On July 12, Tesla and Elon Musk will face one of their significant challenges so far. It has nothing to do with autonomous technology or quality control issues. Instead, both will have to prove that Musk did not personally benefit from Tesla buying SolarCity in 2016. More than that, they will have to prove the CEO did not force Tesla into the business. Union pension funds and asset managers accuse Musk of being the controlling shareholder of the company.

According to Reuters, Musk had about 22% of the company’s shares when Tesla bought SolarCity. That was not a majority stake. Despite that, the plaintiffs accuse him of ordering the purchase of SolarCity for a price that was much higher than what it was really worth. To make things worse, they also claim that SolarCity was losing money and that Musk only made Tesla buy it to save it.

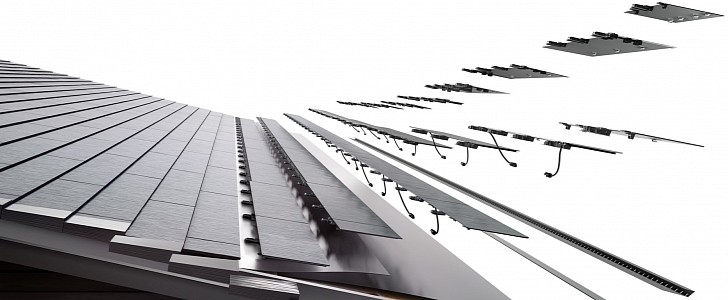

Musk’s lawyers said that Musk does not control the company as he pleases. He would just have a strong management style. The board would have approved the purchase without his influence because it was a crucial part of the “Master Plan, Part Deux” to integrate solar energy with electric cars. Ironically, no Tesla to date has V2G (vehicle-to-grid) capabilities.

To make matters harder for Tesla and Musk, the Tesla CEO had 22% of SolarCity’s shares when the business was sealed. Four members of the board also directly or indirectly owned stocks from the solar power business.

Proving that Musk pushed the deal into Tesla is crucial for the case to be judged under the “entire fairness standard.” This legal doctrine establishes that if a company decision were taken without the necessary independence and hurt fiduciary duties toward other shareholders, it has to prove the business was in its best interests.

If Musk is not considered the controlling shareholder, his lawyers can try to frame the case under the “business judgment rule.” According to that principle, the executives involved with the decision just took it because they thought it would benefit the company. In this situation, it is up to the plaintiffs to prove that it was a wrong business decision.

In January, five directors involved with the decision made a settlement and paid $60 million to be cleared of any accusations. Among them is Kimball Musk, Elon Musk’s brother.

If the Tesla CEO loses the lawsuit, he may have to pay $2.6 billion back to Tesla’s shareholders. That’s how much Tesla paid for SolarCity in 2016. It is not clear if the deal can be reversed, and SolarCity may become an independent company again.

If that is the case, SolarCity will struggle to survive. It is not deploying nearly as many solar roofs as Musk said it could install, and its costs are higher than previously expected. Many clients also complained about leaks and other problems with these solar roofs. Business Insider brought up a long article about them. That’s probably one of the reasons Musk has all his attentions on SolarCity, as Bloomberg recently reported.

Musk’s lawyers said that Musk does not control the company as he pleases. He would just have a strong management style. The board would have approved the purchase without his influence because it was a crucial part of the “Master Plan, Part Deux” to integrate solar energy with electric cars. Ironically, no Tesla to date has V2G (vehicle-to-grid) capabilities.

To make matters harder for Tesla and Musk, the Tesla CEO had 22% of SolarCity’s shares when the business was sealed. Four members of the board also directly or indirectly owned stocks from the solar power business.

Proving that Musk pushed the deal into Tesla is crucial for the case to be judged under the “entire fairness standard.” This legal doctrine establishes that if a company decision were taken without the necessary independence and hurt fiduciary duties toward other shareholders, it has to prove the business was in its best interests.

If Musk is not considered the controlling shareholder, his lawyers can try to frame the case under the “business judgment rule.” According to that principle, the executives involved with the decision just took it because they thought it would benefit the company. In this situation, it is up to the plaintiffs to prove that it was a wrong business decision.

In January, five directors involved with the decision made a settlement and paid $60 million to be cleared of any accusations. Among them is Kimball Musk, Elon Musk’s brother.

If the Tesla CEO loses the lawsuit, he may have to pay $2.6 billion back to Tesla’s shareholders. That’s how much Tesla paid for SolarCity in 2016. It is not clear if the deal can be reversed, and SolarCity may become an independent company again.

If that is the case, SolarCity will struggle to survive. It is not deploying nearly as many solar roofs as Musk said it could install, and its costs are higher than previously expected. Many clients also complained about leaks and other problems with these solar roofs. Business Insider brought up a long article about them. That’s probably one of the reasons Musk has all his attentions on SolarCity, as Bloomberg recently reported.