Li-Ion batteries are the most important component of an electric vehicle, and EV market expansion has led to rapid developments in this field. Traditionally, EV makers favored nickel-based chemistries, like NCA (Tesla) and NCM (other carmakers), but the market trend shows the LFP batteries will become dominant by 2030.

Although a fervent promotor of nickel-cobalt-aluminum (NCA) chemistry, Tesla has shown more flexibility in the past year. Tesla Model 3 RWD is now exclusively available with LFP batteries and Model Y will also follow this trend. What’s more interesting is that Elon Musk has signaled more trims of its Tesla models, specifically all standard-range versions, will adopt the cheaper chemistry. Musk also let us know that Tesla explores using manganese as an option.

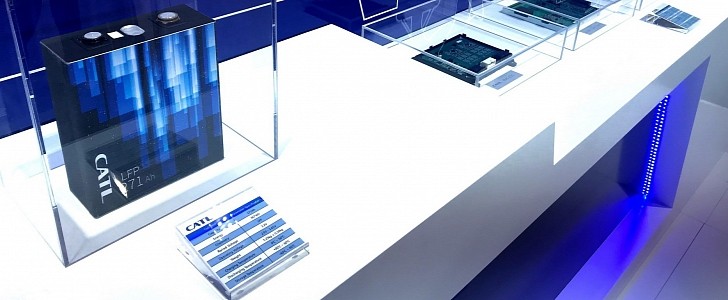

The Lithium-Ferro-Phosphate (LFP) chemistry gained traction in the past year thanks to its lower costs, longer lifecycle, and higher safety performance. Despite these advantages, they also have a lower energy density, which is why they are now used in lower-end EVs. Chinese companies like CATL are the most important producers of LFP batteries and their grip on the market will only strengthen in the following years.

According to a new analysis into the lithium-ion battery manufacturing industry published by Wood Mackenzie, the global battery capacity will expand to more than 3,000 GWh by 2030. CATL has the more aggressive plans, accelerating from 150 GWh’s existing capacity to almost 850 GWh by 2030, which is almost a six-fold increase. Wood Mackenzie projects that LFP’s market share will surpass nickel-based chemistries in 2028. LFP adoptions will only accelerate as the nickel and cobalt prices will go up.

Other than CATL, LG, Panasonic, and BYD will add the most battery capacity in the next eight years. Chinese manufacturers will continue to dominate the battery market throughout this decade, although their market share will continue to shrink. By 2030, the Asia-Pacific region will have fallen to 69% from today’s 90%. North America’s cell capacity will expand 10-fold by 2030, but it will lose the battery war to Europe starting this year already. By the end of the decade, Europe will account for more than 20% of the Li-Ion battery market.

The Lithium-Ferro-Phosphate (LFP) chemistry gained traction in the past year thanks to its lower costs, longer lifecycle, and higher safety performance. Despite these advantages, they also have a lower energy density, which is why they are now used in lower-end EVs. Chinese companies like CATL are the most important producers of LFP batteries and their grip on the market will only strengthen in the following years.

According to a new analysis into the lithium-ion battery manufacturing industry published by Wood Mackenzie, the global battery capacity will expand to more than 3,000 GWh by 2030. CATL has the more aggressive plans, accelerating from 150 GWh’s existing capacity to almost 850 GWh by 2030, which is almost a six-fold increase. Wood Mackenzie projects that LFP’s market share will surpass nickel-based chemistries in 2028. LFP adoptions will only accelerate as the nickel and cobalt prices will go up.

Other than CATL, LG, Panasonic, and BYD will add the most battery capacity in the next eight years. Chinese manufacturers will continue to dominate the battery market throughout this decade, although their market share will continue to shrink. By 2030, the Asia-Pacific region will have fallen to 69% from today’s 90%. North America’s cell capacity will expand 10-fold by 2030, but it will lose the battery war to Europe starting this year already. By the end of the decade, Europe will account for more than 20% of the Li-Ion battery market.