The Teslasphere trembled at the news that all Model 3 versions miraculously qualify for the full $7,500 IRA tax credit. Previously, the RWD variant built with LFP cells from China was only suitable for half the credit, and even that was a surprise. Read on for my analysis on how Tesla pulled this off and the implications for the auto industry at large.

Tesla's tango with its EVs' prices no longer shocks people, as it happened before. The EV maker uses a complex market analyzing tool, allowing it to gather feedback and fine-tune prices almost in real time. This is a luxury no traditional carmaker can afford, considering they need to gather their data from the dealers. Tesla's direct sales strategy has many advantages, and this is only one of them. Still, how Tesla prices its vehicles is not the only thing people watch closely.

Equally important is how Tesla's EVs relate to the Inflation Reduction Act (IRA) and the tax credits on offer. The EV maker is a net beneficiary of the new program, considering that it lost the federal incentives in 2020 after selling the 200,000-unit limit under the previous program. The IRA tax credits brought Tesla an important advantage in 2023 versus the previous years, leveling the playing ground with the rest of the industry.

Still, the same IRA imposed strict rules for the origin of battery materials, which took effect on April 18. With the Tesla Model 3 RWD sporting lithium-iron-phosphate (LFP) batteries imported from China, the base model in Tesla's lineup was at a disadvantage compared to the rest of the market. To everyone's surprise, Tesla retained half the IRA tax credit ($3,750) even for the Model 3 RWD with LFP cells. The same conditions applied to the mysterious Model 3 Long Range AWD introduced in May, which made people think it also had LFP cells.

Many thought this reflected a change in battery material sourcing or battery pack manufacturing. Indeed, procuring raw materials from white-listed countries such as Australia or Canada would make the cars comply with the IRS's rules of origin introduced on April 18. Also, assembling the batteries in the US instead of importing them from China would likely change the situation.

Until now, Tesla's Fremont factory was getting full LFP packs from Giga Shanghai. Tesla might have switched to manufacturing those battery packs in the US while still using Chinese cells. At the same time, all the cars sold in Canada are now coming from China, freeing up US battery production for local deliveries in the US. That way, Tesla would be able to benefit the most from the IRA tax credits.

This is all good, but there's more than meets the eye. According to Tesla, new Model 3 RWD examples in the existing inventory also qualify. Clearly, their battery packs weren't replaced with US-made parts overnight, so something else changed. Under Reg. § 1.30D-3 Critical mineral and battery component requirements, at least 40% of the critical minerals contained in the battery must be extracted or processed in the United States or a country with which the United States has a free trade agreement or be recycled in North America to qualify for the $3,750 tax credit. To get another $3,750, 50% of the battery components must be manufactured or assembled in North America.

