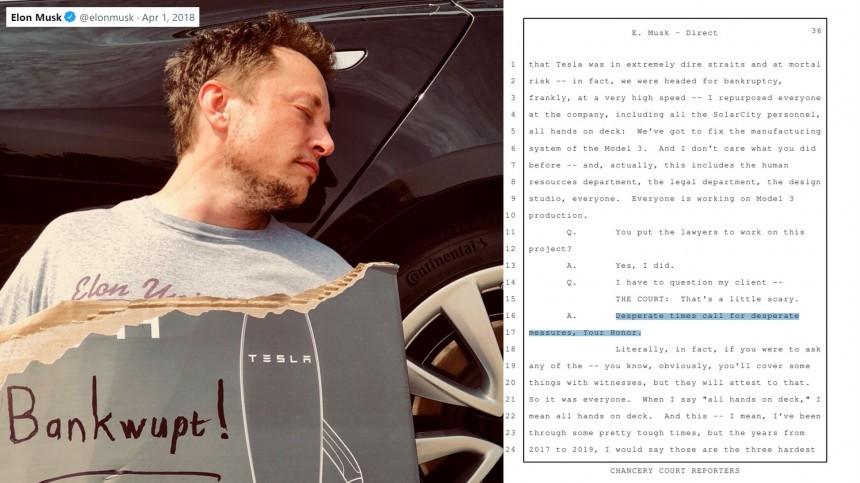

Several autonomous driving specialists have already said that it is impossible for the company's current BEVs to be "fully self-driving" with the hardware they have. Tesla seems to agree with that by releasing HW 4.0, and stating it is not compatible with older cars. Although Musk still states that HW 3.0 should be capable of achieving full autonomy, he said the same about HW 2.5. To make matters worse, a 2016 video of an Autopilot drive was edited to make it look like the car drove itself with no disengagements. It didn't. The video also had the following disclaimer: "The person in the driver's seat is only there for legal reasons. He is not doing anything. The car is driving itself." That was also not true. Bloomberg revealed that Musk dictated this text.

The Tesla CEO's biggest profitability argument is also the BEV maker's worst mistake. Instead of investing in new products and renovating the current ones, the company bet on a revenue stream for a feature that is still under development. Achieving production status for it was and still is wishful thinking. Musk was pretty close to admitting on the earnings call that Tesla's current market cap depends entirely on achieving full autonomy. To be honest, he already did that in June 2022, when he said the company was "worth basically zero" without its autonomous driving software.

This stubbornness in following this path is what prevented the BEV maker from admitting it is a car company and that it should behave as one, not like an energy enterprise that also sells computers on wheels. Tesla's strategy of trying to make its vehicles more attractive through over-the-air (OTA) updates has already led customers to complain that the user interface is constantly changing without warning. In other words, Tesla's tech industry approach to the automotive business is backfiring.

One of the company's greatest assets (more profitability per car than its competitors) is going down the drain with these successive price cuts. The goal of increasing sales is also hurt by that strategy: nobody wants to be the fool who bought a car that got cheaper just a while later. Most will prefer to wait and see how much more affordable these BEVs will get. In China, those who did not have that option carried out aggressive protests that vandalized some Tesla Service Centers. That said, Tesla's dynamic pricing policy made investors and customers furious and cautious. Only Musk and those who invested everything they had in the BEV maker's shares can hope that promising to reach full autonomy this year will fix that. They need that to be true.

For everybody else, even the most optimistic investors must recognize that the price cuts were enough only for Tesla to keep production and sales volumes similar to what they were in the previous quarter, not to significantly increase them. For a company that aims to grow 50% every year, that's bad news. Some investors even decided to send an open letter to Robyn Denholm urging the Tesla chairwoman to take measures to protect the company. One of these measures would be removing directors tied to Musk to prevent mismanagement.

That said, Tesla has not started a price war, as some outlets claimed it did. Most car companies have already noticed that these price reductions are not a strategy: they are a dangerous and unsustainable way to maintain production as high as possible. Ironically, Tesla could have kept them strong if it had maintained its lineup fresh and expanded it, ensured service levels would remain at a high standard, and invested in quality control… In other words, if it offered better products and a better experience with them, as any successful business would. None of the ones still on their feet depended on promises to thrive.

As you may remember from my analysis when Q1 2023 numbers were out, Tesla is yet to sell 84,583 vehicles, considering the balance between what it produced and delivered since 2018. Dan Levy analyzed the last three quarters and came up with more conservative numbers: he wrote for Barclays that Tesla made around 75,000 more vehicles than it sold in this period. The precise figure is 74,449 BEVs. That's relevant because it shows most of the production excess occurred in the last nine months.

Still trying to deny the obvious problem, Musk tweeted an explanation for that subject that initially looked like a mockery. The Tesla CEO said that "demand at scale is limited by affordability." His advocates took that as a touch of his genius, even if that is just elementary: cheaper cars will naturally appeal to more people.

To add insult to injury, Musk also tweeted that "there is plenty of demand" for Tesla's products, "but if the price is more money than people have, that demand is irrelevant." Rolls-Royce and Ferrari could say the same thing: if they offered their vehicles for $30,000 or even less, they would sell millions of cars every year. The difference is that neither carmaker has ever lowered their prices. Yet, they still have plenty of customers interested in purchasing their goods. Tesla doesn't, at least not in the market segments where it sells cars. Lowering prices is an artificial attempt to play in lower segments where Tesla does not compete. What investors and analysts tried to ask Musk at the earnings call was: at what cost?

Indeed: Musk believes Tesla can operate with no profits while waiting for Full Self-Driving (FSD) to turn its vehicles into appreciating assets. This is why Tesla shares melted down after the earnings call. They are 11.4% lower in the last five days. For the record, the Tesla CEO said the BEV maker would have 1 million robotaxis on the road by 2020.

The Tesla CEO's biggest profitability argument is also the BEV maker's worst mistake. Instead of investing in new products and renovating the current ones, the company bet on a revenue stream for a feature that is still under development. Achieving production status for it was and still is wishful thinking. Musk was pretty close to admitting on the earnings call that Tesla's current market cap depends entirely on achieving full autonomy. To be honest, he already did that in June 2022, when he said the company was "worth basically zero" without its autonomous driving software.

One of the company's greatest assets (more profitability per car than its competitors) is going down the drain with these successive price cuts. The goal of increasing sales is also hurt by that strategy: nobody wants to be the fool who bought a car that got cheaper just a while later. Most will prefer to wait and see how much more affordable these BEVs will get. In China, those who did not have that option carried out aggressive protests that vandalized some Tesla Service Centers. That said, Tesla's dynamic pricing policy made investors and customers furious and cautious. Only Musk and those who invested everything they had in the BEV maker's shares can hope that promising to reach full autonomy this year will fix that. They need that to be true.

That said, Tesla has not started a price war, as some outlets claimed it did. Most car companies have already noticed that these price reductions are not a strategy: they are a dangerous and unsustainable way to maintain production as high as possible. Ironically, Tesla could have kept them strong if it had maintained its lineup fresh and expanded it, ensured service levels would remain at a high standard, and invested in quality control… In other words, if it offered better products and a better experience with them, as any successful business would. None of the ones still on their feet depended on promises to thrive.

So many well off critics don’t understand that demand at scale is limited by affordability.

— Elon Musk (@elonmusk) April 7, 2023

There is plenty of demand for our products, but if the price is more money than people have, that demand is irrelevant.