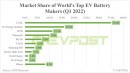

The world’s largest battery maker CATL has announced that it renegotiated prices with its customers to address pressure from the supply chain. CATL is the main battery supplier for Tesla, which means EV prices will likely continue to rise, dealing a blow to the belief that electric cars will soon achieve price parity with ICE vehicles.

For the past few years, the car industry believed that electric vehicles will get to the same prices as their ICE equivalents once the battery price will fall below $100 per kWh. The world was close to achieving just that, but then all hell broke loose. First, there came the pandemic, and then the supply chain got disrupted, and the raw material prices have gone through the roof ever since. At the moment, the rising price of nickel, cobalt, and other metals crucial to the production of EV batteries makes it impossible to lower EV prices.

In fact, Tesla acknowledged that already, and they have been factoring in the raw materials price increases for some time already. Tesla customers know the EV maker has raised prices several times already and even the Model 3 is now a pretty expensive vehicle, selling for at least $46,990 in the U.S. This is a big bump from the initial projected $35,000 price and certainly one that makes the Model 3 anything but affordable.

The prices will continue to go up, and this will happen rather quickly. CATL, the battery supplier of choice for Tesla’s base-version Model 3, has just announced it will raise battery prices. During its first-quarter earnings call, CATL said it renegotiated the prices with its customers based on the increases in raw material prices. That’s because CATL could no longer absorb the price increases from its supply chain and started to pass some of them on to its customers.

This has become imperative as the company’s profits have plunged despite a healthy increase in revenues. Indeed, CATL reported a 154% increase in revenue year on year in the first quarter, while the net profit was 24% lower compared to the first quarter of 2021. CATL’s operating costs grew 199% year on year due to the rapid increase in upstream material prices, which was the main cause of pressure on its earnings, according to CNEVPost.com.

In fact, Tesla acknowledged that already, and they have been factoring in the raw materials price increases for some time already. Tesla customers know the EV maker has raised prices several times already and even the Model 3 is now a pretty expensive vehicle, selling for at least $46,990 in the U.S. This is a big bump from the initial projected $35,000 price and certainly one that makes the Model 3 anything but affordable.

The prices will continue to go up, and this will happen rather quickly. CATL, the battery supplier of choice for Tesla’s base-version Model 3, has just announced it will raise battery prices. During its first-quarter earnings call, CATL said it renegotiated the prices with its customers based on the increases in raw material prices. That’s because CATL could no longer absorb the price increases from its supply chain and started to pass some of them on to its customers.

This has become imperative as the company’s profits have plunged despite a healthy increase in revenues. Indeed, CATL reported a 154% increase in revenue year on year in the first quarter, while the net profit was 24% lower compared to the first quarter of 2021. CATL’s operating costs grew 199% year on year due to the rapid increase in upstream material prices, which was the main cause of pressure on its earnings, according to CNEVPost.com.