Sergio Marchionne once said that only a carmaker that was able to make more than six million vehicles per year would survive. This is why he tried so hard to merge FCA with another automaker while he lived. Stellantis only came into existence years after he passed away. Ironically, this automotive titan is the one instigating me to pose this question: how will the automotive industry deal with different car solutions for different markets?

I’ll explain my concern. In the automotive business, scale is king. In the early days, carmakers tried their luck in new markets by directly importing the products they made at their headquarters or selling them to representatives in these countries. If there was enough demand, they could establish factories and adapt these vehicles to the tastes of these new markets. Depending on how successful they were, they could justify investments in local engineering and design centers, which allowed them to have products that were specific to what local customers needed and wanted.

That was what allowed European car projects to survive Latin American roads and bad (or adultered) fuel. Some automakers even implemented changes these local engineering centers came up with to all vehicles when they could help them save some bucks, but that was not usual. Most of the modifications were restricted to the markets where they were developed. More than that, some of these engineering centers managed to create vehicles only their countries had.

The Volkswagen Gol, Brasilia, SP1, and SP2, the Chevrolet Opala, Celta, Spin, the Ford Corcel, EcoSport (a taller European Ford Fusion in its early days), Courier, and the Fiat 147, Palio, Premio, Elba, Mobi, Toro, and Argo are all examples of locally-developed vehicles. Some of them were exported to other markets, but the target was to supply Brazilian and South American customers with them.

In the 1970s and 1980s, world cars started to turn up. That meant being developed to be sold and manufactured simultaneously in markets as diverse as Europe, the U.S., and South America. Vehicles such as the Opel Ascona C and Ford Escort Mk III allowed their companies to order larger quantities of certain components. As an engineer once told me, ordering 100,000 units of a given part is very different from buying 1 million pieces. You always get good discounts when you are a big customer.

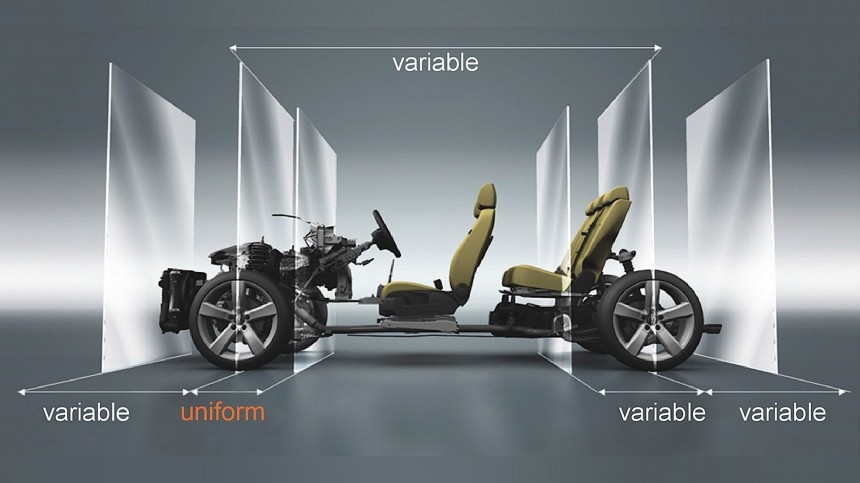

From being a competitive advantage at first, this opportunity created by world cars soon became a requirement for the automotive industry. If you did not have the same car everywhere, at least these vehicles had the same engines and platforms. The Volkswagen group had dozens of models with the same underpinnings: PQ24 for B-segment vehicles, PQ34 for compact cars, and so forth. Eventually, the German engineers developed the modular architecture, which fitted vehicles from several market segments (they all use the MQB, regardless of their size). That also became a benchmark for lowering costs and improving profitability.

The idea behind all that was simple: instead of having different engines and multiple platforms, using the same ones for several products lowered development costs. Creating a new platform may cost more than $1 billion, and an engine project may demand even more money. If all vehicles from a given automaker anywhere in the world rely on the same components and structures, it spends less money to make a car. When you keep the same prices from previous generations on vehicles made with these prerequisites, you get a higher profit margin. Another option is charging less for the new model and reaching more customers, which may also improve profits by multiplying them by more significant sales numbers.

