Elon Musk used to bash Bob Lutz for saying Tesla would eventually go bankrupt. Ironically, he plays the same tune for Rivian and Lucid, saying that they will ultimately break and that Lucid is “not long for this world.” What he doesn’t seem to realize is that both startups have a financial backup Tesla never had. In Lucid’s case, it comes from Saudi Arabia's Public Investment Fund (PIF), which invested $915 million more in the company on December 22.

The deal only became public after Lucid filed a Form 4 with the U.S. Securities and Exchange Commission (SEC) on December 27. According to the document, PIF bought 85,712,679 Lucid shares at an average price of $10.6752 per share. That led the Saudi Arabian sovereign wealth fund to reach 1.1 billion Lucid shares. PIF is the majority stakeholder at the EV maker, which makes it more than just an investor: It owns most of the company. If you think Saudi Arabia will let Lucid go under, forget it.

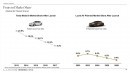

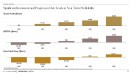

Lucid knows it will take a while to reach profitability. In a presentation released in February 2021, the company said it would only achieve free cash flow in 2025. It even calculated how much it would be: $321 million, with $1.5 billion in 2026. Getting there would depend on three products: Air, Gravity (the SUV), and a new vehicle to be introduced in 2025. In its first full year of sales, it should be Lucid’s second best-selling vehicle, second only to the Gravity.

Achieving these goals may be more complicated than the company previously thought. We have already reported the several flaws the Lucid Air is presenting in its first batches despite the company’s promises of a flawless vehicle. Many of these problems are very similar to those presented by Tesla, not only in its early stages but to this day. Lucid could have learned from these mistakes.

If the current Lucid team fails to fix the issues and deliver on its objectives, it is easier to imagine Saudi Arabia demanding new executives than letting it go bankrupt. The country’s rulers are dead serious about wanting to become a relevant player in the automotive industry – ironically, with vehicles that do not burn the oil that made them rich. Lucid is not their only shot at getting there. In November, Crown prince Mohammed bin Salman announced Ceer, a Saudi Arabian company with licensed BMW parts and manufacturing from Foxconn.

Although money will not be a problem for either of these car startups, being associated with Saudi Arabia may impose a heavy reputation cost. The U.S. Central Intelligence Agency (CIA) concluded that Bin Salman ordered the assassination of the exiled Saudi journalist Jamal Khashoggi in 2018. The journalist went to the Saudi consulate in Istanbul to obtain documents for his marriage and never left. Lucid and Ceer will have to distance themselves from this background as much as possible or count on selective or weak memory to sell as many cars as they need to walk on their own feet.

Lucid knows it will take a while to reach profitability. In a presentation released in February 2021, the company said it would only achieve free cash flow in 2025. It even calculated how much it would be: $321 million, with $1.5 billion in 2026. Getting there would depend on three products: Air, Gravity (the SUV), and a new vehicle to be introduced in 2025. In its first full year of sales, it should be Lucid’s second best-selling vehicle, second only to the Gravity.

Achieving these goals may be more complicated than the company previously thought. We have already reported the several flaws the Lucid Air is presenting in its first batches despite the company’s promises of a flawless vehicle. Many of these problems are very similar to those presented by Tesla, not only in its early stages but to this day. Lucid could have learned from these mistakes.

If the current Lucid team fails to fix the issues and deliver on its objectives, it is easier to imagine Saudi Arabia demanding new executives than letting it go bankrupt. The country’s rulers are dead serious about wanting to become a relevant player in the automotive industry – ironically, with vehicles that do not burn the oil that made them rich. Lucid is not their only shot at getting there. In November, Crown prince Mohammed bin Salman announced Ceer, a Saudi Arabian company with licensed BMW parts and manufacturing from Foxconn.

Although money will not be a problem for either of these car startups, being associated with Saudi Arabia may impose a heavy reputation cost. The U.S. Central Intelligence Agency (CIA) concluded that Bin Salman ordered the assassination of the exiled Saudi journalist Jamal Khashoggi in 2018. The journalist went to the Saudi consulate in Istanbul to obtain documents for his marriage and never left. Lucid and Ceer will have to distance themselves from this background as much as possible or count on selective or weak memory to sell as many cars as they need to walk on their own feet.