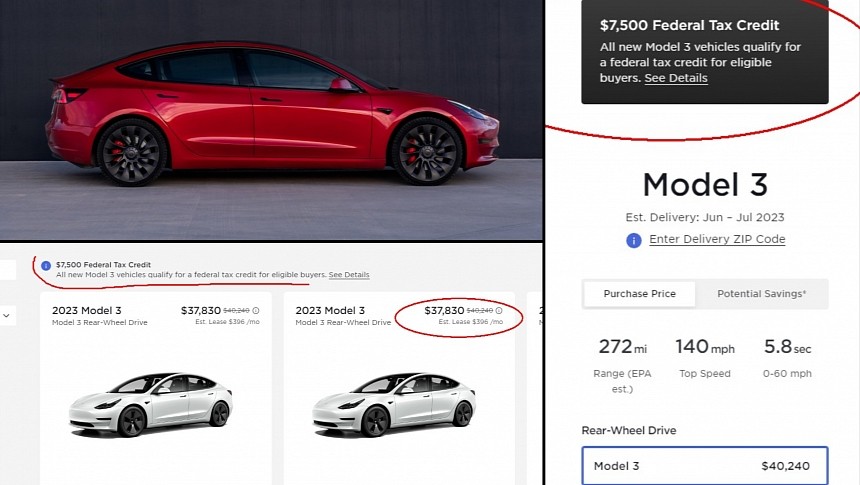

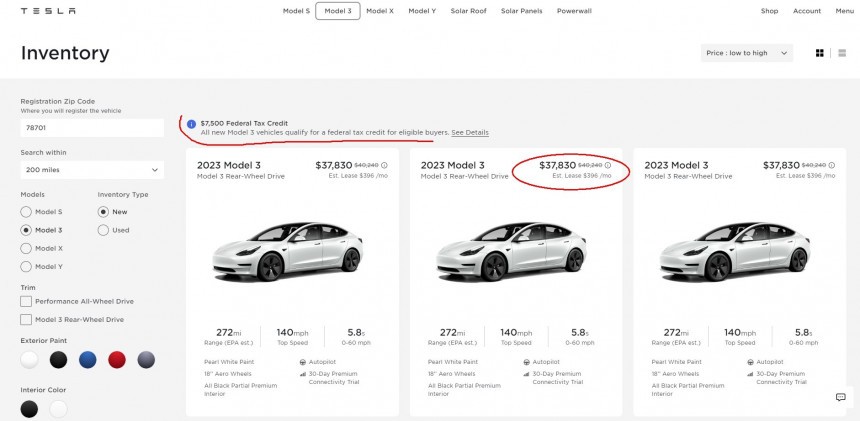

It's, indeed, a technicality, but it helps Tesla offer the Model 3 RWD at a price point that makes it far more attractive, even compared with ICE vehicles. Considering the current price of $40,240 for the Tesla Model 3 RWD, the destination charges (+$1,640), and the tax credit (-$7,500), the final price for qualifying buyers is $34,380. When you take local incentives into account, things get even sweeter. Starting July 1, qualifying customers could get a Tesla Model 3 RWD in Colorado for $29.380, considering the local tax credit of $5,000. Things are even better for cars in Tesla's inventory, already discounted by $2,410 in the case of the Model 3 RWD.

We can safely assume that Tesla will have no problem clearing Model 3 inventory for the upcoming Model 3 refreshed model. But that's not even close to what this can do to competitors. If Tesla can sell the current generation for under $30,000, imagine what Project Highland would bring, considering the optimized production and simplifications baked in. And we're not even talking about the Gen-3 vehicles, which are an order of magnitude more cost-effective to manufacture.

Equally important is how Tesla's EVs relate to the Inflation Reduction Act (IRA) and the tax credits on offer. The EV maker is a net beneficiary of the new program, considering that it lost the federal incentives in 2020 after selling the 200,000-unit limit under the previous program. The IRA tax credits brought Tesla an important advantage in 2023 versus the previous years, leveling the playing ground with the rest of the industry.

Still, the same IRA imposed strict rules for the origin of battery materials, which took effect on April 18. With the Tesla Model 3 RWD sporting lithium-iron-phosphate (LFP) batteries imported from China, the base model in Tesla's lineup was at a disadvantage compared to the rest of the market. To everyone's surprise, Tesla retained half the IRA tax credit ($3,750) even for the Model 3 RWD with LFP cells. The same conditions applied to the mysterious Model 3 Long Range AWD introduced in May, which made people think it also had LFP cells.

Tesla Model 3 now qualifies for a $7,500 federal tax credit

If that was surprising, the announcement that all Model 3 variants now qualify for the full $7,500 IRA tax credit was even more baffling. Everyone wondered what Tesla did do to make the LFP-powered Model 3 RWD benefit from the full IRA tax credit. The change is not yet reflected on the Department of Energy's website, as it still lists the Model 3 RWD and Model 3 AWD Long Range with only a $3,750 tax credit. Still, Tesla's website has changed, and it now says that "all new Model 3 vehicles qualify for a $7,500 federal tax credit for eligible buyers."Many thought this reflected a change in battery material sourcing or battery pack manufacturing. Indeed, procuring raw materials from white-listed countries such as Australia or Canada would make the cars comply with the IRS's rules of origin introduced on April 18. Also, assembling the batteries in the US instead of importing them from China would likely change the situation.

This is all good, but there's more than meets the eye. According to Tesla, new Model 3 RWD examples in the existing inventory also qualify. Clearly, their battery packs weren't replaced with US-made parts overnight, so something else changed. Under Reg. § 1.30D-3 Critical mineral and battery component requirements, at least 40% of the critical minerals contained in the battery must be extracted or processed in the United States or a country with which the United States has a free trade agreement or be recycled in North America to qualify for the $3,750 tax credit. To get another $3,750, 50% of the battery components must be manufactured or assembled in North America.

Tesla used a clever trick to bend the IRA provisions

The trick is that the regulation allows an EV manufacturer to use an alternate method for calculating the critical mineral content. According to the above regulation, Tesla "could average the qualifying critical mineral content calculation over a limited period of time (for example, a year, quarter, or month) with respect to vehicles from the same model line, plant, class, or some combination of thereof." In other words, if Tesla produces enough qualifying Model 3 batteries or even overall production at Fremont, it can offset the Model 3 RWD, which normally would not qualify for the full tax credit.It's, indeed, a technicality, but it helps Tesla offer the Model 3 RWD at a price point that makes it far more attractive, even compared with ICE vehicles. Considering the current price of $40,240 for the Tesla Model 3 RWD, the destination charges (+$1,640), and the tax credit (-$7,500), the final price for qualifying buyers is $34,380. When you take local incentives into account, things get even sweeter. Starting July 1, qualifying customers could get a Tesla Model 3 RWD in Colorado for $29.380, considering the local tax credit of $5,000. Things are even better for cars in Tesla's inventory, already discounted by $2,410 in the case of the Model 3 RWD.

We can safely assume that Tesla will have no problem clearing Model 3 inventory for the upcoming Model 3 refreshed model. But that's not even close to what this can do to competitors. If Tesla can sell the current generation for under $30,000, imagine what Project Highland would bring, considering the optimized production and simplifications baked in. And we're not even talking about the Gen-3 vehicles, which are an order of magnitude more cost-effective to manufacture.