With standardized engines and platforms, the next step was to kill models for specific markets. Why have local engineering and design centers if the idea was to get everybody everywhere to buy identical vehicles? Members of these teams were either laid off or transferred to bigger centers in the U.S., Europe, and China. Factories were closed, models died, and the plan to make millions of the same models kept improving. This is the point where Stellantis becomes relevant to this story.

Carlos Tavares runs Stellantis with a cautious perspective on the future of personal mobility. The CEO does not think electric cars are the solution for a carbon-neutral future and believes they will kill affordable cars. Like Akio Toyoda, Tavares states there are several paths to get there, including some internal combustion engine options. In a recent interview with Valor Econômico, he said Brazilians did not need EVs because they already had an excellent solution with ethanol.

Just to give you some background, several automakers have already wondered about powering their vehicles with ethanol or methanol. If I am not mistaken, Ford was the first one with the Model T in 1908. In Brazil, the idea materialized after the 1970s oil crisis. There were big lines to refuel cars and limitations to buying gas on weekends. To stop that, the military government at the time pursued ethanol distribution. Several companies adapted their engines to burn the renewable fuel, with Fiat being the first one.

In the 1980s, an ethanol crisis led people to go back to gasoline engines, a trend that got even stronger when carburetors died in the country at the beginning of the 1990s. Eventually, flex-fuel cars were developed, and Brazilian customers could choose which fuel to use in their tanks: ethanol, gasoline, or any blend of the two. It was an insurance policy not to depend on any of these options.

I told you this whole story just for you to understand the context in which ethanol became relevant in Brazil. It was never to be a clean fuel: it was an attempt to ensure energy security. Ethanol detractors used to make fun of the idea because the tractors that harvested sugar cane and the trucks that transported it, all used diesel – they still do. Others said sugar cane crops were taking the place of other cultures, which is not correct. If they were not used to make ethanol, those fields would still have sugar cane to make sugar. Anyway, several companies are now developing ethanol from biomass, and although it is still more expensive than the regular one, it is gaining traction.

Since both sugar cane and biomass extract carbon from the atmosphere, ethanol is carbon neutral. In other words, it does not add more carbon to the air as fossil fuels do. Oil is a way nature found to remove carbon from the atmosphere, storing it underground. When you burn it, you get more carbon in the air, worsening the greenhouse effect. As I have said before, this phenomenon allows life on the planet by helping the Earth keep warm. It is like a planetary blanket: without it, Earth could lose all the energy it receives from the sun. With too many blankets or one that is thicker than it should be, the planet sweats, and the climate changes.

In other words, ethanol happened to be carbon neutral, but it was not adopted as fuel in Brazil because of that. Now that this is the main reason for promoting electric cars, Tavares apparently turned it into an argument for saving the combustion engine. However, there is a massive problem with that reasoning: who will develop the ethanol cars he thinks Brazil should keep using?

Remember the standardization push to improve profit margins? It makes having combustion-engined cars in some markets and electric vehicles in others challenging, if not impossible. If the idea is to have the same vehicles everywhere, they will either have to be electric or based on internal combustion engines.

Electric cars need dedicated architectures. Combustion-engined platforms did not work well for EVs, as the Mercedes-Benz EQC proves. There is always a compromise. ICE architectures need to include exhaust pipes, reinforcements around the engine bay, a cabin that will be able to deal with the forces in a crash, and so forth. An EV platform has a battery pack underneath the passenger area. The electric motors are generally on the axles, leaving the front and rear overhangs for crash structures that need to protect the passengers and the massive component in the vehicle’s belly. If that does not happen, the battery pack becomes a safety hazard.

Modular platforms could theoretically deal with both propulsion systems, but who will develop internal combustion engines when they are illegal in most developed markets? Why would automakers design them at their headquarter when they need to improve their electric vehicles instead? Automakers closed R&D centers in developing countries, remember?

