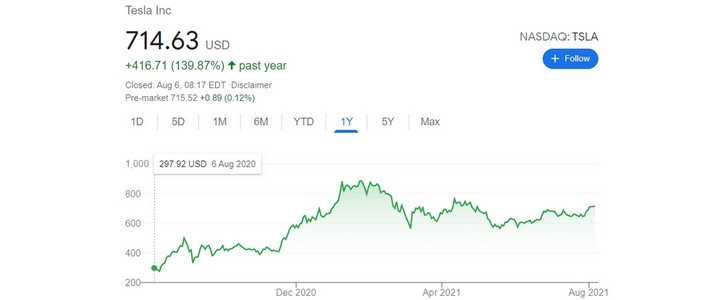

People buy and sell shares every single day, but that sort of trade calls a lot of attention when it comes from executives running large businesses. Tesla’s current market cap makes it the most valuable car company in the world. Robyn Denholm is Tesla’s chairman. On August 4, she sold 31,250 shares from the company, a deal that put more than $22 million in her pockets. And she was not the first one.

Surprisingly, Kimball Musk, Elon Musk’s brother and a Tesla board member, was the first one to do that. In February, he sold $25.56 million worth of stock, but he still had 599,740 shares.

In March, Zachary Kirkhorn sold 1,250 Tesla shares for $819,762. He’s the company’s CFO (Chief Financial Officer), or – as Musk prefers to call him – Master of Coin.

Panasonic followed suit. The Japanese battery maker’s ties with Tesla are old, and it still runs Giga Nevada with the American automaker, but that did not stop it from selling all of its Tesla stocks in the last fiscal year.

It bought 1.4 million shares at a unitary price of $21.15 when Tesla made its IPO in June 2010. Panasonic started selling them in 2020 got rid of the remaining stake in March. It corresponded to 81 billion yen, or $730 million. We only learned about the deal on June 25, 2021. In total, Panasonic made $3.9 billion in profits.

On June 3, Tesla informed that Jérôme Guillen was no longer with the company. On June 10, the most important executive Tesla had, apart from Elon Musk, started selling all the shares he had in the company, pocketing around $274 million.

On July 8, Vaibhav Taneja sold 4,459 Tesla shares. The company’s CAO (Chief Accounting Officer) raised $2,950,029.81 with the deal. Denholm was just the most recent top executive to do the same.

Apart from Guillen, all other people and companies mentioned here are still involved with Tesla. Of course, you may face a financial emergency and need to raise $800,000, $2 million, $22 million, or $25 million… However, that may have affected other investors.

In March, the billionaire Ron Baron got rid of 1.8 million Tesla shares allegedly because they would be representing a large percentage of some portfolios. In May, the Scottish fund Baillie Gifford & Co. sold 11.1 million shares, representing 1.2% of Tesla’s total shares. In the same month, Michael Burry revealed he had a short position of $534 million against the company. You know Burry thanks to "The Big Short" movie.

With this landscape, any movement may call the attention of investors. When significant executives in the company sell their shares, that may cause an impact, regardless of their personal reasons to do so.

In March, Zachary Kirkhorn sold 1,250 Tesla shares for $819,762. He’s the company’s CFO (Chief Financial Officer), or – as Musk prefers to call him – Master of Coin.

Panasonic followed suit. The Japanese battery maker’s ties with Tesla are old, and it still runs Giga Nevada with the American automaker, but that did not stop it from selling all of its Tesla stocks in the last fiscal year.

It bought 1.4 million shares at a unitary price of $21.15 when Tesla made its IPO in June 2010. Panasonic started selling them in 2020 got rid of the remaining stake in March. It corresponded to 81 billion yen, or $730 million. We only learned about the deal on June 25, 2021. In total, Panasonic made $3.9 billion in profits.

On June 3, Tesla informed that Jérôme Guillen was no longer with the company. On June 10, the most important executive Tesla had, apart from Elon Musk, started selling all the shares he had in the company, pocketing around $274 million.

On July 8, Vaibhav Taneja sold 4,459 Tesla shares. The company’s CAO (Chief Accounting Officer) raised $2,950,029.81 with the deal. Denholm was just the most recent top executive to do the same.

Apart from Guillen, all other people and companies mentioned here are still involved with Tesla. Of course, you may face a financial emergency and need to raise $800,000, $2 million, $22 million, or $25 million… However, that may have affected other investors.

In March, the billionaire Ron Baron got rid of 1.8 million Tesla shares allegedly because they would be representing a large percentage of some portfolios. In May, the Scottish fund Baillie Gifford & Co. sold 11.1 million shares, representing 1.2% of Tesla’s total shares. In the same month, Michael Burry revealed he had a short position of $534 million against the company. You know Burry thanks to "The Big Short" movie.

With this landscape, any movement may call the attention of investors. When significant executives in the company sell their shares, that may cause an impact, regardless of their personal reasons to do so.