Despite being a market leader only in Brazil, Fiat will unify its lineup worldwide. Ironically, the Italian brand only sells thousands of cars to Brazilians every year because it was independent enough from the headquarters to do whatever seemed better. By unifying its lineup worldwide, will it sell Toros and Stradas in Italy? Or will it offer only the Panda, Tipo, and Cinquecento in Brazil? As these questions make clear, Tavares should have problems in his own house with his strategy: Fiat belongs to Stellantis, and it seems to be taking the inverse route to that proposed by the CEO.

Brazil may not need EVs now, but it will get them anyway when all car companies have to sell electric cars. Brazilian engineers fought hard to establish a national automotive company. Sadly, apart from a few low-volume initiatives, they never managed to pull that off. That said, most cars sold in the country depend on foreign companies, which are being pushed by their governments to sell EVs.

As I write this, it seems Brazil will only keep ethanol as a carbon-neutral solution for a little while. This renewable fuel is already adopted in hybrid cars. Nissan should soon give the e-POWER system its first flex-fuel engine (in the Kicks sold to Brazilians), and we may even see an EV with an ethanol-powered range extender. Still, there is no way future cars will stay away from batteries – whether in Brazil or anywhere else. The question is how big their battery packs will be.

Without the independence or means to develop their own solutions, all emerging markets will follow what developed countries rule as the right choices. In the best-case scenario, automakers may maintain manufacturing operations in countries with large car markets or the ones in which they already sell well. They will not have the option to export these cars because very few countries will accept them. All other places will either lose these companies or get smaller representations based on imported vehicles. And the cars coming from abroad will all soon be electric.

In the worst-case perspective, developing countries will become the junkyards of rich ones. They will buy used combustion-engined vehicles until first-world markets have replaced them all with EVs. When that finally happens, poor countries will get used EVs with dying battery packs. And the dead battery packs will be recycled and sent back to rich markets, leaving the emerging ones with cars that cannot work anymore.

Either ethanol is an option for all countries, or Tavares will bet on a short-term solution for Brazil. For the record, Volkswagen thinks hybrid cars powered by this green fuel will be the solution for that market while it invests heavily in electrification in Europe. Having different cars for sale in developing countries will go against the standardization strategy to lower costs that the industry compulsorily follows. Feel free to guess who will be the winner, but remember: scale and costs are kings.

That was what allowed European car projects to survive Latin American roads and bad (or adultered) fuel. Some automakers even implemented changes these local engineering centers came up with to all vehicles when they could help them save some bucks, but that was not usual. Most of the modifications were restricted to the markets where they were developed. More than that, some of these engineering centers managed to create vehicles only their countries had.

The Volkswagen Gol, Brasilia, SP1, and SP2, the Chevrolet Opala, Celta, Spin, the Ford Corcel, EcoSport (a taller European Ford Fusion in its early days), Courier, and the Fiat 147, Palio, Premio, Elba, Mobi, Toro, and Argo are all examples of locally-developed vehicles. Some of them were exported to other markets, but the target was to supply Brazilian and South American customers with them.

From being a competitive advantage at first, this opportunity created by world cars soon became a requirement for the automotive industry. If you did not have the same car everywhere, at least these vehicles had the same engines and platforms. The Volkswagen group had dozens of models with the same underpinnings: PQ24 for B-segment vehicles, PQ34 for compact cars, and so forth. Eventually, the German engineers developed the modular architecture, which fitted vehicles from several market segments (they all use the MQB, regardless of their size). That also became a benchmark for lowering costs and improving profitability.

The idea behind all that was simple: instead of having different engines and multiple platforms, using the same ones for several products lowered development costs. Creating a new platform may cost more than $1 billion, and an engine project may demand even more money. If all vehicles from a given automaker anywhere in the world rely on the same components and structures, it spends less money to make a car. When you keep the same prices from previous generations on vehicles made with these prerequisites, you get a higher profit margin. Another option is charging less for the new model and reaching more customers, which may also improve profits by multiplying them by more significant sales numbers.

Carlos Tavares runs Stellantis with a cautious perspective on the future of personal mobility. The CEO does not think electric cars are the solution for a carbon-neutral future and believes they will kill affordable cars. Like Akio Toyoda, Tavares states there are several paths to get there, including some internal combustion engine options. In a recent interview with Valor Econômico, he said Brazilians did not need EVs because they already had an excellent solution with ethanol.

Just to give you some background, several automakers have already wondered about powering their vehicles with ethanol or methanol. If I am not mistaken, Ford was the first one with the Model T in 1908. In Brazil, the idea materialized after the 1970s oil crisis. There were big lines to refuel cars and limitations to buying gas on weekends. To stop that, the military government at the time pursued ethanol distribution. Several companies adapted their engines to burn the renewable fuel, with Fiat being the first one.

I told you this whole story just for you to understand the context in which ethanol became relevant in Brazil. It was never to be a clean fuel: it was an attempt to ensure energy security. Ethanol detractors used to make fun of the idea because the tractors that harvested sugar cane and the trucks that transported it, all used diesel – they still do. Others said sugar cane crops were taking the place of other cultures, which is not correct. If they were not used to make ethanol, those fields would still have sugar cane to make sugar. Anyway, several companies are now developing ethanol from biomass, and although it is still more expensive than the regular one, it is gaining traction.

Since both sugar cane and biomass extract carbon from the atmosphere, ethanol is carbon neutral. In other words, it does not add more carbon to the air as fossil fuels do. Oil is a way nature found to remove carbon from the atmosphere, storing it underground. When you burn it, you get more carbon in the air, worsening the greenhouse effect. As I have said before, this phenomenon allows life on the planet by helping the Earth keep warm. It is like a planetary blanket: without it, Earth could lose all the energy it receives from the sun. With too many blankets or one that is thicker than it should be, the planet sweats, and the climate changes.

Remember the standardization push to improve profit margins? It makes having combustion-engined cars in some markets and electric vehicles in others challenging, if not impossible. If the idea is to have the same vehicles everywhere, they will either have to be electric or based on internal combustion engines.

Electric cars need dedicated architectures. Combustion-engined platforms did not work well for EVs, as the Mercedes-Benz EQC proves. There is always a compromise. ICE architectures need to include exhaust pipes, reinforcements around the engine bay, a cabin that will be able to deal with the forces in a crash, and so forth. An EV platform has a battery pack underneath the passenger area. The electric motors are generally on the axles, leaving the front and rear overhangs for crash structures that need to protect the passengers and the massive component in the vehicle’s belly. If that does not happen, the battery pack becomes a safety hazard.

Despite being a market leader only in Brazil, Fiat will unify its lineup worldwide. Ironically, the Italian brand only sells thousands of cars to Brazilians every year because it was independent enough from the headquarters to do whatever seemed better. By unifying its lineup worldwide, will it sell Toros and Stradas in Italy? Or will it offer only the Panda, Tipo, and Cinquecento in Brazil? As these questions make clear, Tavares should have problems in his own house with his strategy: Fiat belongs to Stellantis, and it seems to be taking the inverse route to that proposed by the CEO.

Brazil may not need EVs now, but it will get them anyway when all car companies have to sell electric cars. Brazilian engineers fought hard to establish a national automotive company. Sadly, apart from a few low-volume initiatives, they never managed to pull that off. That said, most cars sold in the country depend on foreign companies, which are being pushed by their governments to sell EVs.

Without the independence or means to develop their own solutions, all emerging markets will follow what developed countries rule as the right choices. In the best-case scenario, automakers may maintain manufacturing operations in countries with large car markets or the ones in which they already sell well. They will not have the option to export these cars because very few countries will accept them. All other places will either lose these companies or get smaller representations based on imported vehicles. And the cars coming from abroad will all soon be electric.

Either ethanol is an option for all countries, or Tavares will bet on a short-term solution for Brazil. For the record, Volkswagen thinks hybrid cars powered by this green fuel will be the solution for that market while it invests heavily in electrification in Europe. Having different cars for sale in developing countries will go against the standardization strategy to lower costs that the industry compulsorily follows. Feel free to guess who will be the winner, but remember: scale and costs are kings.